Anheuser-Busch InBev SA/NV BUD, commonly known as AB InBev, is geared up for expansion due to sustained consumer demand for its brand portfolio. The company’s accelerated digital transformation, pricing actions, revenue management initiatives, and ongoing premiumization are propelling its growth trajectory.

The company’s strategy has been centered around offering premium beer variants, aligning with the consumer premiumization trend in the alcohol industry. It has been committed to developing a diverse portfolio of global, international, and crafts and specialty premium brands within its markets. In addition to the premium brands, BUD’s global brands have been leading the charge in premiumization.

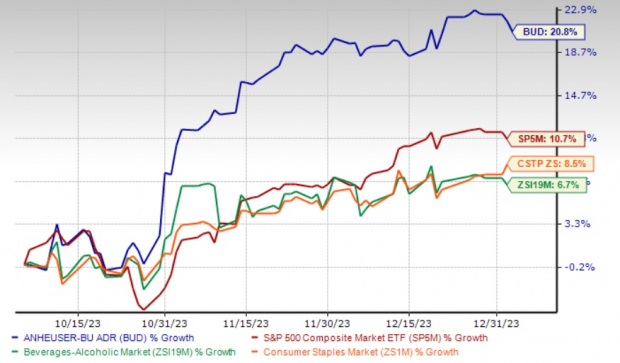

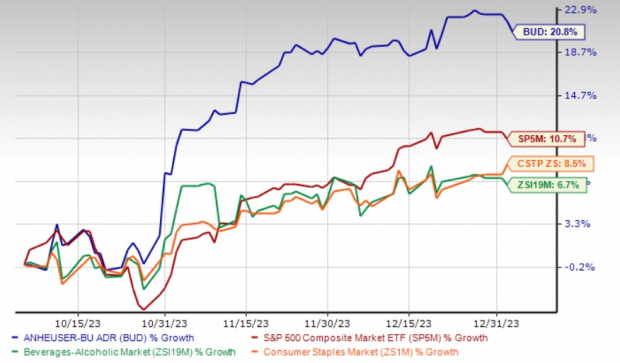

AB InBev’s focus on premiumization and pricing actions is mirrored in its share price, with the stock outperforming the industry and the sector. Shares of the Zacks Rank #3 (Hold) company have surged 20.8% in the past three months, in comparison to the industry’s growth of 6.7%. The stock has also outpaced the sector and the S&P 500’s gains of 8.5% and 10.7%, respectively, during the same period.

Further optimism surrounding the stock is evidenced by its forward sales estimates, which indicate substantial growth. The Zacks Consensus Estimate for BUD’s 2023 sales projects a 4.5% increase from the previous year’s figure.

Image Source: Zacks Investment Research

The Push for Premiumization

Embracing the premiumization strategy, BUD has been actively expanding its beyond beer collection and investing in B2B platforms, e-commerce, and digital marketing. These concerted efforts position the company for long-term growth.

What is premiumization? This is the increasing consumer desire for premium alcohol products. This trend has driven alcohol manufacturers to adopt strategies aimed at bolstering their premium portfolio. AB InBev is strongly committed to capitalizing on the premiumization trend, which has emerged as a significant growth opportunity for the company within the beer industry.

Diverse Beyond Beer Initiatives

AB InBev is steadfast in expanding its beyond beer portfolio, encompassing products such as ready-to-drink beverages like Canned Wine and Canned Cocktails, Hard Seltzers, Cider, and Flavored Malt Beverages. The beyond beer trend has gained traction due to the rising demand for low-alcohol or non-alcoholic drinks.

The company remains focused on broadening its beyond beer portfolio, which has also contributed to the top line. Notably, the beyond beer portfolio contributed over $385 million to total revenues in the third quarter of 2023. In the same quarter, the global beyond beer business’s revenues experienced mid-single-digit growth globally, propelled by expansions of Flying Fish in Africa and the Vicky portfolio in Mexico. This growth was somewhat offset by a slowdown in the malt-based seltzer industry in the United States.

Embracing Digital Transformation

AB InBev has been diligently investing in new capabilities for several years to enhance its connections with customers and consumers. Its digital platform has witnessed rapid growth, leveraging technology such as B2B sales and other e-commerce platforms including BEES and Zé Delivery. Over the past few months, there has been significant growth in B2B platforms, e-commerce, and digital marketing trends, which has contributed to the company’s overall growth.

Challenges Along the Way

AB InBev continues to grapple with elevated costs resulting from commodity cost inflation and investments to support long-term growth, leading to pressure on EBITDA margin.

Selected Stock Picks

We have highlighted some well-ranked stocks from the broader Consumer Staples sector, namely Dutch Bros BROS, Fomento Economico Mexicano FMX, and Molson Coors TAP, all exhibiting promising potential within the industry.

Dutch Bros currently boasts a Zacks Rank #1 (Strong Buy), with a trailing four-quarter earnings surprise of 57.1%, on average. The Zacks Consensus Estimate for Dutch Bros’ current financial year sales and earnings implies growth of 30.6% and 81.3%, respectively, from the previous year’s levels.

Similarly, Fomento Economico Mexicano, alias FEMSA, currently flaunts a Zacks Rank #1, with a trailing four-quarter earnings surprise of 23.2%, on average. The Zacks Consensus Estimate for FEMSA’s current financial year sales and earnings suggests a rise of 32.3% and 60.3%, respectively, from the year-ago figures.

Molson Coors currently carries a Zacks Rank #2 (Buy), with a trailing four-quarter earnings surprise of 41.3%, on average. The Zacks Consensus Estimate for Molson Coors’ current financial year’s sales and earnings implies improvement of 9.1% and 28.8%, respectively, from the previous year’s reported numbers.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.