Nvidia’s Market Position and Growth Prospects

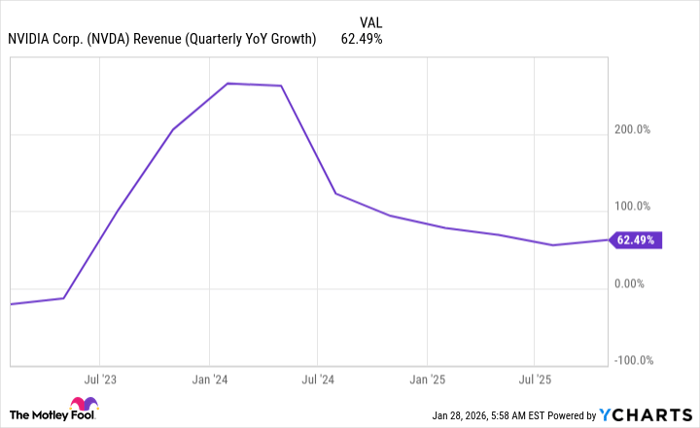

Nvidia (NASDAQ: NVDA), the world’s largest company by market capitalization, is projected to experience significant revenue growth, making it a potential investment opportunity. Wall Street analysts anticipate 67% revenue growth for Q4 and 52% for the fiscal year 2027, ending January 2027. Currently, Nvidia trades at 24.6 times its FY 2027 earnings estimates, comparably lower than other big tech stocks that average around 30 times.

Driving Forces Behind Nvidia’s Growth

The company specializes in graphics processing units (GPUs), initially developed for gaming, but now widely used in artificial intelligence applications. Despite a 63% year-over-year growth figure, Nvidia’s growth trajectory remains strong, particularly due to the rising demand for its comprehensive technology stack. As of now, Nvidia’s stock is considered to be priced fairly in the context of its growth potential, representing a slight premium over the S&P 500 which trades at 22 times forward earnings.