The Importance of Selecting High Dividend Yield Companies

The inclusion of high dividend yield companies in your investment portfolio demands a discerning selection process. These companies provide a stable and predictable dividend income stream, thus playing a crucial role in achieving a favorable risk-return profile for your overall investment portfolio. Furthermore, a judicious selection of companies that pay sustainable dividends significantly reduces the risk level and enhances the probability of reaching positive investment results.

Historically, companies paying sustainable dividends have shown a lower probability of experiencing a dividend cut. Additionally, their financial health often contributes to an attractive Total Return for the investor.

Conversely, companies with a higher risk of facing a dividend cut pose an elevated probability of reducing the Total Return of an investment portfolio. The implications of a dividend cut can significantly impact stock prices, underlining the critical importance of investing in high dividend yield companies with sustainable dividend policies.

The Dividend Income Accelerator Portfolio is one such investment model that meticulously implements a strategy of overweighting companies with sustainable dividends while underweighting those with a higher risk of experiencing a dividend cut, thus ensuring a stable income stream and a favorable risk-return profile.

Before introducing the selected companies for January 2024, the detailed selection process of high dividend yield companies will be explained in greater detail, shedding light on the criteria employed in curating a portfolio of high dividend yield stocks.

Curating the Top 10 High Dividend Yield Companies

Companies with a high Dividend Yield [FWD], a Market Capitalization greater than $10B, and a reasonable P/E [FWD] Ratio are key criteria for the pre-selection phase. These parameters contribute to lowering investment risks and refining the selection to encompass companies with stable financial foundations.

A Market Capitalization of more than $10B is vital in mitigating investment risks, as companies with higher Market Capitalization commonly exhibit lower volatility, a desirable trait in investment vehicles.

Likewise, a P/E [FWD] Ratio of less than 30 eliminates companies with stock prices reflecting high growth expectations, a factor that introduces substantial volatility and risk for investors. By employing this filter, the overall risk is reduced, leading to more astute investment decisions.

Refining the Selection Process

Subsequent to the financial ratio analysis, a scrutiny of the companies’ competitive advantages is conducted. This step aims to identify companies with strong competitive advantages such as brand image, technology, and economies of scale. These attributes are vital, as companies lacking in competitive advantages are at a higher risk of financial instability, posing potential risks to investors.

The valuation of the companies is the next crucial step in the selection process. A meticulous analysis, including metrics such as the DCF model and P/E [FWD] Ratio, further refines the list of selected companies by ensuring an attractive valuation, thus aiding investors in identifying companies that are at least fairly valued.

The final step emphasizes the importance of diversification across industries and geographical regions. This strategy aims to ensure a robust investment portfolio with a balanced risk-return profile, limiting exposure to industry-specific risks and enhancing geographical diversification.

The Cream of the Crop for January 2024

- Coca-Cola (KO)

- Zurich Insurance Group AG (OTCQX:ZURVY)

- Verizon (VZ)

- AT&T (T)

- Altria Group (MO)

- British American Tobacco (BTI)

- ING Groep N.V. (ING)

- Bayer (OTCPK:BAYZF) (OTCPK:BAYRY)

- Banco de Chile (BCH)

- Realty Income (O)

Exploring Attractive Dividend Yields and Growth Opportunities for January 2024

Key Companies Overview

The start of 2024 presents investors with a cohort of ten appealing high-dividend-yield companies to consider. These companies include The Coca-Cola Company, Zurich Insurance Group AG, Verizon Communications Inc., AT&T Inc., Altria Group, Inc., British American Tobacco p.l.c., ING Groep N.V., Bayer Aktiengesellschaft, Banco de Chile, and Realty Income Corporation. Each company represents diverse sectors and industries, offering unique value propositions to potential investors.

These entities are structured across Consumer Staples, Financials, Communication Services, Health Care, and Real Estate, with market capitalizations ranging from multi-billion-dollar behemoths to smaller-scale entities.

A preview of their financial landscape indicates that the dividend yields provided show substantial variation, with prospective dividends ranging from 3.13% to an impressive 9.76%. Moreover, these companies exhibit a spectrum of dividend growth rates and profitability markers, aligning with unique long-term investment dynamics and risk-reward propositions. These companies’ forward-looking PE ratios also provide an overview of their relative valuations vis-a-vis potential earnings for the year ahead.

Source: The Author, data from Seeking Alpha

Coca-Cola: A Steady Sip of Dividends and Growth

The Coca-Cola Company, currently priced at $58.77 per share, offers shareholders a 3.13% forward dividend yield. Notably, the company boasts a robust 10-year dividend growth rate (CAGR) of 5.09%, underscoring its long-term commitment to sustainable dividends, supported by an impressive 61 consecutive years of dividend growth.

These metrics position Coca-Cola as an attractive option for investors aiming to combine dividend income with consistent growth. With a payout ratio of 68.68%, the company’s dividend appears relatively secure in the coming years. This conviction is further bolstered by its 6.38% EPS GAAP (FWD) growth rate.

The Seeking Alpha Profitability Grade strengthens these perspectives, highlighting Coca-Cola’s leading position in the Soft Drinks & Non-alcoholic Beverages Industry – evident in the company’s EBIT margin (TTM) which surpasses the sector median by a substantial margin. The company’s return on equity stands at a remarkable 43.85%, soaring well above the sector median by a staggering 275.42%.

Zurich Insurance Group: Weathering the Tides of Dividends and Risks

Zurich Insurance Group, a stalwart in the Multi-line Insurance Industry since 1872, presents shareholders with a forward dividend yield of 5.15%. Underpinning its allure, the company sports a 5-year dividend growth rate (CAGR) of 9.10%, marking it as an enticing prospect for both dividend income and growth-seeking investors.

The company’s EBIT margin (TTM) of 15.95% and return on common equity of 18.41% underscore its robust profitability. Exhibiting substantial financial health, Zurich Insurance’s return on common equity exceeds the sector median by an impressive 57.68%.

Further, the company’s forward EBIT growth rate of 11.45% validates its consistent growth trajectory, contributing to its inclusion in the list of high dividend yield companies for this month.

The Elevated Risk Factors of an Investment in Zurich Insurance Group – The Case for a 2.5% Limit on Your Overall Portfolio

A prudent consideration of Zurich Insurance Group reveals two substantial risk factors: currency risk, and an elevated possibility of a dividend cut, as indicated by its high dividend payout ratio (FY1) (Non-GAAP) of 82.08%. Therefore, I recommend a maximum 2.5% portfolio allocation for this company due to these critical risk considerations.

Verizon: Navigating Stormy Seas

Verizon Communications Inc. has demonstrated significant underperformance in the stock market.

Stellar Performances and Undervalued Gems: Top Investment Opportunities Uncovered

The S&P 500 has been a juggernaut over the past three years, demonstrating a remarkable Total Return of 27.98%. In stark contrast, the telecommunications giant, Verizon, has endured a tumultuous period with a staggering Total Return of -21.81%. However, amid this market rollercoaster, savvy investors are eyeing undervalued opportunities that promise substantial rewards.

Verizon’s Unwavering Dividend and Undervaluation

In the realm of dividend income investing, Verizon stands out as a beacon of reliability. Despite the company’s price turbulence, it continues to generously reward its shareholders with a robust Dividend Yield [FWD] of 7.13%. Moreover, Verizon’s track record of 19 consecutive years of dividend growth underscores its unwavering commitment to shareholders.

Amidst the market volatility, Verizon presents itself as an enticing prospect, boasting a P/E [FWD] Ratio of 8.47, portraying an undervalued status that is 20.14% below its 5-year average. This undervaluation is further corroborated by its Price/Sales [FWD] Ratio of 1.19, a significant 25.10% below its 5-year average.

The Seeking Alpha Dividend Yield Grade for Verizon reaffirms its appeal to dividend income investors, positioning it as a compelling contender for those seeking stability and growth.

ING Groep N.V. – An Undervalued Financial Powerhouse

Steeped in a rich history dating back to 1762, ING Groep N.V. has emerged as a financial institution of substantial prowess. With a P/E [FWD] Ratio of 7.00, significantly diverging 18.04% below its 5-year average, it presents an alluring prospect for investors seeking undervalued opportunities.

Additionally, ING Groep offers a commendable Dividend Yield [FWD] of 5.01%, complemented by a balanced 3 Year Dividend Growth Rate [CAGR] of 2.03%. The company’s robust Profitability metrics, boasting a Net Income Margin [TTM] surpassing the Sector Median by 77.83% and a remarkable Return on Common Equity [TTM] exceeding the Sector Median by 153.94%, further underscores its potential for investors.

However, prudence is essential when considering ING Groep, as its elevated risk factors necessitate a cautious approach. The suggestion to limit the investment to a maximum of 2.5% of the overall portfolio serves as a prudent risk management strategy, assuring investors of a balanced and diversified investment approach.

Bayer – Valuation and Risk Analysis

Bayer, with roots tracing back to 1863, stands as a stalwart in the Pharmaceuticals Industry. Despite current market undulations, Bayer presents an enticing proposition with a P/E Non-GAAP [FWD] Ratio of 5.45, depicting a substantial undervaluation that is 33.85% below its 5-year average.

Investors eyeing dividend potential are beckoned by Bayer’s Dividend Yield [FWD] of 7.08%, although prudence is paramount due to its negative 3 Year Dividend Growth Rate [CAGR] of -4.69%. A comparative analysis with industry peers such as Johnson & Johnson unveils Bayer’s compelling valuation and dividend yield, albeit accompanied by significantly higher risks.

Despite the allure, Bayer’s lower EBIT Margin [TTM], higher Total Debt to Equity Ratio, and Beta Factor accentuate the inherent risks. Consequently, a cautious approach is advocated, limiting Bayer’s position to a maximum of 2% of the overall portfolio to mitigate downside risk and foster positive investment outcomes.

Banco de Chile – An Investment Chronicle

Established in 1893, Banco de Chile heralds a rich legacy within the financial landscape. Its trajectory mirrors the tumultuous market landscape, prompting investors to appraise its potential as an investment opportunity.

With insights into the company’s financials and dividend potential, investors are poised to navigate the turbulent market waters with prudence and foresight, leveraging undervalued opportunities, and mitigating risks to yield favorable investment outcomes.

The Volatile Terrain of International Investments – Navigating Risks and Rewards

In Santiago, Chile, Banco de Chile provides its shareholders with a Dividend Yield [FWD] of 9.40%, a figure that catches the eye of any ambitious investor. This notable rate becomes even more impressive when considering the bank’s 5 Year Dividend Growth Rate [CAGR] of 16.13%.

The Quandary of Dividend Safety

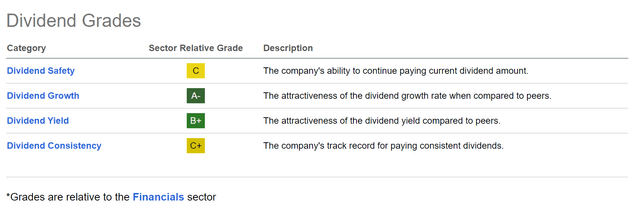

However, potential investors must tread warily in this foreign territory. The bank’s Dividend Payout Ratio [TTM] [Non GAAP] of 75.91% stands as a red flag, being 118.92% above the Sector Median. Furthermore, the Seeking Alpha Dividend Grades dealing Banco de Chile a D rating in Dividend Safety only adds to the pervasive unease.

Banco de Chile’s P/E [FWD] Ratio of 9.27, 17.08% below the Sector Median and 16.24% less than its 5-year average, indicates an undervalued bank.

In stark comparison to U.S. banking giants JPMorgan and Bank of America, Banco de Chile flaunts a lower Valuation. With a P/E [FWD] Ratio of 9.27 versus JPMorgan’s P/E [FWD] Ratio of 10.21 and Bank of America’s 10.07, Banco de Chile’s value proposition is hard to ignore.

Moreover, Banco de Chile offers a substantially higher Dividend Yield [FWD] of 9.30% in contrast to JPMorgan’s 2.47% and Bank of America’s 2.85%.

Despite these alluring figures, the investment landscape remains treacherous. The risks accompanying an investment in Banco de Chile far outweigh those linked to JPMorgan or Bank of America.

Therefore, for those seeking a safer bet, the logical move would be to consider investing in JPMorgan or Bank of America. Their dividends stand as a bastion of safety, a stark contrast to the precarious nature of Banco de Chile’s dividends.

The Elevated Risk Factors of an Investment in Banco de Chile – The Case for a 1.5% Limit on Your Overall Portfolio

Amidst the profound risks lurking within an investment in Banco de Chile, caution should be the guiding principle. Besides the currency risk, the fragile nature of its dividend is yet another cause for concern. A potential dividend cut could spell disaster for the company’s stock price.

Hence, prudence dictates that the position on Banco de Chile should be stunted, capped at a maximum of 1.5% of the overall investment portfolio.

Realty Income: Navigating the Waters of Stability

Realty Income presently sports a Dividend Yield [FWD] of 5.31%, a figure that glimmers with promise, underpinned by the sustainability and safety of the company’s dividend. Its sustainability finds reinforcement in the company’s EPS Diluted Growth Rate [FWD] of 21.24% and its impressive streak of 26 consecutive years of dividend growth. Additionally, Realty Income boasts a 10 Year Dividend Growth Rate [CAGR] of 3.79%.

Priced at $57.50, the company appears undervalued, as indicated by its P/AFFO [FWD] Ratio of 14.35, 6.25% below the Sector Median of 15.35.

The Seeking Alpha Dividend Grades serve as a nod to Realty Income’s dividend sustainability, bestowing upon them an A+ for Dividend Consistency, a B+ for Dividend Growth, a B for Dividend Safety, and a B- for Dividend Yield.

The company’s robust dividend, coupled with its attractive risk-reward profile, aligns seamlessly with the investment thesis to overweight the company in a long-term investment portfolio.

Embracing this very approach, The Dividend Income Accelerator Portfolio has privileged Realty Income with an elevated proportion of the overall portfolio.

Enthusiastically delving into the article below, the reasons for incorporating Realty Income into The Dividend Income Accelerator Portfolio are expounded in elaborate detail:

Realty Income: A Strong Alignment With The Dividend Income Accelerator Portfolio Approach

British American Tobacco: Navigating Stormy Seas

Over the past 12 months, British American Tobacco has endured a grim -26.74% performance, marking a stark contrast to the S&P 500’s robust 23.91% within the same period.

The company’s P/E [FWD] Ratio of 7.13, standing 63.34% below the Sector Median and 25.84% beneath its 5-year average, further asserts the case for undervaluation.

Notably, British American Tobacco brandishes a Dividend Yield [FWD] of 9.55%, significantly exceeding its 5-year average of 7.56%, emblematic of its current undervalued status.

Besides, the company parades a 5 Year Dividend Growth Rate [CAGR] of 2.46%, making it an enticing choice for those yearning to intertwine dividend income with dividend growth potential.

This enticing fusion of dividend income and potential for dividend growth stands as prime motivation for the inclusion of British American Tobacco in The Dividend Income Accelerator Portfolio:

British American Tobacco Vs. Altria: Which Is The Better Dividend Choice?

AT&T: Navigating Choppy Waters

Over the past 3 years, AT&T has struggled to keep pace with the S&P 500. While the S&P 500 has surged by 27.98%, AT&T has staggered with a negative performance of -7.64%.

Investor’s Guide: High Dividend Yield Companies in January 2024

AT&T’s current P/E [FWD] Ratio is at 7.56, which is 31.22% below its 5 Year Average, indicating that the company is undervalued at its current price level of $17.10.

Undervaluation is further underscored by its Price/Sales [FWD] Ratio of 0.98, which is 15.93% below its 5 Year Average.

Altria has shown a negative Total Return of -4.03% as compared to the S&P 500’s positive Total Return of 23.91% during the past 12-month period.

With Altria’s current stock price standing at $41.18, it provides investors with an attractive Dividend Yield [FWD] of 9.76%.

The graphic below illustrates the Dividend Yield [FWD] of the 10 selected high dividend yield companies that are worth considering investing in during this month of January. From the 10 selected companies, Altria, British American Tobacco and Banco de Chile stand out with the highest Dividend Yield [FWD] of 9.76%, 9.55%, and 9.40%.

However, it should be noted that Altria, British American Tobacco and Banco de Chile’s Dividend Payout Ratios [FY1] [Non GAAP] stand at 77.32%, 63.40%, and 70.10%, respectively. These figures indicate that their dividends are not entirely safe.

Therefore, I suggest that their proportion compared to the overall portfolio should not be disproportionally high. This strategy helps to mitigate the downside risk of your portfolio, thereby enhancing the prospects for positive investment outcomes.

Today’s article has focused on companies that pay an attractive Dividend Yield, aimed at generating additional income for investors.

Each of the selected companies not only boast an attractive Valuation and financial health but also possesses strong competitive advantages, in addition to offering an attractive Dividend Yield with potential for substantial dividend increases in the years ahead.

In my opinion, incorporating high dividend yield companies that pay sustainable dividends into an extensively diversified dividend portfolio which also includes companies that emphasize dividend growth, provides investors with the greatest benefits. This approach ensures a steady income stream for you as an investor, coupled with annual dividend enhancements.

I am actively applying this investment strategy through The Dividend Income Accelerator Portfolio. Thanks to the portfolio’s focus on risk-mitigation, it is strategically positioned to achieve an attractive Total Return with a high probability, while, simultaneously, balancing dividend income with dividend growth. This investment strategy continuously strives to maximize investor benefits.

Author’s Note: I would appreciate hearing your opinion on my selection of high dividend yield companies to consider buying in January 2024. Do you already own or plan to acquire any of the picks? Which are currently your favorite high dividend yield companies?

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.