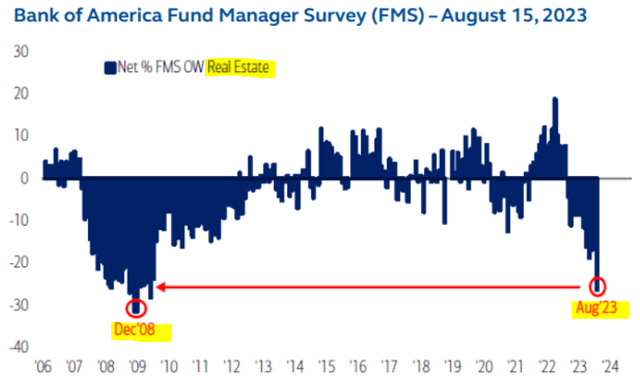

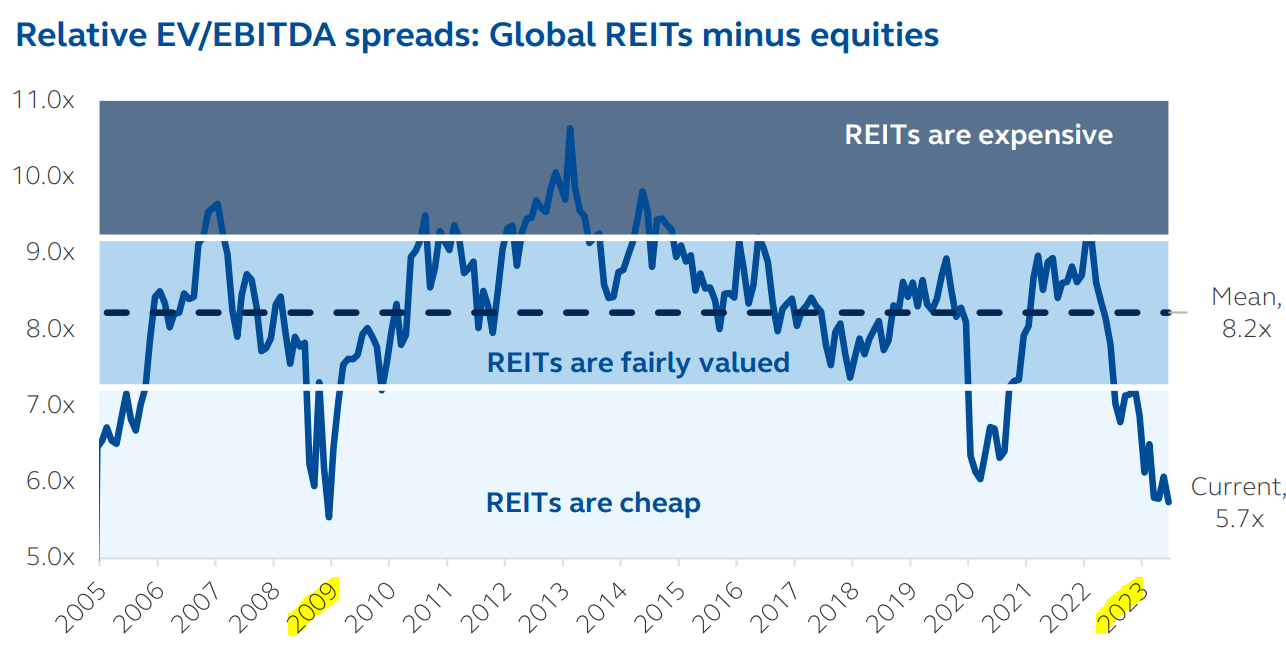

For most of 2022 and 2023, investors shunned REITs due to rising interest rates, causing allocations to plummet to their lowest levels since the great financial crisis. As a result, REIT valuations also took a severe hit, becoming heavily discounted.

The Reversal of Fortune

Inflation has normalized, the economy is weakening, and interest rates have already begun to decline. Most major banks are now predicting significant rate cuts by mid-2024, and the Fed has hinted at at least 3 rate cuts in the next 12 months.

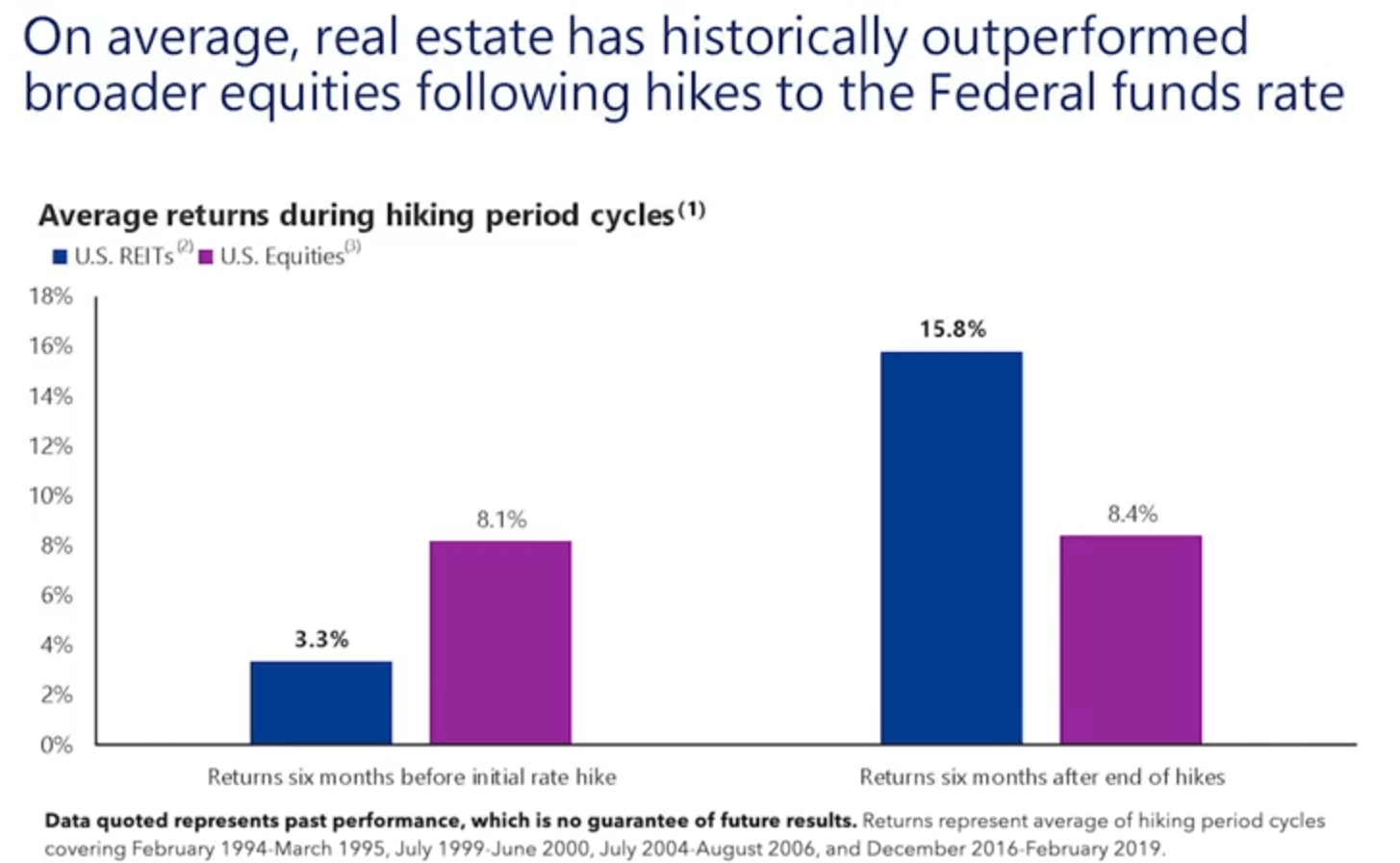

The impending rate cuts mark a pivotal shift for REITs, as the very reason they were shunned by the market is about to disappear. Studies also back this up, showing that REITs are strong outperformers in the periods after rates reach their peak and begin to decline.

If REITs crashed due to rising interest rates, then declining interest rates should have the opposite effect.

Right now, investors are still comfortably hiding in money market funds and short-term treasuries, thinking that they will earn a ~5% yield. However, this 5% yield is nothing more than an illusion.

As rates are cut, and the expectation for declining rates kicks in, investors are likely to realize that the “5% yield” was just a mirage. A significant portion of the capital invested in short-term fixed-income instruments is expected to come back into the REIT market.

What Lies Ahead

After rates are cut by ~100 basis points, and the market begins to anticipate further rate cuts, money market funds will suddenly become unattractive relative to alternatives like REITs. Investors may find themselves exposed to a significant reinvestment risk, and the appeal of REITs – with their ~6% dividend yield and potential for growth as rates are cut – will become far more compelling.

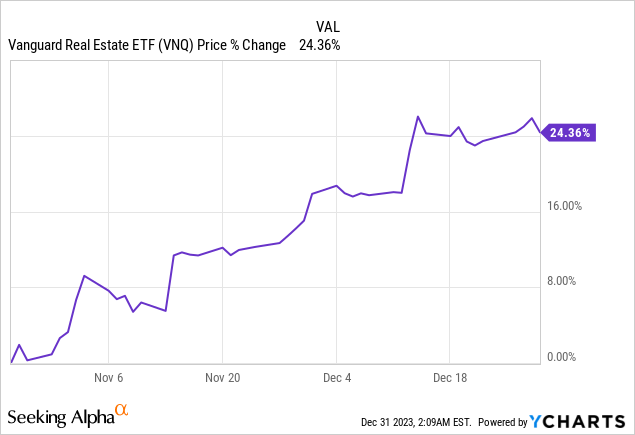

In fact, the REIT market has already witnessed a recovery, even before the rates have been cut. This serves as a precursor of what to anticipate in 2024.

Abundant Opportunities

Even after the recent rally, REIT valuations remain historically low relative to other stocks. The S&P 500 (SPY) is back near its all-time-highs, but REITs are still down nearly 30% on average, with a substantial portion of capital sitting in money market funds.

If you look beyond the mega-cap investment-grade rated companies dominating the REIT sector, smaller and lesser-known REITs not included in major indexes are down by close to 50%.

Here are a few examples expected to benefit from significant upside in 2024:

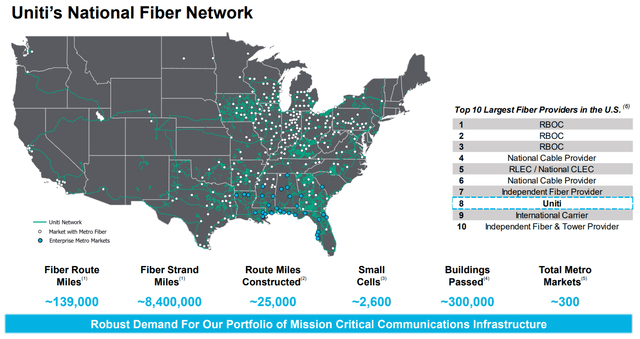

Uniti Group (UNIT): This small-cap infrastructure REIT owns a vast portfolio of fiber networks. Despite a 50% drop over the past 3 years, it currently trades at just 4x its cash flow, a 50% discount to its net asset value, and offers a 10.4% dividend yield. While there are risks due to heavy leverage and exposure to a private company with shaky financials, the potential impact of declining interest rates provides a compelling investment case.

Steep Discounts and Hidden Gems: Unveiling the Potential of Small-Cap REITs

Clipper Realty (CLPR): The real estate investment trust, Clipper Realty, has witnessed a staggering decline, plummeting over 50% from its peak. However, this downfall has resulted in an enticing opportunity, with the stock currently trading at a substantial 50% discount to its net asset value, coupled with an appealing 7% dividend yield. Despite concerns surrounding its usage of leverage in comparison to larger apartment REITs, the company’s leverage remains within reasonable bounds. Notably, Clipper Realty faces no significant debt maturities until 2028. Primarily owning properties in the coveted areas of Manhattan and Brooklyn, which boast formidable barriers to entry due to the scarcity of available land for new developments, further fortifies its position. With the company’s management holding the largest stake in the firm, their equity value significantly eclipses their salaries. As recuperation looms on the horizon, the stock holds the potential to surge by over 50% as it gravitates towards its net asset value.

Armada Hoffler (AHH)

Armada Hoffler, a diversified small-cap REIT, centers its focus on burgeoning sunbelt markets while predominantly deriving its revenue from defensive properties, including newly constructed apartment communities and service-oriented mixed-use retail properties. Despite experiencing a 30% decline in its stock, the management has recently initiated share repurchases to capitalize on the glaring disparity between the stock price and the company’s fundamentals. Trading at 10x cash flow and offering a lucrative 6.3% dividend yield, Armada Hoffler retains substantial cash flow for reinvestment in expansion and share buybacks. With estimations placing the share price at approximately 30% below its net asset value, promising prospects await in prospective recoveries.

Insightful Outlook

REITs weathered a precarious period as a consequence of escalating interest rates throughout 2022 and 2023, prompting a substantial capital exodus towards money market funds.

However, a reversal of fortunes is poised to transpire in 2024.

Presently, REIT valuations continue to languish at discounted levels, presenting abundant opportunities within the sector. Nevertheless, the time window for seizing these opportunities is rapidly diminishing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.