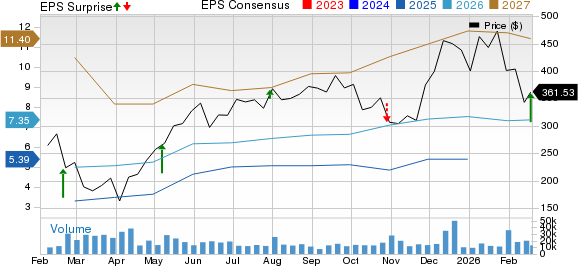

Used car e-retailer Carvana (CVNA) reported fourth-quarter earnings on December 31, 2025, posting $4.22 per share, significantly surpassing the Zacks Consensus Estimate of $1.13 and rising from 56 cents in the same period last year. Total revenues increased by 58% year over year to $5.6 billion, exceeding the estimated $5.22 billion.

In terms of segment performance, retail vehicle sales totaled $4.16 billion, a 62.9% increase compared to the prior year, with 163,522 vehicles sold, up 43%. Wholesale vehicle sales reached $988 million, a 45.7% rise, with 81,050 units sold, both figures exceeding estimates. Total gross profit was $1.05 billion, while adjusted EBITDA was $511 million, yielding an adjusted EBITDA margin of 9.1%.

As of December 31, 2025, Carvana’s cash and cash equivalents stood at $2.33 billion, an increase from $1.72 billion in 2024, with long-term debt decreasing to $4.83 billion from $5.26 billion. The company anticipates continued growth in retail units sold and adjusted EBITDA for 2026, assuming stable market conditions.