M-tron Industries, Inc. (MPTI) reached a new 52-week high of $41.62 on Jan 3. The stock pulled back to end the trading session at $36.23, down 1.5% from the previous day’s closing price of $36.79.

Riding the Surge

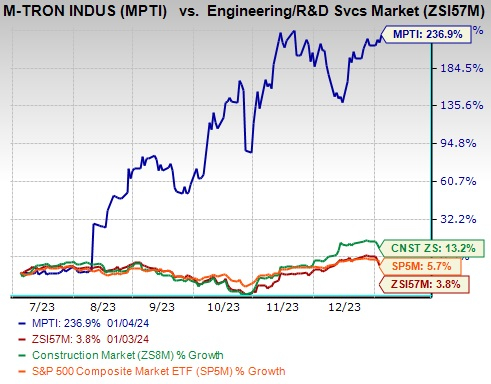

This Zacks Rank #1 (Strong Buy) company’s shares have surged 236.9% in the past six months, outperforming the Zacks Engineering – R and D Services industry’s 3.8% growth, the Construction sector’s 13.2% increase and the S&P 500 Index’s 5.7% rise.

Historical Context

M-tron is benefiting from increased customer demand, especially for defense products despite lingering supply-chain constraints, and diverse end-markets. The advance order phenomenon is driving the backlog of the company, and thus, the business volume. The separation of the company from The LGL Group, Inc. has encouraged its ability to facilitate strategic plans and fueled growth prospects.

Quote attributable to the author: “M-tron’s meteoric rise is akin to a rocketship blasting through weighty atmosphere, heedless of external limitations. It has plowed through challenges, accelerated by resolute demand, akin to a surfer riding the crest of a gigantic wave.”

Strength in Numbers

The company’s earnings estimate for 2023 has moved north to $1.72 per share from $1.17 in the past 60 days. Furthermore, the company reported an earnings beat in two of the trailing four quarters with an earnings surprise of 35.6%, on average. The stock portrays a positive trend, indicating robust fundamentals and elevating the expectation of an outperformance in the near term, despite the uncertain economic scenario.

Driving Forces

Growing Backlog: M-tron witnessed consistent backlog growth since the beginning of 2023, thanks to an increase in defense product orders. As of Sep 30, 2023, the company’s backlog was $50.3 million, up 14.1% year over year attributable to customers’ motivation to order in advance to secure product deliveries for their production requirements.

Diverse End Markets: MPTI is thriving despite the uncertain economic scenario because of its diversified end markets, which include avionics, defense and aerospace, space and SATCOM along with instrumentation, industry and computing. The company’s revenues grew 31.2% in the first nine months of 2023, driven by the recovering avionics market and strong defense product shipments.

Higher ROE: M-tron’s trailing 12-month ROE is 22.9%, higher than the industry’s 16.3%, indicating the company’s superior efficiency at creating profits and increasing shareholders’ value.

Strategic Separation Move: On Oct 7, 2022, M-tron announced its official separation from The LGL Group, Inc., becoming the sole publicly traded company. This strategic move became a growth driver, helping it to efficiently allocate its resources and tailor its strategic plans and growth opportunities.

Peer Performance

The article also highlights other top-ranked stocks in the same sector, such as Fluor Corporation (FLR), Martin Marietta Materials, Inc. (MLM), and Taylor Morrison Home Corporation (TMHC).

So, what’s next for MPTI? Can it maintain its momentum and defy expectations anew?

“Like a marathon champion sprinting across the finish line, M-tron appears to have legs to power through market naysayers and keep soaring.”

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.