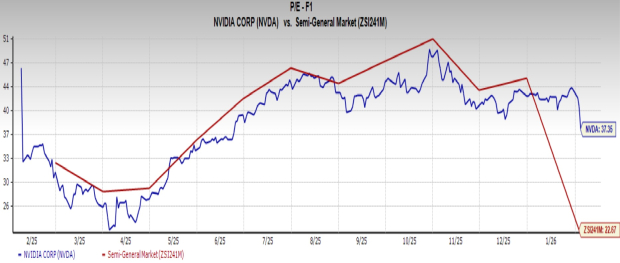

NVIDIA Corporation (NVDA) is currently trading at a forward price-to-earnings (P/E) ratio of 37.35, significantly higher than the Semiconductor industry’s average of 22.67, indicating a high valuation amid strong demand for its chips. In contrast, Super Micro Computer, Inc. (SMCI) reported a remarkable 123% year-over-year increase in net sales, reaching $12.7 billion for Q2 of fiscal year 2026, while trading at a P/E of 15.83, below the Computer-Storage Devices industry’s average of 28.9.

CEO Charles Liang projects third-quarter fiscal 2026 revenues of at least $12.3 billion and full-year net sales of at least $40 billion, reflecting optimism about its new Data Center Building Block Solutions. However, Supermicro faces challenges, including a gross margin decrease to 6.3% and a high debt-to-equity ratio of 66.9%, above the industry average of 20.1%.

Overall, Supermicro holds a Zacks Rank #3 (Hold), suggesting investors may need to exercise caution before making investment decisions amidst these financial risks.