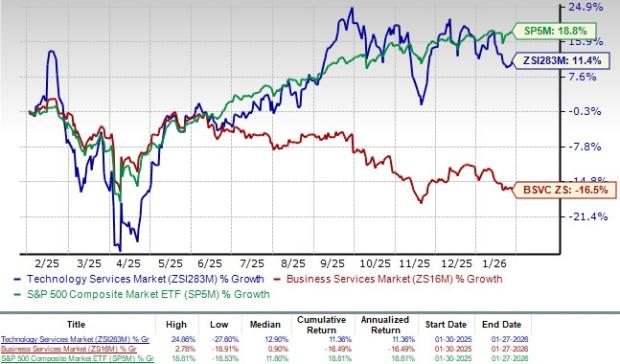

The Technology Services industry is projected to return to pre-pandemic levels, driven by increased remote work adoption, rapid digital transformation, and advancements in 5G, blockchain, AI, and machine learning. The U.S. GDP grew at an annual rate of 4.4% in the third quarter of 2025, up from 3.8% in the previous quarter, indicating strong economic recovery, which is essential for industry growth. The Zacks Technology Services industry currently ranks #153 out of 243, placing it in the bottom 37% of Zacks industries, despite showing a return of 11.4% over the past year.

Figure Technology Solutions reported a third-quarter adjusted EBITDA of $86 million, up 75% year-over-year, while Skillsoft experienced a 6% year-over-year revenue decline due to challenges in its Global Knowledge segment. In contrast, Adeia’s top line for the third quarter of 2025 was $87.3 million, with a 31% year-over-year gain in non-Pay TV recurring revenues, indicating positive momentum across diverse sectors of the industry.

Currently, the Zacks Technology Services industry trades at an EV-to-EBITDA ratio of 17.83X, compared to the S&P 500’s 19.08X, suggesting relative valuation opportunities. Economic indicators and technological advances are paving the way for significant growth, particularly as companies adopt innovative solutions to maintain competitiveness.