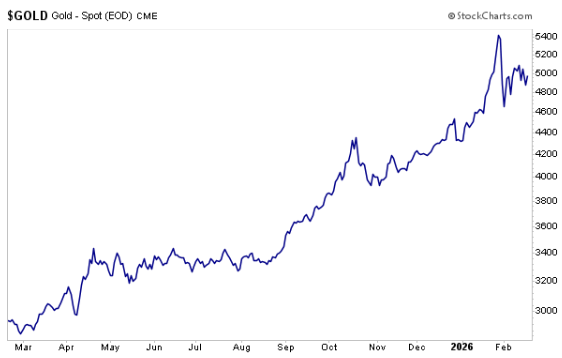

Gold prices experienced a significant drop of approximately 16% following President Trump’s announcement on January 30 that Kevin Warsh would be nominated as the next Federal Reserve Chair. Traders rapidly sold off gold, fearing that Warsh’s more neutral stance could lead to higher interest rates, which typically decreases gold’s appeal as a safe-haven asset.

Prior to this, gold had surged nearly 85% over the past year. Experts, including Yardeni Research, predict that gold prices could skyrocket to $10,000 per ounce by the end of the decade, driven by factors such as economic uncertainty and limited alternatives for investors. Currently, gold remains one of the few viable safe havens alongside the U.S. dollar as other currencies, including the Chinese yuan and British pound, face challenges.

As of now, gold-related stocks have bounced back, averaging over 15% gains year-to-date, reinforcing the outlook that gold will continue to be in demand, especially if U.S. interest rates are expected to decline further in the coming years.