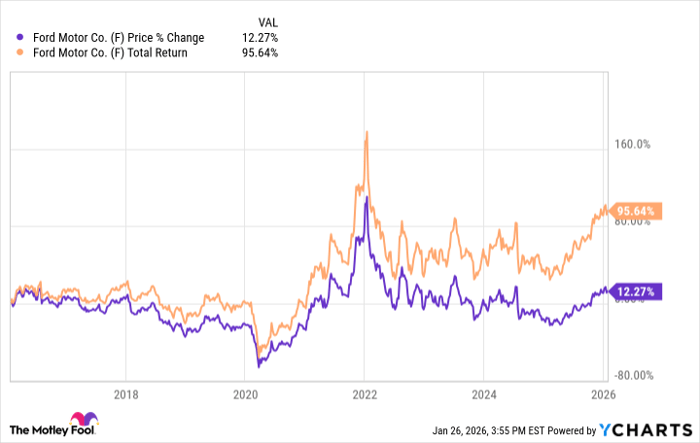

Ford and GM Shareholder Returns Diverge

Ford Motor Company (NYSE: F) offers a strong dividend yield of 4.4% while committing to return 40% to 50% of its free cash flow to shareholders. The company also supplements its dividends during strong financial years. In contrast, General Motors (NYSE: GM) has focused on share buybacks, announcing $22 billion in repurchases since January 2023, including a new $6 billion authorization, to enhance per-share earnings.

As of 2023, GM has reduced its outstanding shares significantly, contributing to a rise in share price. Both automakers are demonstrating robust shareholder commitment, with GM increasing its quarterly dividend by 20% late last year, showcasing confidence in their investments and financial health.