**Four Monthly Dividend Stocks to Consider for 2026**

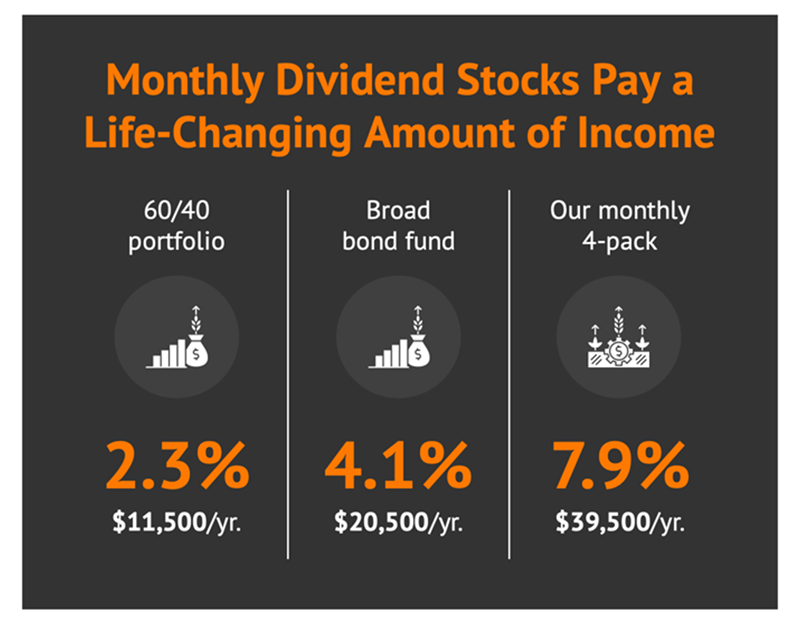

Investors are increasingly drawn to monthly dividend-paying stocks, which can yield between 5% and 11% annually, with an average yield of 7.9%. An investment portfolio of $500,000 in these stocks could generate approximately $39,500 in annual dividend income while maintaining the principal.

Key contenders include:

1. **Realty Income (O)** – A $55 billion REIT, boasting a yield of 5.3% and over 667 consecutive monthly dividend payments.

2. **SL Green Realty (SLG)** – Manhattan’s largest landlord, with a 6.7% yield, managing 53 buildings totaling nearly 31 million square feet.

3. **Apple Hospitality REIT (APLE)** – Specializing in upscale hotels, offering a 7.8% yield and comprising 217 hotels across 37 states and D.C.

4. **Ellington Financial (EFC)** – A small-cap mortgage REIT with a robust yield of 11.7%, recently benefiting from the decline in long-term mortgage rates.

These monthly payers provide investors with consistent cash flow and potential for growth.