**Advanced Micro Devices (NASDAQ: AMD) stock dropped over 17% on Wednesday** after the company’s growth forecast fell short of investor expectations. By the end of trading, AMD’s share price reflected concerns over its future performance, despite a strong past quarter.

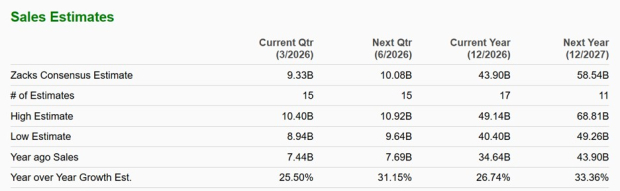

In its fourth quarter, AMD reported a **34% year-over-year increase in revenue, reaching $10.3 billion**. Data center sales surged 39% to **$5.4 billion**, driven by demand for EPYC processors and Instinct GPUs. The company also saw a **42% rise in adjusted net income**, totaling **$2.5 billion**, or **$1.53 per share**, which exceeded Wall Street’s forecast of $1.32. Looking ahead, AMD projected first-quarter revenue between **$9.5 billion and $10.1 billion**, indicating over 30% year-over-year growth at the midpoint.

Despite these strong numbers, investor sentiment was cautious, as some analysts anticipated a more aggressive growth outlook driven by AI technology demands. This reaction suggests that AMD may be facing pressure from high market expectations after its stock had roughly doubled in value over the past year.