Exploring Freeport-McMoRan’s Indelible Infrastructure

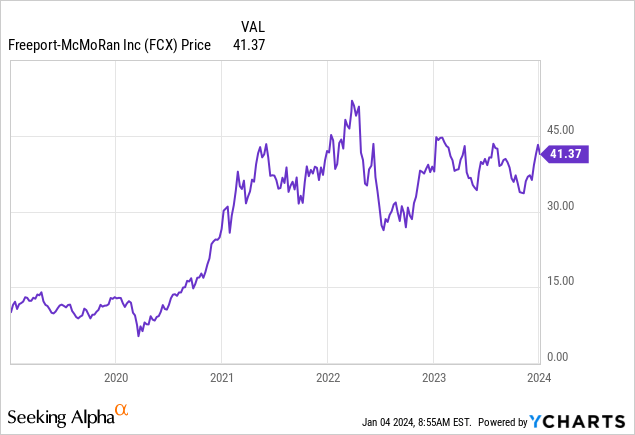

Freeport-McMoRan (NYSE:FCX), a captivating figure in the basic materials sphere, has long captivated market observers with its foothold in the copper mining industry. Hailing from Phoenix, Arizona, the company not only stands as one of the world’s largest copper miners but also serves as a pivotal economic barometer due to the cyclical nature of copper prices.

My interest in this company spans many years, with my most recent article dating back to October 2, in which I extolled the company’s enduring strength in the face of short-term hurdles.

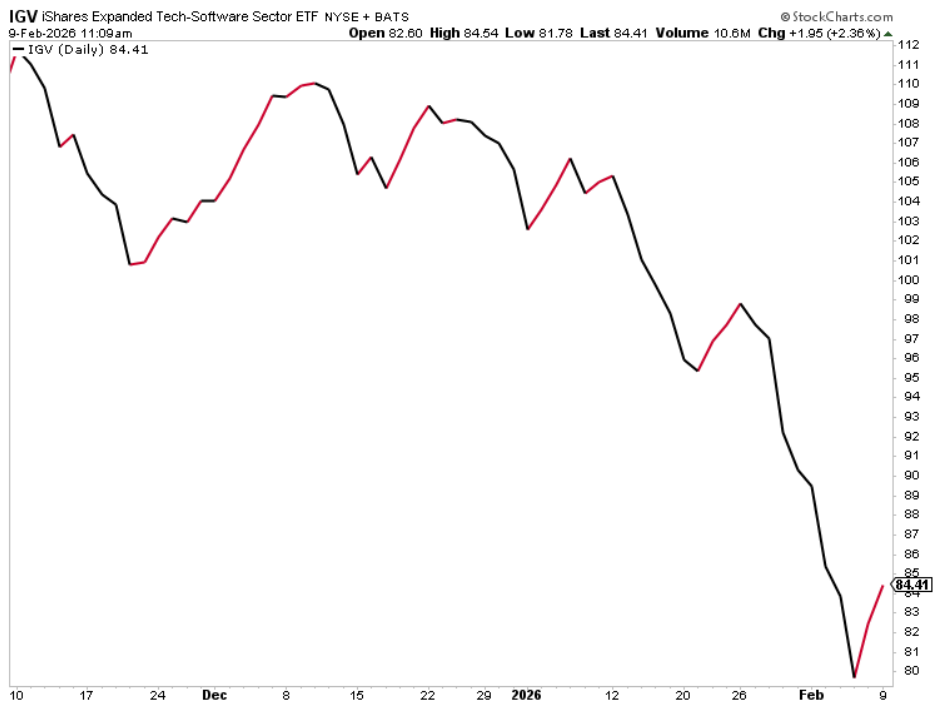

Since then, FCX shares have outperformed the S&P 500, climbing 13%.

In this article, I’ll update my bullish take, leveraging recent developments in the copper industry and the company’s internal enhancements to fuel future growth.

So, without further ado, let’s dive in!

The Pinnacle of Copper

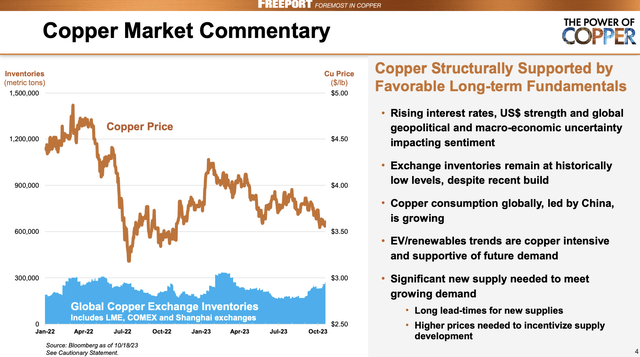

Post-Christmas, copper surged to its highest price since August, with subsequent gains partially reversed.

On December 27, Bloomberg reported that base metals, including copper, charted upward momentum driven by optimism around potential Federal Reserve monetary policy easing.

The global copper supply, as per Bloomberg, appears to be dwindling, with the anticipated surplus for 2024 rapidly shrinking.

Initial projections of a copper oversupply have been whittled down, primarily due to supply chain vulnerabilities stemming from issues like political resistance, social unrest, and operational setbacks.

In late November/early December, one of the world’s largest copper mines shuttered due to intense public protests.

Moreover, operational hurdles prompted a leading mining company to slash its production estimates, erasing roughly 600,000 tons of anticipated copper supply and potentially reshaping the market from forecasted surplus to equilibrium or even deficit.

Consequently, industry analysts now anticipate a small deficit in refined copper for the upcoming year, a stark departure from previous projections.

The market’s tepid response to supply disruptions belies the potential impact of a demand resurgence, underscoring the latent long-term secular tailwinds obscured by cyclical weakness.

The chart juxtaposing the ISM Manufacturing Index against COMEX Copper futures hints at a turnaround in economic growth expectations, signaled by an uptick in copper futures.

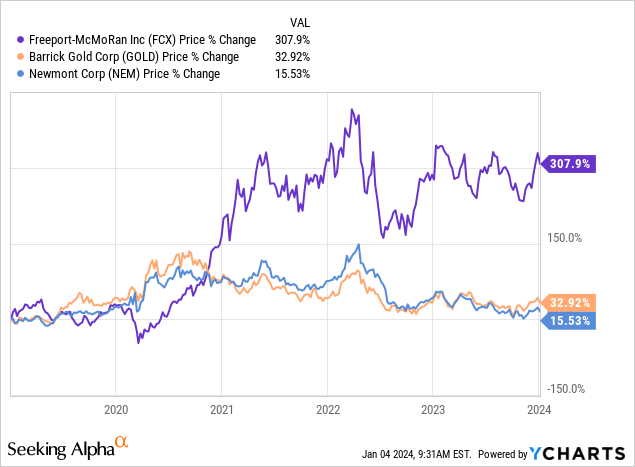

These tailwinds coalescing around copper prices have spurred even gold miners to recalibrate their focus towards copper, as substantiated by the Wall Street Journal’s report on their shift towards copper in light of the global energy transition.

The surge in gold prices has prompted major players like Newmont (NEM) and Barrick Gold (GOLD) to fortify their foothold in copper, exemplified by Newmont’s acquisition of Newcrest Mining for $15 billion and Barrick’s plans to establish a significant copper operation in Pakistan.

Unsurprisingly, this pivot reflects investors’ recognition of the burgeoning demand for

Electric Vehicle and Renewable Energy Boom Set to Propel Copper Demand

The global demand for copper is set to undergo a seismic shift in the coming years, driven by the rising prominence of electric vehicles and renewable energy production. Industry analysts are predicting a substantial doubling in demand for copper by the year 2050. These projections have major implications for companies deeply involved in copper mining and production, such as Freeport-McMoRan.

A Fantastic Long-Term Investment

Freeport-McMoRan recently discussed the robust long-term outlook for copper during its earnings call. The company highlighted the global investment in electrification as a primary driver for the expected surge in copper demand. Despite short-term challenges such as rising interest rates and a strong U.S. dollar, recent months have seen a reduction in these headwinds.

Notably, regional trends have indicated growth in the U.S. power cable, building wire, and automotive sectors. China has displayed resilience in copper consumption, underpinned by investments in renewable energy and electric vehicles. Even historically low copper-consuming regions such as India have exhibited increasing consumption. This global landscape speaks to a promising future for copper producers like Freeport-McMoRan.

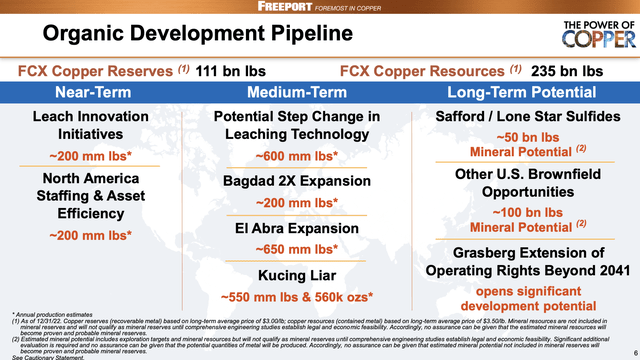

Looking ahead, the company’s growth initiatives extend globally, with major projects like the Kucing Liar development in Grasberg expected to commence production by 2030. This project represents a substantial ore body, projected to ramp up to 550 million pounds of copper and 560,000 ounces of gold in the next decade. Freeport-McMoRan is also engaged in exploration activities to identify potential below the Deep MLZ ore body in the Grasberg district.

Meanwhile, negotiations in Indonesia for extension beyond 2041 are ongoing, potentially unlocking further large-scale mining opportunities in one of the world’s most significant copper and gold mining districts. In the U.S., Freeport sees a major opportunity in the Safford/Lone Star district, with plans to identify a significant resource that could add another cornerstone asset of scale.

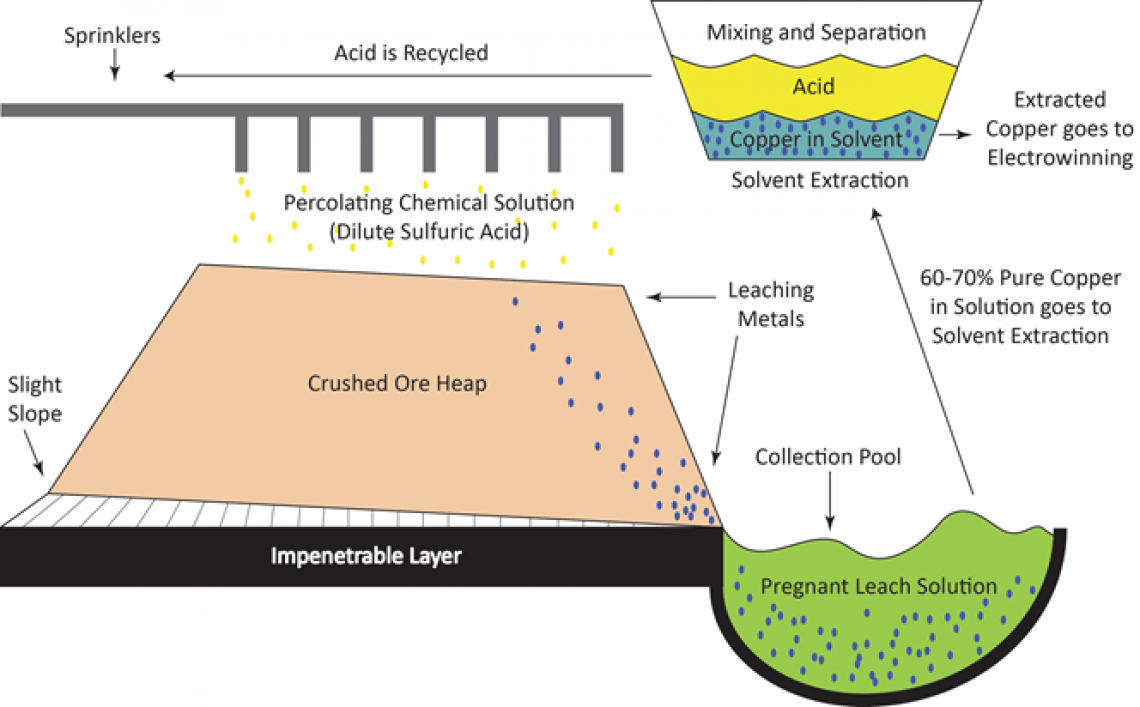

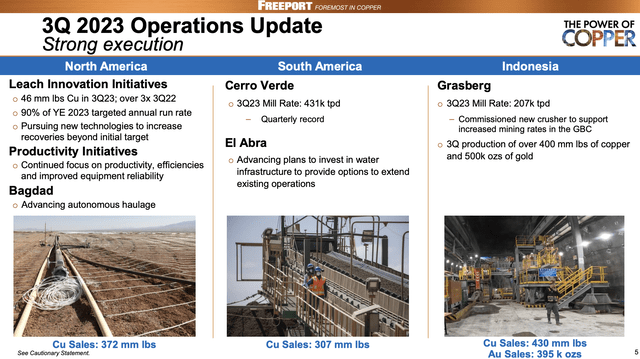

The company has achieved significant milestones with its leach innovation initiatives in the U.S., resulting in incremental copper production and positioning the company to achieve its target run rate. Freeport is aggressively advancing these initiatives, focusing on retaining more heat in stockpiles and applying solutions to areas that were not previously leached.

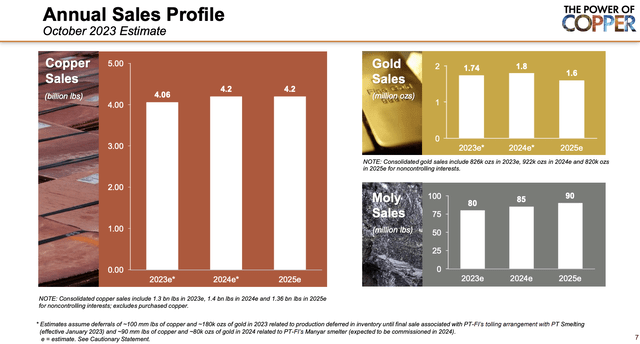

Moreover, the company is conducting targeted drilling to inject solutions into areas where blockages may have occurred over time. Leveraging data and modeling, Freeport is gearing up to scale these activities, aiming to double the incremental copper to 400 million pounds per annum. The company has set its sights on boosting copper production to 4.2 billion pounds by 2025, with every $0.10 increase in the copper price potentially resulting in substantial additional annual copper EBITDA.

Valuation

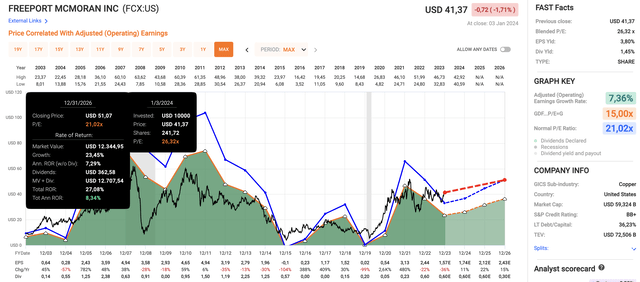

The valuation of stocks in the commodity sector can be intricate due to the significant impact of changes in commodity prices on earnings expectations. Despite the complexities, current estimates indicate that Freeport-McMoRan is trading below its fair value. Based on a blended P/E ratio of 26.3x and normalized valuation of 21.0x earnings, the stock is estimated to have a fair price target of roughly $51. This implies 8% annual returns through 2025, with the current consensus price target at $45.

While Freeport-McMoRan’s stock could remain volatile in the short term, stemming from economic growth concerns, there is a bullish sentiment on the company’s future prospects. It is expected that the stock price will soar when global growth conditions improve, with a stronger focus on long-term growth trends such as net zero and supply shortages.

Takeaway

Freeport-McMoRan appears to be a resilient investment amid short-term challenges in the copper industry. The company’s strategic initiatives, including global growth projects and innovative practices, position it to capitalize on the growing demand for copper, fueled by global electrification investments. With a promising long-term outlook and seemingly undervalued stock, Freeport-McMoRan presents an attractive opportunity for investors, poised to deliver robust returns as global economic conditions improve.

The only reason why I do not own Freeport-McMoRan shares is my position in the highly correlated Caterpillar (CAT) stock.