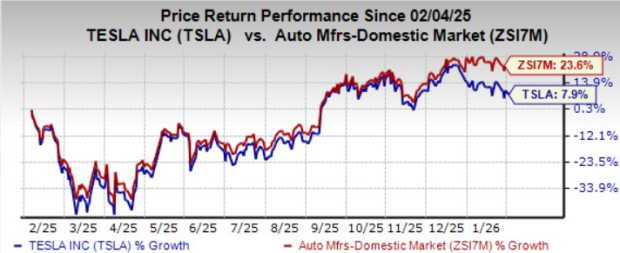

Tesla’s Sales Decline and Strategic Shift

On January 28, 2026, Tesla (NASDAQ: TSLA) reported a significant decline in electric vehicle (EV) sales, dropping from 1.79 million vehicles in 2024 to 1.63 million in 2025, marking a 9% decrease. This decline in sales, which represents 73% of Tesla’s total revenue, comes as the company faces stiff competition from both legacy automakers and budget brands like BYD, whose Dolphin Surf EV retails for $26,900 compared to Tesla’s Model 3 starting at over $40,000.

In response to waning sales, CEO Elon Musk is pivoting Tesla’s focus to its autonomous Cybercab robotaxi and the Optimus humanoid robot. While the Cybercab aims to generate new revenue through its Full Self-Driving software, regulatory hurdles still prevent its deployment. Musk forecasts that production could commence in April 2026 at the earliest. Meanwhile, Tesla has removed the Model S and Model X from its lineup to boost manufacturing capacity for Optimus, which Musk projects could yield $10 trillion in revenue over time.