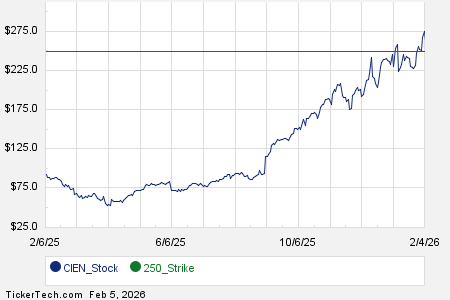

Investors in Ciena Corp (Symbol: CIEN) were presented with new options expiring on March 27, 2023. Notably, a put contract with a $250.00 strike price has a current bid of $29.00, allowing investors to potentially lower their cost basis to $221.00 per share if they sell-to-open, compared to the current trading price of $252.44. The odds of this put option expiring worthless are estimated at 60%, with an expected return of 11.60% on the cash commitment, or an annualized return of 84.75%.

On the call side, a contract at the $260.00 strike price is bidding at $31.00. If purchased at today’s share price and sold as a covered call, this could yield a total return of 15.27% by the March expiration, assuming the shares are called away. With the odds of this call option expiring worthless at 45%, the potential premium represents a 12.28% additional return, or 89.72% on an annualized basis. Both options reflect an implied volatility of approximately 91%.

Overall, Ciena Corp’s options trading activity presents diverse strategies for investors looking to optimize their returns given the current stock price and market conditions.