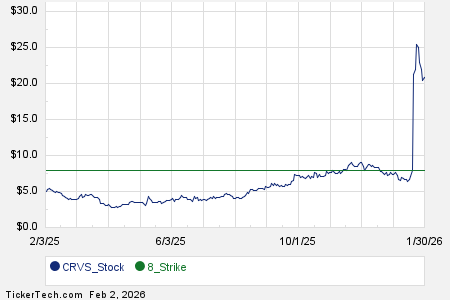

Investors interested in Corvus Pharmaceuticals Inc (CRVS) at the current market price of $21.47 may consider selling puts as a strategy. Notably, the January 2028 put option with an $8 strike is trading with a bid of $1.60, which offers a 20% return on the $8 commitment, translating to a 10.2% annualized rate of return.

This put option presents a scenario in which the investor would only own shares if the stock price falls significantly, by 62.9%, to trigger the exercise of the contract. If exercised, the effective cost basis would be $6.40 per share after accounting for the premium received. The historical volatility for the stock is calculated to be 122% over the past year, providing a context for evaluating the potential risks and returns associated with this strategy.