Key Points

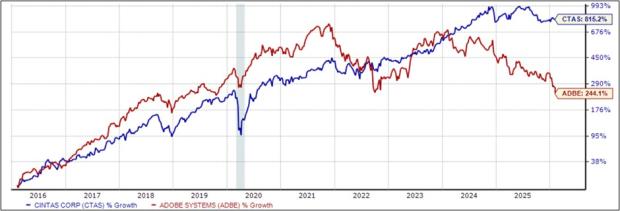

Microsoft Corporation (NASDAQ: MSFT) reported a significant five-year return of approximately 85.5% as of its recent fiscal 2026 second-quarter earnings, falling just short of the S&P 500‘s 87% increase. The earnings report, which covered the period ending December 31, revealed that the company’s stock had more than doubled prior to a recent sell-off.

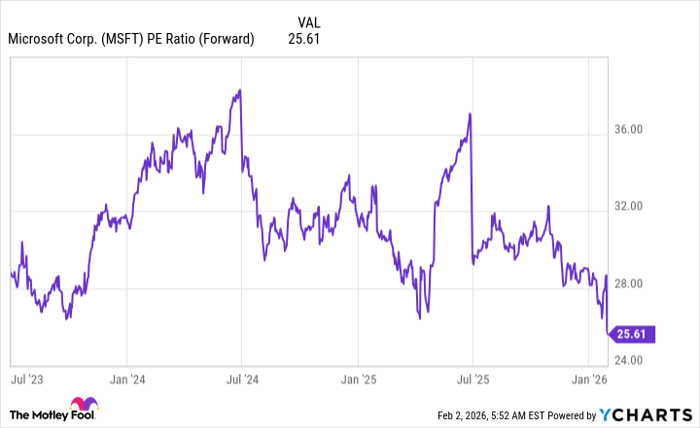

Microsoft’s cloud division, Azure, demonstrated a 39% year-over-year revenue growth in the second quarter, exceeding the company’s guidance of 37%. Additionally, Microsoft holds a 27% stake in OpenAI, which is reportedly considering an IPO later this year. Following a 10% drop in Microsoft’s stock price post-earnings, shares now trade at under 26 times forward earnings, presenting a potential buying opportunity for investors.

The company has projected a robust future for Azure with $625 billion in remaining performance obligations, indicating substantial growth potential amid increasing AI investments.