ManpowerGroup Inc. has shown a 6.3% appreciation in its shares over the past three months, accompanied by an impressive Growth Score of B. This robust style score aggregates critical metrics from a company’s financial statements to provide a genuine understanding of the quality and sustainability of its growth.

Positive Indicators

ManpowerGroup’s steadfast commitment to delivering returns to its shareholders not only offers a reliable avenue for long-term wealth accumulation but also bolsters investor confidence. The company executed buybacks worth $270 million, $210 million, and $264.7 million, alongside dividend payments totaling $139.9 million, $136.6 million, and $129.1 million in 2022, 2021, and 2020, respectively. These initiatives not only uplift investors’ trust but also have a positive impact on earnings per share.

The company has been undertaking significant transformations in line with its Diversification, Digitization, and Innovation strategy. It is effectively implementing strong pricing and cost control measures and making substantial investments in technology to bolster productivity and efficiency.

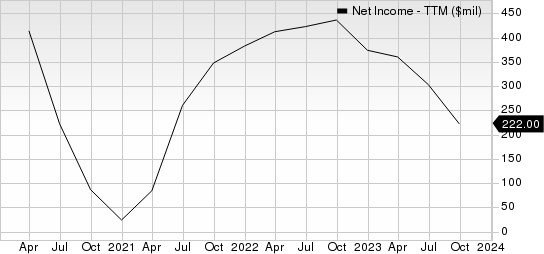

ManpowerGroup Inc. Net Income (TTM)

ManpowerGroup Inc. net-income-ttm | ManpowerGroup Inc. Quote

The acquisition of Tingari in 2022 has bolstered ManpowerGroup’s Talent Solutions brand in France, while the 2021 acquisition of ettain has fortified the company’s Experis business, enhancing its capabilities in Financial Services, Healthcare, and Government clients.

ManpowerGroup’s current ratio stood at 1.21 at the end of the third quarter of 2023, remaining consistent with the prior quarter’s figure. A current ratio exceeding one often indicates the company’s ability to easily meet its short-term obligations.

Zacks Rank and Alternative Stocks to Deliberate

Presently, ManpowerGroup holds a Zacks Rank #3 (Hold).

Here are some noteworthy stocks within the broader Business Service sector.

Rollins holds a Zacks Rank #2 (Buy) at the moment. The Zacks Consensus Estimate for its fourth-quarter 2023 earnings stands at 21 cents, implying a 23.5% year-over-year growth. Find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Rollins has demonstrated an impressive earnings surprise history, surpassing the consensus mark in three of the last four quarters, with one instance of meeting expectations, and an average surprise of 7.2%.

FTI Consulting also carries a Zacks Rank of 2 currently. The consensus estimate for its fourth-quarter 2023 earnings is $1.57 per share, reflecting a 3.3% year-over-year growth.

FTI Consulting has a commendable earnings surprise track record, exceeding the consensus mark in three of the last four quarters, with one instance of falling short, and an average surprise of 8.5%.

Are you enticed? For a mere $1, you can access all of Zacks’ picks for 30 days. Yes, just a single dollar. This offer, once deemed a shocking surprise to our members, aims to acquaint you with our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more. These services alone have already closed 162 positions with double- and triple-digit gains in 2023 alone.

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.