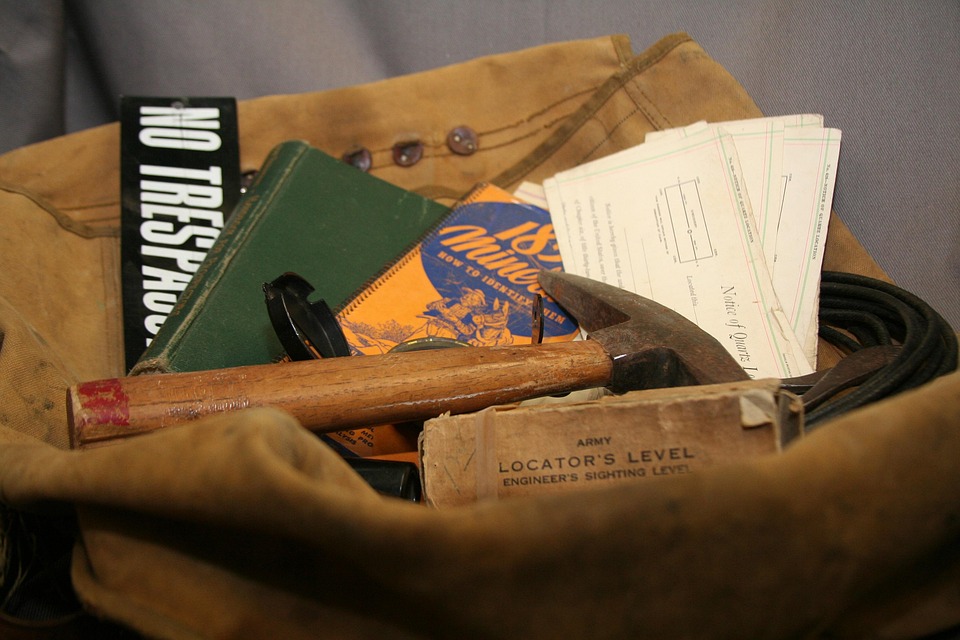

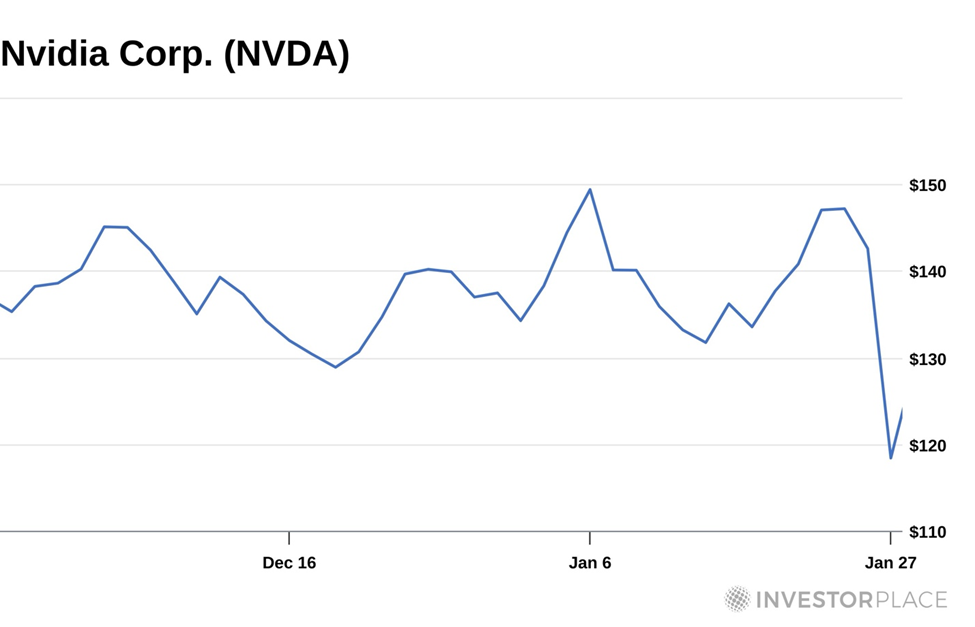

Energy Fuels (TSX: EFR; NYSE: UUUU) has released a new bankable feasibility study indicating that its White Mesa mill in Utah could become one of the largest producers of rare earths outside of China, with the potential to process approximately 6,000 tonnes per year of separated products over a projected 40-year lifespan. The facility is expected to also process 198,000 pounds of uranium annually from its Pinyon Plain and La Sal mines. Energy Fuels shares rose 6%, reaching C$30.85, bringing the company’s market value to C$7.3 billion.

The study highlights a post-tax net present value (NPV) of $1.9 billion for the mill’s stage two circuit expansion, with an after-tax internal rate of return of 33% based on initial capital costs of $410 million. This value could rise to $3.7 billion when combined with the NPV of Energy Fuels’ Vara Mada project, which was also detailed in a recent study. The White Mesa mill, located approximately 500 km southeast of Salt Lake City, is the only operational conventional uranium facility in the U.S. capable of processing both light and heavy rare earths.

Energy Fuels aims to supply 45% of the U.S.’s near-term rare earth requirements and all its heavy rare earth needs by 2030. This push could significantly reduce dependence on China, which accounted for 270,000 tonnes of rare earth oxides in 2024, dwarfing outputs from other producers. Current major non-Chinese producers include Lynas Rare Earths and MP Materials, which reported lower production levels in comparison.