Netflix reached over 325 million paid memberships globally in Q4 2025, marking a significant milestone for the streaming platform, which serves more than 190 countries. Despite only capturing less than 10% of total television viewing in major markets, Netflix’s engagement showed signs of reacceleration, with a 9% increase in branded original content viewership in the latter half of 2025.

The company anticipates revenue between $50.7 billion and $51.7 billion for 2026, representing a 12-14% year-over-year growth as it navigates challenges from streaming competition and content cost inflation. Netflix’s ad-supported tier is crucial for attracting price-sensitive consumers, while strategic franchise releases and partnerships with other companies aim to sustain subscriber growth.

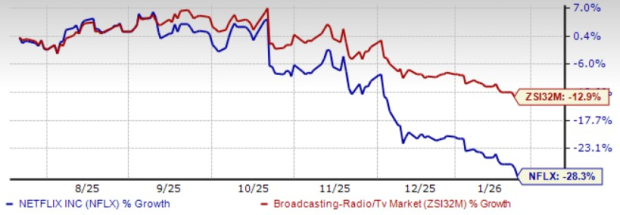

In competitive analysis, Netflix faces pressure from Disney and Amazon, which employ different growth strategies targeting family-oriented and bundled subscriptions respectively. As of now, Netflix stock has declined 28.3% over the past six months, trading at a forward price-to-sales ratio of 7.05, compared to the broadcasting industry average of 4.3.