Today’s episode of Full Court Finance at Zacks dives into the much-needed market pullback to start 2024, and why investors might want to start taking advantage of the downturn. The episode then digs into two highly-ranked stocks—Encompass Health (EHC)and Shift4 Payments (FOUR)—with strong growth potential in key industries that investors might want to buy amid the early 2024 cooldown.

Market Rebound Amidst Pullback

The Nasdaq posted its fifth-straight drop on Thursday, marking its longest losing streak since October 2022. That might scare off some investors, but it’s worth constantly remembering that stocks without fail pull back to key moving averages throughout bull runs.

Thursday’s selling sent the S&P 500 below its 21-day moving average and the Nasdaq slightly closer to testing its 50-day. The nearby chart shows investors that buyers might start to step up to the plate soon as the tech-heavy index gets closer to its 50-day and oversold RSI levels.

The downturn also seems poised to spark a more sustainable 2024 rally since many of the factors that drove the impressive 2023 run and the surge off the October lows remain firmly in place.

Encompass Health: A Steady Performer

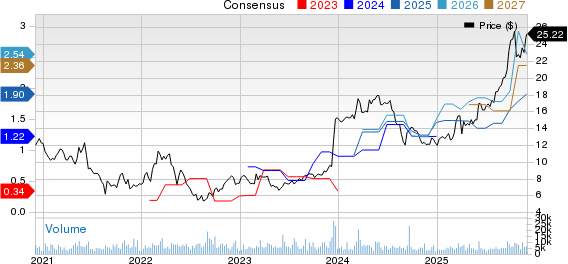

Encompass Health (EHC)

Encompass Health is one of the largest owners and operators of rehabilitation hospitals in the U.S., with roughly 160 locations across 37 states and Puerto Rico. Encompass Health has been steadily expanding its bed count and hospitals to help it post a CAGR of 7.2% since 2010, with revenue up nearly 11% through the first nine months of 2023.

Encompass Health is set to expand long-term as the U.S. population grows older. The firm is projected to post another 8% revenue growth next year. Plus, its adjusted earnings are expected to climb by 24% in FY23 and 9% higher in 2024. Encompass Health’s upbeat EPS revisions help it land a Zacks Rank #2 (Buy) and it has topped our bottom line estimates by an average of 17% in the trailing four quarters.

Encompass Health’s dividend yields 0.9% right now and its industry is in the top 25% of over 250 Zacks industries. EHC stock has climbed by 575% in the last 15 years vs. the S&P 500’s 475%. Yet, EHC is trading around 25% below its peaks and 18% below its average Zacks price target.

Encompass Health is poised to retake its 50-month moving average soon while trading above its 21-day. EHC trades near its 10-year median at 19.1X forward earnings and at a 16% discount to the Zacks Medical sector despite easily outperforming the space during the past 10 years.

Shift4 Payments: Riding the Wave

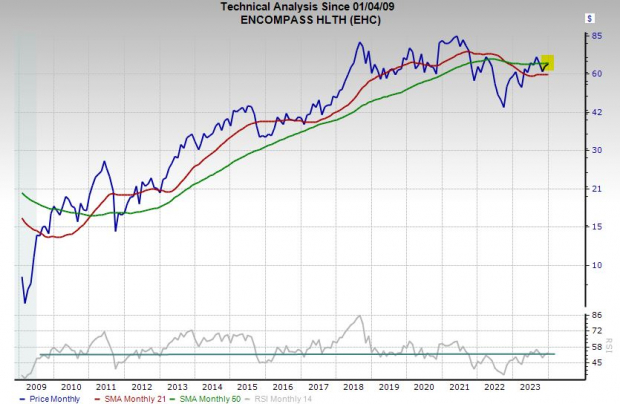

Shift4 Payments (FOUR)

Shift4 Payments is an integrated payment processing solutions leader, with a portfolio that spans in-person and digital, helping run payment infrastructure across various sectors and industries. Shift4 Payments’ clients range from Hilton to Little Caesars pizza. The company’s offerings include everything from POS and contactless solutions to fraud prevention and payments integration.

Shift4 Payments has topped our quarterly EPS estimates by an average of 25% in the trailing four quarters, including a 17% Q3 beat. Shift4 Payments’ consensus earnings estimates have surged for both FY23 and FY24 to help it capture a Zacks Rank #1 (Strong Buy). The company’s adjusted earnings are projected to climb by 110% and 32%, respectively in FY23 and FY24 on 31% and 37% higher revenue.

On the valuation front, FOUR trades at a 90% discount to its peaks at 31.7X forward earnings. Shift4 Payments’ PEG ratio sits at 0.6 vs. the Zacks Tech sector’s 2.1, with its earnings outlook for 2025 soaring. Plus, 16 of the 19 brokerage recommendations Zacks has are “Strong Buys.”

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.