A General Store Giant

Casey’s General Stores, Inc. (CASY) has successfully woven itself into the fabric of small-town America with over 2,500 convenience stores across 17 states, primarily in the Midwest. Casey’s offerings range from typical convenience store fare and grocery items to freshly prepared food, notably its renowned donuts, sandwiches, breakfast food, and above all, its pizzas. The company also operates self-service fuel stations at nearly every location.

Casey’s has adapted to the retail evolution by launching digital offerings for enhanced convenience and customer loyalty through its mobile app and online ordering. This successful blend of convenience and community presence has propelled Casey’s to become a staple in local neighborhoods and a success story on Wall Street.

Historical Performance and Diverse Outreach

Roughly 50% of Casey’s stores are located in towns with populations of 5,000 people or less, with the company now expanding its presence into larger regions, with about 25% of its locations catering to areas with 20,000 people or more.

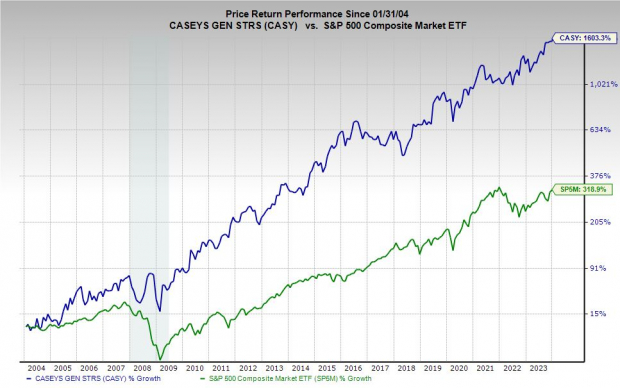

Image Source: Zacks Investment Research

Recent Performance and Growth Prospects

Casey’s topped its second-quarter fiscal 2024 EPS estimate and expanded its guidance, underlining its capacity for growth. The company’s increasing efficiency and business expansion were exemplified by the construction or acquisition of 59 stores in the last quarter, including entry into Texas through a 22-store acquisition, marking its 17th state presence.

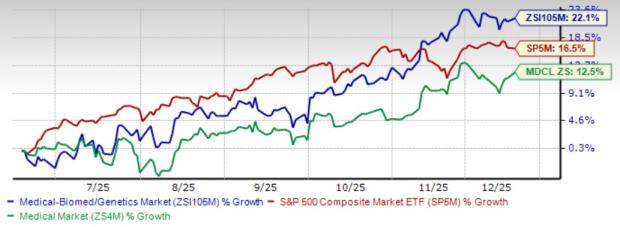

Image Source: Zacks Investment Research

Future Outlook and Financial Metrics

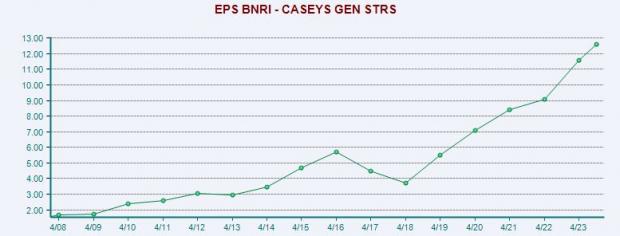

Despite facing tough year-over-year comparisons, Casey’s fiscal 2024 forecasts a marginal revenue climb. An impressive 9% and 8.3% surge is projected for the firm’s adjusted earnings in FY24 and the subsequent year, with an estimated 6% revenue growth.

The company’s current year EPS estimate has climbed 10% in the past two months, while its most recent earnings estimates have surpassed expectations, affirming Casey’s Zacks Rank #1 (Strong Buy) status.

Performance, Technical Levels & Valuation

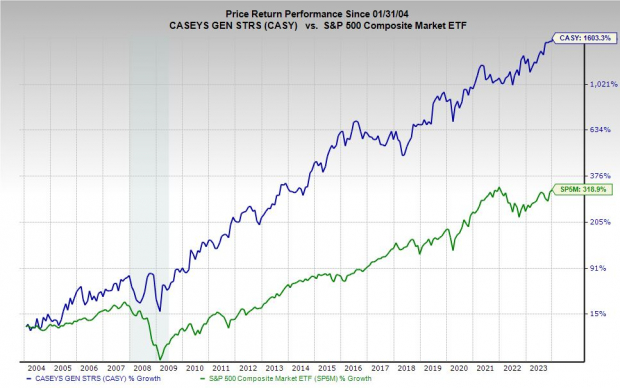

Casey’s stock has significantly outperformed retail-wholesale sector stalwarts like Walmart (WMT) and Target (TGT) over the past 20 years, soaring nearly 1,600% and exhibiting a 120% surge in the last five years alone. The company also stands at a 5% discount relative to its forward 12-month earnings compared to Walmart’s valuation.

Image Source: Zacks Investment Research

Resilience in Adversity

Despite reaching historic RSI levels, Casey’s has consistently traded above its 50-month moving average, reflecting its resilience. The company’s current valuation levels also mark a nearly 30% discount to its 10-year highs, reinforcing its attractiveness to investors.

Image Source: Zacks Investment Research

Continued Lucrative Prospects

Casey’s is making strategic strides in expanding its offerings and reach while focusing on boosting efficiency and returning more value to shareholders. With its impressive performance, solid balance sheet, and a 0.6% dividend yield, Casey’s is an excellent option for investors, resonating with small-town America and Wall Street alike.

Community-Centric Success

Casey’s unique position in serving small-town America reinforces its status as not just a commercial venture, but a beloved part of the heartland, connecting with local communities and investors alike.

The Rise of Casey’s General Stores, Inc.

Investors might not always associate convenience stores with major stock market gains, but companies like Casey’s General Stores, Inc. have been quietly outperforming major retail giants like Walmart and Target. The recent outperformance suggests that these smaller, local-focused stores are more essential to the communities they serve than the likes of Walmart, Target, and many others. Casey’s General Stores, Inc.’s impressive performance supports and exemplifies this trend.

Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.