Bitcoin (BTC) continues to decline, having dropped 22.9% year to date to approximately $67,000 after peaking at $127,000 in October. Recent months have seen significant selling pressure, profit-taking, and a decline in institutional interest, highlighted by $3 billion in outflows from U.S. spot Bitcoin ETFs in January alone. This downturn is exacerbated by geopolitical tensions that have shifted investor focus toward safer assets.

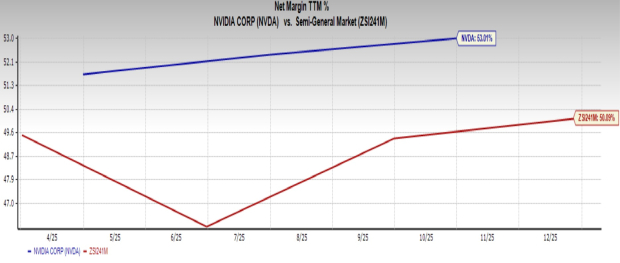

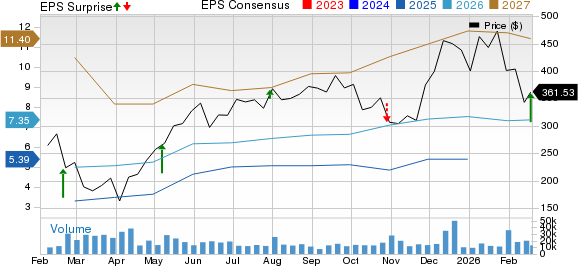

Conversely, NVIDIA Corporation (NVDA) has seen robust growth, with revenues increasing 62% year-over-year to $57 billion in its third fiscal quarter of 2026. The company anticipates fourth-quarter revenues of nearly $65 billion as demand for AI-driven chips surges amid easing U.S.-China trade tensions, with expected global data center spending hitting $3 to $4 trillion annually by 2030.