Shareholders of Navient Corp (NAVI) have the opportunity to increase their income through a February covered call at a $12.50 strike price, offering a premium of 35 cents per share. This strategy could yield an annualized return of 51.6%, bringing the total potential return to 57.5% if the stock is not called away. Currently, NAVI shares are priced at $10.80, meaning a 16.1% price increase would see the stock called, resulting in a total return of 19.3% including any dividends.

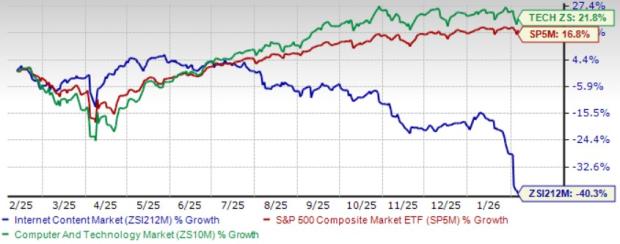

In mid-afternoon trading on Wednesday, the put volume among S&P 500 components was 858,771 contracts, while call volume reached 1.86 million contracts, resulting in a put:call ratio of 0.46. This figure indicates a preference for call options among buyers compared to the long-term median ratio of 0.65.

The trailing twelve-month volatility for Navient Corp is calculated at 38%, based on the last 251 trading days.