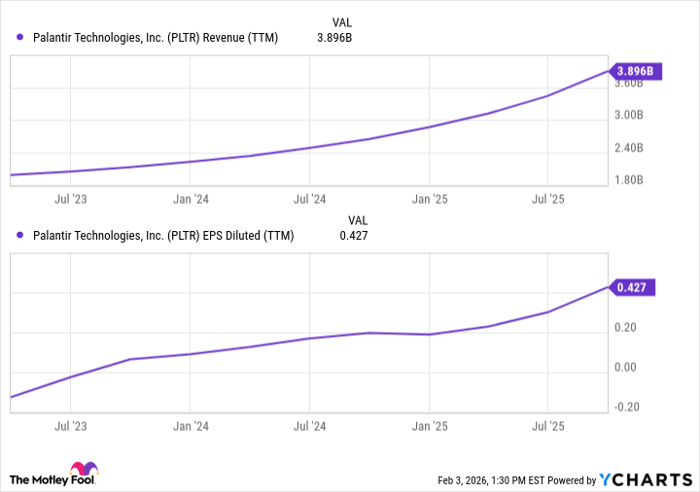

Palantir Technologies (NASDAQ: PLTR) experienced significant growth in its fourth quarter, reporting a 137% year-over-year increase in revenue from its U.S. commercial sector. This surge, largely driven by the company’s Artificial Intelligence Platform (AIP), marks a notable acceleration from the previous quarter, which saw nearly 28% growth. Despite this impressive performance, Palantir’s stock remains 33% below its November peak and is valued at a forward price-to-earnings (P/E) ratio of approximately 160.

The company’s focus on providing tailored software solutions, particularly through its flagship products Gotham and Foundry, has created a strong competitive moat. Palantir’s strategy involves embedding engineers within client organizations for extended periods to customize solutions, which discourages clients from switching to competitors. However, growth outside the U.S. has stalled, with the company reporting only a 10% increase in the U.K. year-over-year, presenting concerns over its ability to sustain long-term expansion.