When it comes to Apple (NASDAQ:AAPL), investors face a conundrum. Is it time to steer clear of this tech giant’s overpriced stock, or are there upcoming innovations that could justify a long position? Let’s dive into the rational, fact-based analysis to provide a fresh perspective for those holding or considering AAPL in their portfolio.

The Case for Apple

Amid the current share price, AAPL presents itself as an investment with limited potential to outperform in the near future. Though it is priced as a growth stock, its fundamental value resembles that of a traditional company.

On the flip side, shorting AAPL warrants caution due to passive flows and other dynamics that influence its direction, often overriding underlying business performance.

Taking all into account, my recommendation is to steer clear of AAPL without resorting to a short position.

Now, let’s delve into the justification behind this stance.

Unraveling the Multiples

Currently, AAPL trades at a P/E multiple of 29x, signaling the market’s view of it as a value stock.

One might argue that P/E is not the be-all and end-all, suggesting a focus on metrics that capture AAPL’s cash generation prowess.

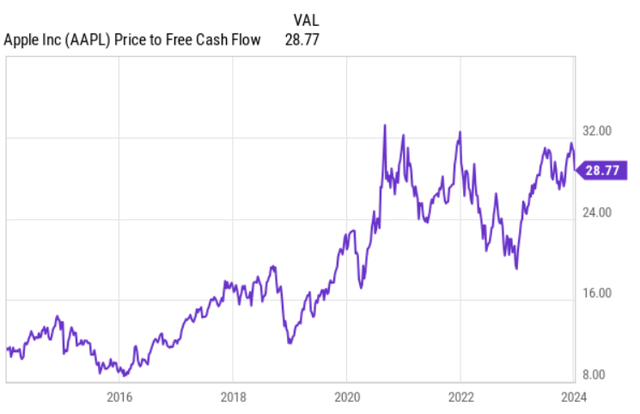

However, evaluating AAPL’s valuation through the P/CF metric yields strikingly similar conclusions, despite the company not being capital-intensive.

From a P/CF perspective, AAPL trades well above its 10-year historical norm and near all-time highs, despite significant SOFR inflation, which theoretically should dampen valuations.

A Seeking Alpha valuation table further highlights AAPL’s unattractive multiples, exerting pressure on the company to validate them for investors to realize substantial returns.

For instance, a P/E of 29x implies investors would need to wait nearly 29 years to recoup their investment, holding all else constant. This lofty multiple could be justified by potential growth, but AAPL’s dwindling cash flows tell a different story.

Waning Cash Flows

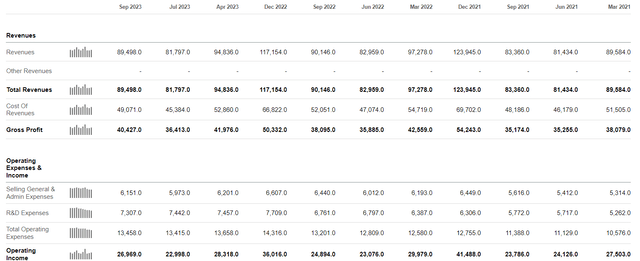

With a P/E of 29x, one would expect robust top-line growth. However, AAPL’s sales have been nearly stagnant since March 2021, with a slight dip at the EBIT level.

The latest results indicate AAPL’s struggle to maintain its historical financial performance levels. The key product categories, including iPhone, iPad, and Mac, experienced a decline in September 2023 compared to the same period in 2022, with only the services segment showing positive momentum.

Considering the soaring inflation since March 2021, one would anticipate substantial revenue growth in this period. However, AAPL’s lackluster single-digit sales growth, when adjusted for inflation, likely results in negative real growth.

This underwhelming performance, combined with a near 10-year high P/E of 29x, fails to compensate investors adequately.

Questionable Growth Prospects

The debate on AAPL’s future growth prospects is highly subjective. Some investors believe that ventures like VR, Apple car, and untapped platform monetization opportunities could propel AAPL’s market cap to new heights. Others argue that these endeavors might drain cash without justifying the current multiple.

In light of AAPL’s tepid cash flows and unimpressive sales growth, the question remains – can forthcoming innovations truly justify the lofty multiples?

Reassessing Apple’s Prospects

The apple doesn’t fall far from the tree, they say, but for Apple Inc., the latest musings over its valuation have certainly fallen short of favorable sentiments. As the venerable tech giant grapples with a market skeptical of its growth potential, analysts are parsing through the company’s earnings and expectations with a discerning eye.

In a landscape marked by the steady drumbeat of quarterly results, Apple Inc. (AAPL) has struggled to meet bullish forecasts. Recent quarters have been marred by underperformance, painting a picture at odds with the robust growth expectations championed by the market.

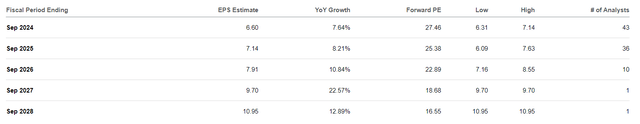

Eyeing the crystal ball of financial projections, the market’s expectations for AAPL’s earnings per share (EPS) growth in 2024 and 2025 reveal a narrative of tempered anticipation. The subdued projections have left many questioning the lofty valuation multiples afforded to the company.

And yet, glimmers of hope appear on the distant horizon, with the market placing a weighty bet on a resurgence in AAPL’s EPS growth in 2026. Should this aspirational scenario materialize, it could prove a boon for investors, potentially reigniting a fervent rally in the tech titan’s share price.

The crux of the matter lies in Apple’s capacity to engineer groundbreaking products that can not only stave off the plateauing iPhone sales but also fuel a fresh wave of cash inflows, thereby substantiating the premium price-to-earnings (P/E) multiple of 29x.

Yet, as the stage is set for this high-stakes drama to unfold, the company finds itself contending with flagging iPhone sales, a wobbly performance in other product categories, and a foreboding shadow cast by the Chinese market, which presently accounts for around 19% of AAPL’s business.

But here’s the rub: the scales seem tipped unfavorably.

Navigating Pitfalls

However, let’s be clear – this isn’t a call to bearish arms against Apple. Two compelling reasons counsel restraint.

Firstly, given AAPL’s gargantuan market capitalization, it commands a significant presence within a plethora of exchange-traded funds (ETFs). This structural quirk introduces extraneous dynamics into the ebb and flow of AAPL’s stock price, divorced from its fundamental performance, confounding any attempts at prognostication.

Secondly, we must acknowledge AAPL’s storied legacy of innovation and its hefty investments in research and development, wielding the potential to roll out game-changing products that could rejig the company’s revenue landscape. If Apple were to strike gold with a groundbreaking new venture, capable of rekindling robust double-digit growth and counterbalancing the waning sales of its core products, the naysayers would be left nursing substantial losses.

Furthermore, eschewing AAPL entails a palpable risk of incurring opportunity costs, as the company’s shares continue their upward ascent. History serves as a stark reminder of investors forfeiting hefty returns by shunning such prospects. Consider this: AAPL’s lofty valuation has been a fixture since early 2021, coinciding with its flagging performance. Yet, a reflective gaze at its 3-year total return performance reveals a staggering 45% surge, edging past the benchmark S&P 500 by approximately 15%.

The Verdict

In light of waning performance and recent erosions in core product sales, tightly entwined with a substantial exposure to China, a factor beset with risk that would necessitate a lofty discount rate in theory, backing Apple for long-term gains seems akin to a suboptimal gamble for investors.

Despite the market’s optimism hinging on a robust growth outlook from 2026 onward and a tepid EPS growth hovering around 7.5% until then, Apple shoulders relaxed expectations to stave off any unwelcome repricing of its shares. However, given the prevailing trajectory of core product sales and the glaring absence of any indicators pointing to a reversal (if anything, exacerbated by geopolitical and macroeconomic headwinds), the notion that Apple will surmount these expectations appears highly dubious.

As such, my firm conviction is that AAPL should be held with a proclivity to trim any position allocated in the stock.