Nvidia Stock Analysis

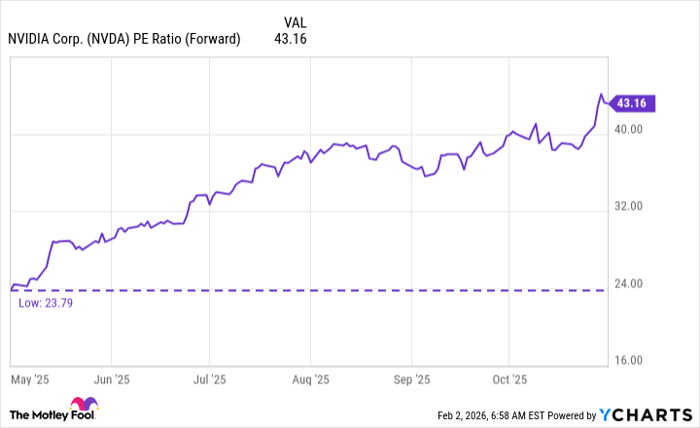

Nvidia’s stock (NASDAQ: NVDA) is currently trading at 25 times forward earnings, following a decline of approximately 10% from previous peaks. This valuation is similar to levels seen during a market trough last spring, where the stock previously soared 81% when it rebounded. Analysts expect Nvidia’s revenue to grow by 52% in fiscal 2027, continuing its multi-year growth trajectory fueled by a booming AI computing market, with global data center capital expenditures projected to reach $3 trillion to $4 trillion annually by 2030.

The company remains a leading provider of graphics processing units (GPUs) used in AI computing, amid intense market competition. As AI hyperscalers ramp up spending on infrastructure, Nvidia is positioned to substantially benefit, making it a compelling option for investors seeking growth in the tech sector.