BorgWarner’s Investment Potential

BorgWarner (NYSE:BWA) specializes in automotive solutions for both internal combustion engine (ICE) and electric vehicles, boasting a substantial economic moat due to strong intellectual properties, switching costs, and tangible cost advantages.

The company’s robust performance in Q1-Q3 of FY23 has been overlooked by investors, resulting in heavily discounted stock prices based on various metrics and intrinsic value calculations.

BorgWarner is well-positioned to capitalize on the burgeoning electric vehicle (EV) market through continuous innovation and distinctive designs, further accentuated by a potential 65% discount on shares, labeling BorgWarner as a Strong Buy.

BorgWarner: A Brief Overview

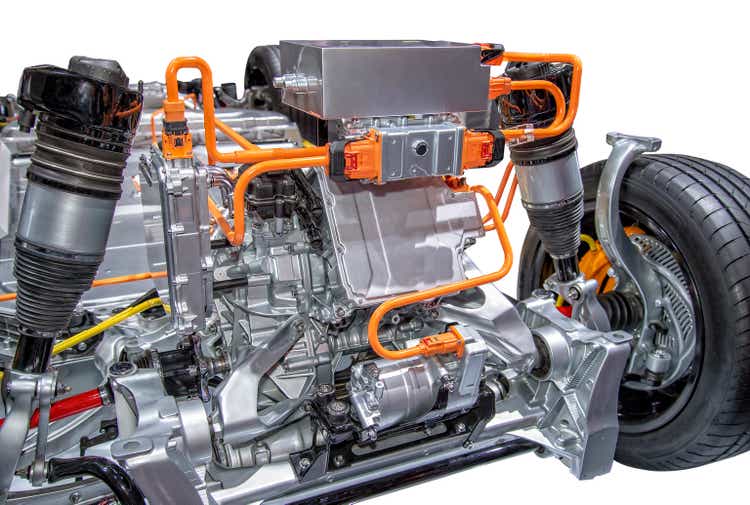

BorgWarner specializes in manufacturing solutions for ICE, hybrid, and electric vehicles, crafting a diverse range of products including traditional combustion turbochargers, eBoosters, emissions systems, battery packs, and automotive software.

Amid the transition from ICE vehicles to hybrid electric vehicles (HEVs), battery electric vehicles (BEVs), and alternative-fuel vehicles, BorgWarner adeptly diversifies its product portfolio to secure a robust position in the evolving automotive industry. Its foray into eBoosters, eTurbos, and other essential components for electric vehicles not only sustains its relevance but also expands its competitive advantage.

BorgWarner operates more than 61 manufacturing facilities across 19 countries and boasts a workforce of over 38,000 employees, including 7,500 engineers. The recent spin-off of its Fuel Systems and Aftermarket segment as PHINIA was aimed at unlocking additional value perceived in these two business segments.

Frédéric B. Lissalde, who assumed the role of CEO in 2018, brings a wealth of industry expertise and automotive engineering experience to steer BorgWarner toward continued success.

BorgWarner’s Impenetrable Economic Moat

BorgWarner’s extensive industry knowledge and continuous innovation have bolstered its position with a wide economic moat, particularly in response to the long-term trend of governments advocating for more efficient and powerful engines.

The company’s recent acquisitions, including Eldor Corporation’s Electric Hybrid Systems Business and Hubei Surpass Sun Electric Charging business, signify a concerted effort to enhance its e-power product lineup, reflecting its strategic focus on the EV automotive landscape.

The Charging Forward 2027 strategic initiative marks BorgWarner’s concerted push into the EV domain, aiming to gradually shift manufacturing volumes from ICE-related components to electric power-oriented products for automakers.

BorgWarner’s substantial investments in electric vehicle technologies position the company to offer a comprehensive portfolio of EV-related solutions, supplementing its long-term industry knowledge and ensuring its relevance as the automotive industry undergoes a seismic shift.

The supplier contracts BorgWarner secures with automotive OEMs further fortify its moat, with lengthy contract periods tying the company closely to OEM manufacturers, which, in turn, bolsters revenues and production volumes, while also deterring potential competitors from replicating BorgWarner’s R&D and innovation prowess.

BorgWarner: Navigating the Road Ahead with Industry Ties and Financial Fortitude

BorgWarner’s unassailable ties with the automotive Original Equipment Manufacturers (OEMs) have become the bedrock of its sustained growth, leveraging formidable switching costs that dissuade OEMs from seeking alternatives. The formidable moatiness generated by these ties has fortified the company’s position in the industry, rendering it an indispensable ally for the OEMs.

In the intricate ecosystem of automotive supply, BorgWarner has strategically entrenched itself by fostering longstanding relationships with OEMs. The enormity of the switching costs faced by the OEMs in transitioning away from BorgWarner is staggering, rendering such a move virtually insurmountable. The daunting prospect entails a comprehensive redesign of their entire engine or drivetrain, consolidating BorgWarner’s supremacy as an indispensable supplier.

These entrenched ties, coupled with BorgWarner’s cost advantage derived from protracted supply contracts, have manifested a formidable moat for the company, effectively nullifying the threat of customer attrition to new component manufacturers.

BorgWarner has harnessed the extensive industry knowledge and forged close alliances with automotive OEMs, capitalizing on cost efficiencies engendered by prolonged supply deals, to carve an expansive economic moat for the company.

BorgWarner: A Financial Odyssey

From an operational standpoint, BorgWarner has exhibited commendable financial prowess, substantiated by its robust profitability and efficacious performance.

The company has evidenced a 5-year average Return on Assets (ROA), Return on Equity (ROE), and Return on Invested Capital (ROIC) of 5.63%, 13.31%, and 8.99% respectively. These figures indicate a positive trajectory, outstripping inflation and illustrating the company’s astute handling of both equity and invested capital.

Although these returns have marginally receded compared to the levels recorded in 2010-2013, it is imperative to acknowledge BorgWarner’s ongoing extensive restructuring to align with the burgeoning demand for Electric Vehicles (EVs).

In the backdrop of the seismic shift in the automotive landscape, BorgWarner’s ability to sustain robust profitability amidst a challenging market milieu vindicates its uncanny knack for meeting the OEMs’ exigencies with aplomb.

BorgWarner’s Weighted Average Cost of Capital (WACC) currently stands at approximately 7.07%, underscoring its capability to secure higher returns on investments relative to the cost of capital acquisition.

Furthermore, in comparison to industry counterparts such as Magna International (MGA) and Vitesco Technologies (OTCPK:VTSCY), BorgWarner’s ROA, ROE, and ROICs are notably higher by approximately 5 and 9 percentage points respectively.

BorgWarner also boasts a 5-year average gross margin of 19.69%, operating margin of 10.20%, and net margin of 5.74%, emphasizing the robustness of its fundamental business model and its consistent profitability.

The fiscal year 2023 has proven to be lucrative for the company, with a 12% upsurge in revenue in Q1, tempering somewhat by stagnant figures in Q2. However, Q3 witnessed a resounding 12.5% surge in net sales, propelled by burgeoning demand for “e”-related products in North America, Europe, and China.

Securing agreements with major North American, European, and Asian OEMs for supplying diverse “e”-related solutions signifies a significant triumph for BorgWarner. Notably, the inclusion of “premium” automakers among its customers portends marginally more lucrative agreements, juxtaposed with dealing with margin-pressured general automakers.

In Q3, the company recorded a 7.4% escalation in gross profits, attributed to the 11.5% hike in Cost of Goods Sold (COGS) being outpaced by the 12.5% surge in net sales. This judicious cost control underscores the management’s dual focus on expanding its suite of EV-related offerings while safeguarding robust profitability.

Although the Selling, General, and Administrative (SGA) expenses have shown meager fluctuations in FY23 and minor restructuring expenses incurred due to the company’s acquisitions in 2023, BorgWarner’s Air Management business segment remains the primary revenue driver, while the drivetrain & battery systems and ePropulsion segment exhibit resonant growth of around 22% and 25% YoY respectively.

Geographically, BorgWarner has successfully diversified its revenue streams, with North America, Europe, and Asia contributing roughly a third of the company’s revenues each. This geographic dispersion insulates the company from localized economic downturns and enhances its ability to mitigate the repercussions of geopolitical upheavals.

Furthermore, Q3 witnessed a 1.6% YoY surge in adjusted operating margins to 10.1%, as the company’s net sales outpaced the escalation in COGS. This upswing in profitability occurred against the backdrop of a $10M upsurge in 2023 eR&D expenses, deemed imperative for realizing the company’s strategic goals encapsulated in the “Charging Forward 2027” initiative.

Noteworthily, Seeking Alpha’s Quant has accorded a “B+” profitability rating to BorgWarner, indicative of the accurate barometer of the company’s current fiscal standing.

However, it is noteworthy that BorgWarner has witnessed a marginal downturn in

The BorgWarner Investment Outlook

Financial Performance

Amidst a highly inflationary macroeconomic environment, BorgWarner’s financial performance has been under scrutiny. The firm experienced a decrease in gross profit margin, net income margin, and ROA compared to their 5-year averages. This was attributed to the increasing cost of goods sold and slightly softened demand for their range of products. However, the firm’s long-term contracts have provided stability to its revenues, and the substantial development of EV-oriented products positions BorgWarner as a competitive force for the next 15 years.

Despite the challenges, BorgWarner demonstrated astute capital allocation management, maintaining a conservative approach, even amidst their acquisitive streak. With $5.9B in total current assets and total current liabilities of just $3.57B, BorgWarner displayed robust short-term liquidity, resulting in an excellent quick ratio of 1.21x and a current ratio of 1.65x.

Furthermore, the firm managed to keep its debt/equity ratio at an impressive 0.67x and a financial leverage ratio of 2.35x for FY22. The affirmation of a Baa1 credit rating for BorgWarner’s senior unsecured domestic notes by Moody’s with a stable outlook indicates a strong financial standing, despite the speculative elements present in the rating.

Debt Profile and Goodwill

One point of concern was the $3.67B in long-term debt held by BorgWarner at the end of Q3 FY23. While the firm’s staggered debt profile suggests a conscientious approach to growth, the observation of a relatively small sum of $141M par value for senior notes at a high interest rate of 7.125% has raised some eyebrows. However, this is mitigated by the relatively low rates on their other maturities, demonstrating thoughtful financial planning.

The recent streak of EV product-related acquisitions has left BorgWarner with $2.94B worth of goodwill on their balance sheet. While this amount has increased significantly from FY19, it is a testament to BorgWarner’s pursuit of valuable automotive technologies through its acquisitions.

These strategic initiatives have played a role in asserting BorgWarner’s competitive edge in the evolving automotive landscape and are indicative of sound financial stewardship, despite the concerns raised by the increase in goodwill.

Dividend and Future Expectations

BorgWarner continues to reward its investors by paying a reasonable dividend. This consistency, with a dividend yield FWD of 1.28% and an annual payout FWD of $0.44, underscores management’s fundamental desire to contribute to shareholder value over time.

As the market eagerly awaits the Q4 earnings report, investors are anticipating insights into BorgWarner’s performance, expectations for FY24, and progress in achieving the objectives outlined in their Charging Forward business plan.

Valuation and Market Performance

BorgWarner’s valuation has come under the spotlight, with the firm’s P/E GAAP TTM ratio of 8.34x representing a significant decrease compared to their running 5-year average. The firm’s P/CF TTM of 5.28x, TTM EV/EBITDA of 4.63x, and Price/Sales TTM of 0.47x point towards an undervalued stance. Additionally, BorgWarner’s Price/Book TTM of 1.40x, notably lower than the sector median, further strengthens the argument for undervaluation.

From an absolute perspective, the current share price of $34.30 represents a substantial 30% contraction relative to the highs seen in July 2023. Despite this, BorgWarner has demonstrated resilience in the face of market challenges, although it has been outperformed by the S&P500 index over the last five years.

While the firm’s valuation may appear pessimistic according to some metrics, the broader context underscores a compelling case for BorgWarner’s shares being heavily undervalued, especially relative to their historic averages.

As the investment community awaits BorgWarner’s Q4 earnings report, all eyes are on the company’s strategic moves, financial performance, and the potential for growth amidst the evolving industry landscape.

The Promising Outlook of BorgWarner in 2024

Amidst the flurry of market fluctuations, BorgWarner Inc. has emerged as a tantalizing prospect for investors seeking an underappreciated gem. As the economy continues to writhe and the automotive industry faces increasing volatility, the resilience and potential of this automotive parts and solutions supplier paint a compelling picture for prospective shareholders.

Intrinsic Value Analysis

Delving into the firm’s valuation, it becomes glaringly evident that BorgWarner is currently lingering in the depths of deep-value territory as indicated by a substantial undervaluation in its shares. Even in a scenario riddled with pessimism, the undervaluation persists, ensuring a healthy margin of safety for value-focused investors.

Long-Term Potential

Amidst the ebb and flow of short-term uncertainties, the long-term outlook for BorgWarner remains resolutely optimistic. With its strategic initiative, “Charging Forward,” the company has positioned itself to be a dominant force, capitalizing on the burgeoning electric vehicle (EV) market and leveraging its research and development efforts to cement a competitive edge in the industry.

Risks and Resilience

Undeniably, BorgWarner confronts inherent risks stemming from the cyclicality of the automotive sector and the potential volatility in demand for its products. However, the company’s focus on efficiency and its foray into the EV arena stand as staunch defenses against these threats, providing a glimmer of resilience in the face of industry headwinds.

ESG Commitment

From an environmental, societal, and governance standpoint, BorgWarner has demonstrated a laudable commitment, positioned to be an attractive choice for socially conscious investors. The company’s dedication to ESG principles and sustainability bodes well for its long-term viability and ethical alignment.

Bullish Assessment

In light of these compelling factors, BorgWarner emerges as a stock with immense promise, presenting a veritable ‘fat-pitch’ opportunity for investors. Despite the stagnation in share prices, the underlying strength and potential of BorgWarner make it a strong candidate for a “Strong Buy,” underpinning its status as an undervalued yet fundamentally robust investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.