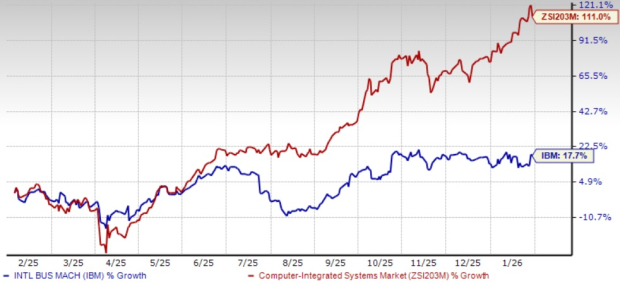

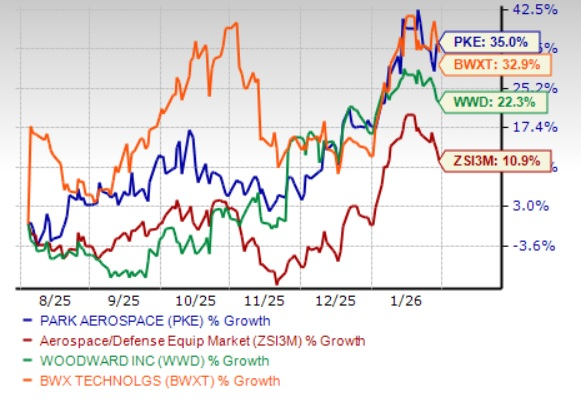

Silver prices fell sharply following US President Donald Trump’s decision to refrain from imposing new tariffs on critical minerals. After reaching an all-time high of $93.75 per ounce on Wednesday, the spot price dropped as much as 7% on Thursday morning before stabilizing around $90 per ounce by midday.

About 434 million ounces of silver are currently held in warehouses linked to the Comex futures exchange in New York, which is approximately 100 million more than the previous year. This increase in stock has contributed to a tight supply environment, further intensified by fears of potential tariffs.

Trump’s approach aims for targeted trade measures rather than broad-brush tariffs, alleviating concerns among traders. The overall market remains influenced by a surge in investor demand and geopolitical tensions, which have supported rising commodity prices, including silver and gold.