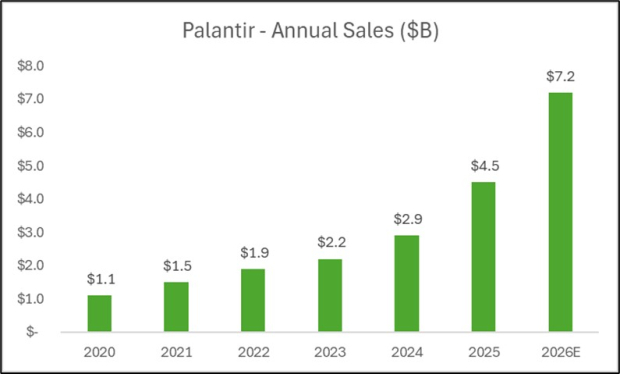

Palantir Technologies (PLTR) saw its stock surge nearly 7% on Tuesday following a robust Q4 earnings report released the previous evening. For Q4 2025, Palantir recorded a quarterly sales peak of $1.4 billion, up 70% year-over-year from $827.52 million, and exceeding analyst expectations of $1.34 billion. U.S. revenue alone rose 93% to $1.07 billion.

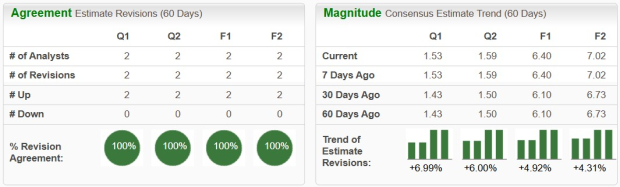

The company also achieved a net income of $608 million, translating to an adjusted EPS of $0.25, topping previous estimates of $0.23. For the full fiscal year, Palantir’s revenue reached $4.48 billion, a 56% increase from the prior year, with guidance for Q1 2026 sales projected between $1.53 and $1.54 billion, surpassing Wall Street expectations.

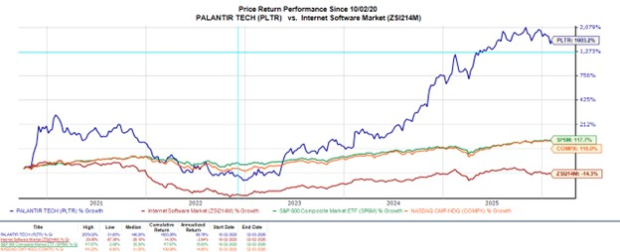

Despite the strong performance, PLTR remains about 25% below its all-time high of $207 per share from November 2022. Following this earnings rally, the stock trades at 142x forward earnings and 56x forward sales, raising some valuation concerns among analysts.