Reddit Inc. (RDDT) is set to announce its fourth-quarter results for 2025 on February 5, 2026. The company anticipates revenues between $655 million and $665 million, reflecting a year-over-year growth of 53% to 55%. In contrast, the Zacks Consensus Estimate is higher at $667.58 million, indicating a growth rate of 56.06%.

The earnings consensus stands at 96 cents per share, marking a 166.67% increase year-over-year. However, this estimate has slightly declined by one cent over the past month. Reddit’s performance is expected to be bolstered by rising ad sales and advancements in AI initiatives, though challenges from a tough macroeconomic climate and stiff competition may impact results.

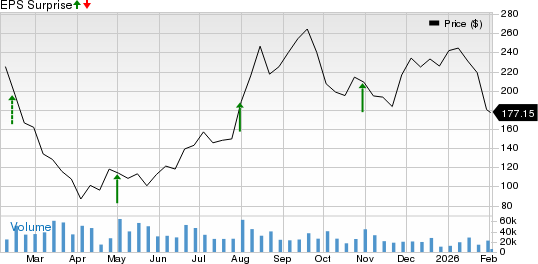

Over the past six months, RDDT shares have decreased by 12.2%, underperforming the Zacks Computer & Technology sector, which rose by 14.6%. Reddit’s current valuation is comparatively high, with a Price/Sales ratio of 10.81X, significantly exceeding the industry average of 4.32X.