Key Investment Moves by Israel Englander

Billionaire hedge fund manager Israel Englander, head of Millennium Management, reduced his stake in Nvidia by 17%, selling 3 million shares, while simultaneously doubling his investment in Palantir Technologies with the purchase of 543,300 shares in the fourth quarter. Englander’s hedge fund outperformed the S&P 500 by 38 percentage points over the past three years.

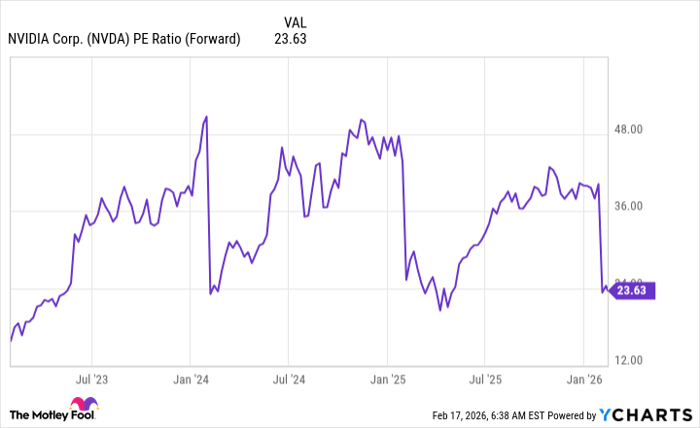

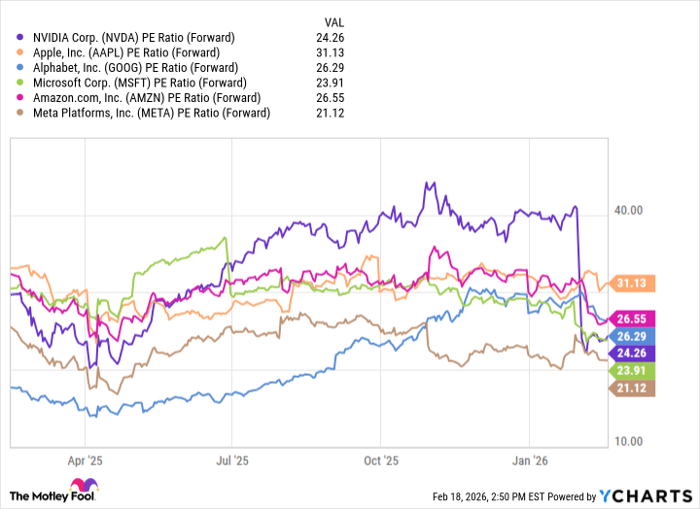

Nvidia, known for its dominance in AI infrastructure, currently trades at a valuation of 47 times earnings, with expected annual earnings growth of 38% over the next three years. In contrast, Palantir has demonstrated exceptional fundamentals with 10 consecutive quarters of accelerating sales growth but is trading at a high valuation of 72 times sales, significantly above its peers.

Investors should consider that while Englander’s moves provide insight, they occurred approximately 50 days ago, warranting a reassessment of current conditions for both stocks before making similar trades.