Ripe for the Picking: A Bountiful Year for Agriculture Stocks

After such an incredible year for the stock market in 2023, investors will certainly be looking for buy-the-dip candidates as a market pullback is to be expected at some point.

In this regard, a few agriculture stocks are attractive as they look poised to move higher even as a potential correction for the broader market looms. With that being said, let’s check out the opportunity in two pleasantly intriguing Zacks Agriculture-Operations Industry stocks.

Dole: Fresh Growth Potential

Boasting a Zacks Rank #1 (Strong Buy) Dole’s stock is starting to look like a steal at its current levels of around $12 a share. Dole is a producer of fresh fruits and vegetables that are sold throughout North America, Europe, Latin America, and Asia.

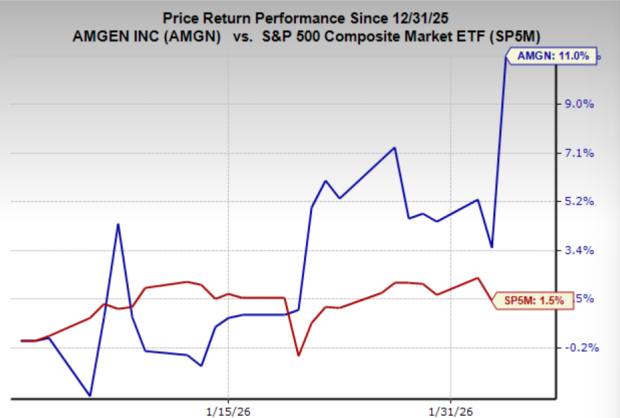

Image Source: Zacks Investment Research

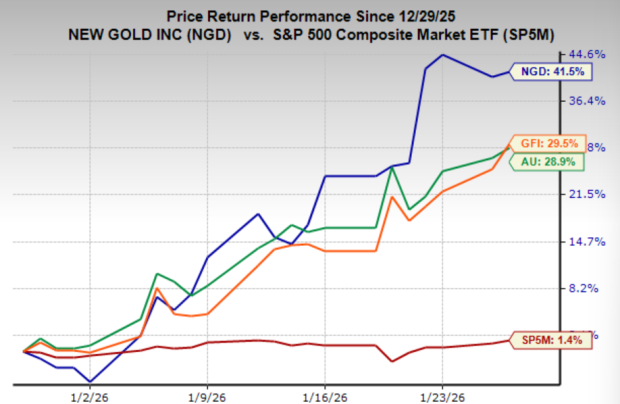

More eye-catching is that Dole’s stock trades at just 9.3X forward earnings and FY24 EPS is projected to jump another 14% to $1.33 per share. Even better, earnings estimate revisions for FY23 and FY24 are up over 11% in the last 60 days respectively. Plus, Dole currently offers a generous 2.58% annual dividend yield.

Image Source: Zacks Investment Research

Archer Daniels Midland: A Sustained Legacy

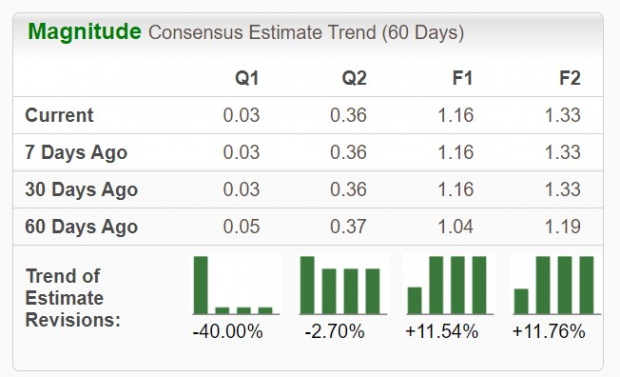

As it relates to income investing, Archer Daniels Midland is a very worthy pick being a “dividend king” that has increased its payout for at least 50 consecutive years. Archer Daniels’ dividend increase is on 51 years and counting and its stock currently sports a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

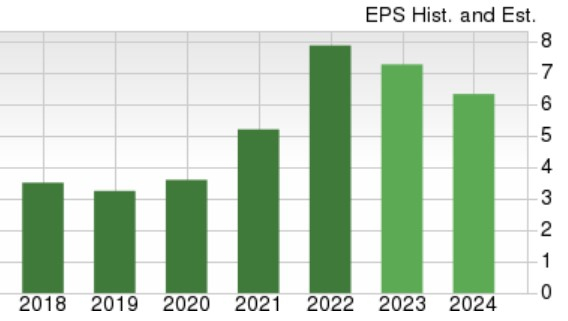

Still, Archer Daniels’ stock looks undervalued trading at 10X forward earnings which is a slight discount to the Zacks Agriculture-Operations Industry average of 12X and well below the S&P 500’s 20.5X. Of course, the cherry on top is Archer Daniels’ extremely reliable 2.47% annual dividend yield which is only at a 24% payout ratio indicating much more hikes should be in store in the years to come.

Image Source: Zacks Investment Research

Bottom Line

There is a lot of value in Dole and Archer Daniels Midland’s stock at current levels and their respectable dividends make them even more attractive to patient investors. Considering the rally in many other sectors these consumer staples stocks still appear to have more upside as the Zacks Agriculture-Operations Industry has made its way into the top 36% of over 250 Zacks industries.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Dole PLC (DOLE) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.