GE Aerospace reported impressive Q4 results on January 22, exceeding Wall Street expectations with a total revenue of $11.86 billion, representing an 18% year-over-year increase. Earnings per share (EPS) reached $1.57, beating estimates by 9%. The company experienced a surge in demand for its jet engines and maintenance services, particularly its LEAP and CFM56 models.

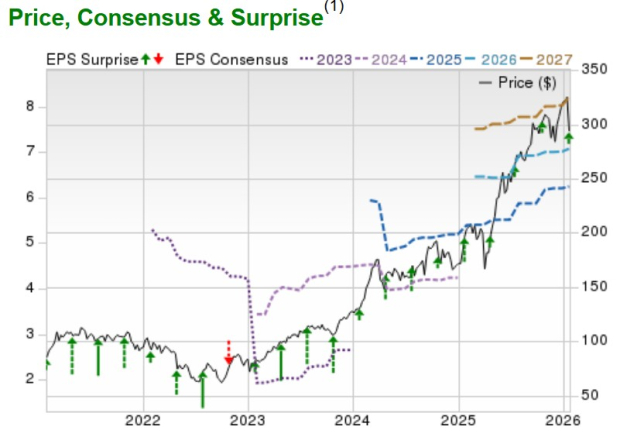

Additionally, GE’s backlog climbed to approximately $190 billion, up nearly $20 billion from the previous year, with Q4 orders rising by 74% to $27 billion. For FY26, GE guided EPS between $7.10 and $7.40, which would mark an 11%-16% growth compared to the prior year’s adjusted EPS of $6.37. Recent consensus estimates have increased to $7.45 for FY26, reflecting positive market sentiment.

Overall, GE Aerospace maintains robust financial health with over $12 billion in cash and $130 billion in total assets, indicating strong operational performance and ongoing investor interest.