### Asset Managers Highlighted for Strong Performance

Brookfield Asset Management (BAM) and Janus Henderson Group (JHG) are two asset managers currently on the Zacks Rank #1 (Strong Buy) list, attracting investor interest due to their solid recurring revenue streams and robust dividend yields. Brookfield, trading at $50 per share, recently raised its quarterly dividend by 13% to $0.50, with an annual yield of 3.5%. The firm is set to acquire Peakstone Realty Trust in a $1.2 billion cash deal, expanding its exposure to high-demand industrial properties.

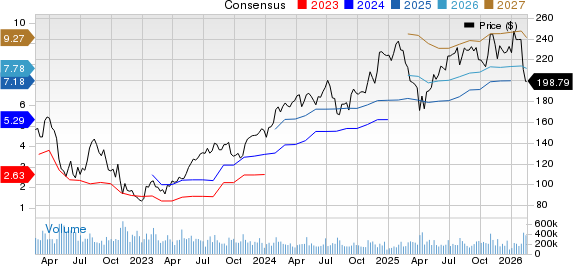

Janus Henderson, also priced at $50, has undergone significant restructuring to enhance investor returns. The company recently posted record EPS in FY25 but anticipates a 6% contraction in earnings this year, with a rebound projected at 8% in FY27. Despite a 70% surge in stock price over the past three years, JHG maintains a relatively low forward earnings multiple of 10X, appealing to income-focused investors.

Additionally, Alerus Financial (ALRS) and Patria Investments Limited (PAX) are noted as affordable options, both trading at around 10X forward earnings and offering dividends above 3%.