Stock market volatility has surged over the past year, primarily due to heightened geopolitical risks, causing Bitcoin (BTC) prices to decline by over 11%. This drop has severely impacted Strategy Incorporated (MSTR), an enterprise software company that holds a significant amount of BTC, leading to a more than 50% decline in its share value over the past year.

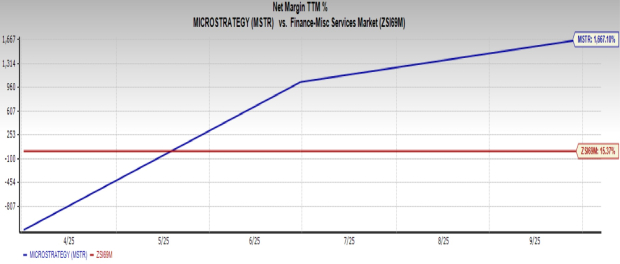

Despite this downturn, Strategy’s fundamentals remain strong, with a net profit margin of 1,667.1%, significantly higher than the industry average of 15.4%. The company has seen its shares and BTC prices soar over 150% since its strategic shift to focus more on Bitcoin accumulation in 2020, indicating potential for future recovery as BTC gains momentum.

Investors are advised to consider holding onto Strategy’s shares due to its status as a BTC proxy, although caution is warranted due to ongoing BTC price volatility. The company’s current Zacks Rank is #3 (Hold), suggesting that buying the dip may not be advisable until BTC shows signs of recovery.