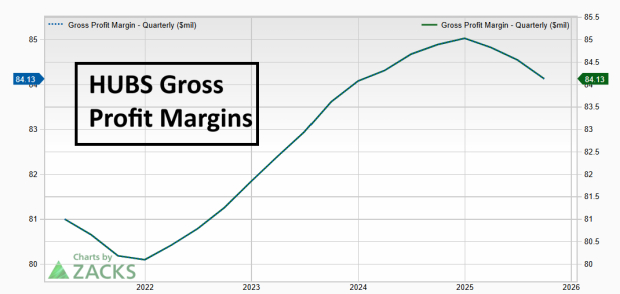

HubSpot Inc. (HUBS), headquartered in Cambridge, MA, is currently facing significant challenges as its stock declines more than 20% year-to-date. The company, known for its cloud-based Customer Relationship Management (CRM) platform tailored to small-to-medium-sized businesses, has been grappling with the impact of emerging AI technologies that threaten traditional software models. The company’s gross profit margins peaked in early 2025, highlighting potential vulnerabilities amid these changes.

Key competitors in the software sector have also seen dire declines, with UiPath (PATH) down 84%, Paycom Software (PAYC) down 73%, and The Trade Desk (TTD) down 70%. HubSpot has recently attempted to adapt by introducing a low-cost $20 starter pack, which may draw in new customers but risks cannibalizing its premium offerings. As the market evolves, the future viability of legacy software subscription models remains uncertain.