Investors are finding potentially undervalued stocks amid the tech sector’s boom, particularly in artificial intelligence (AI). AT&T (NYSE: T), Qualcomm (NASDAQ: QCOM), and IBM (NYSE: IBM) stand out as significant opportunities despite rising costs and competition in the market.

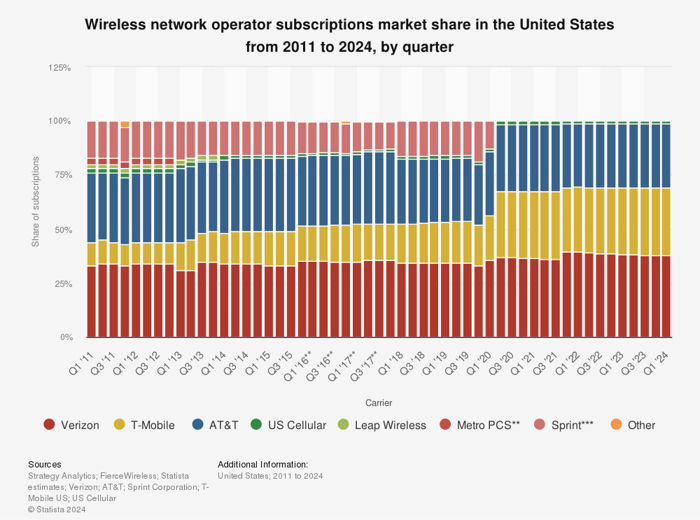

AT&T reported $90 billion in revenue for the first nine months of 2024, a decline from last year, but added nearly 1.2 million wireless and 700,000 fiber customers. Qualcomm’s revenue for the same period was $29 billion, marking a 6% increase, while net income climbed 26% to $7.2 billion. IBM generated $45 billion in revenue, with its software segment growing by 8%, though its net income dropped to $3.1 billion.

AT&T’s stock trades at a P/E of 13, Qualcomm at 22, and IBM at 24. Investors are encouraged to consider these stocks for potential long-term gains as they adapt to evolving technological demands.