Alnylam Pharmaceuticals ALNY reported a noteworthy 39% growth in full-year 2023 net product revenues, amounting to $1.24 billion. This surpassed Zacks Consensus Estimate’s projection of $1.83 billion.

Flagship Products Fuel Growth

In 2023, Alnylam saw strong performance from its four key products, namely Onpattro, Amvuttra, Givlaari, and Oxlumo. Onpattro and Amvuttra contributed over $913 million to the company’s net product revenues, marking a substantial 40% increase from the previous year. The sales of Givlaari and Oxlumo also rose to about $329 million, reflecting a 35% year-over-year improvement.

The positive trajectory of these products has been instrumental in driving the company’s impressive revenue growth, demonstrating their robust market presence and the trust of healthcare providers and patients alike.

Market Challenges and Strategic Shift

However, Alnylam had its share of tribulations, notably when the FDA issued a Complete Response Letter (CRL) for the label expansion of Onpattro to treat the cardiomyopathy of transthyretin-mediated (ATTR) amyloidosis. This setback compelled the company to pivot its focus towards advancing the phase III HELIOS-B label-expanding study of Amvuttra in the treatment of the cardiomyopathy of ATTR amyloidosis, with expectations of unveiling top-line data in early 2024.

Although such regulatory hurdles can be discouraging, they do compel companies to re-strategize and innovate, potentially leading to new avenues of growth and development.

Potential Upside Ahead

The future looks promising for Alnylam, with the company anticipating the submission of an application to extend Amvuttra’s label, targeting a new indication, subject to the success of the HELIOS-B study. This move, if approved, is expected to significantly elevate the drug’s sales as the eligible patient population for Amvuttra expands.

Market Response

On the stock market front, Alnylam encountered challenges, with shares declining by 13.8% in the past year compared to the industry’s 11.4% fall. However, market dynamics are notoriously fickle and often fail to fully represent a company’s potential and long-term prospects.

Investors should consider a balanced view, recognizing that stock market movements may not always be indicative of a company’s true value and future growth potential.

Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). While the company might not be a current crowd favorite, investors can explore other Zacks Rank stocks that could potentially offer better prospects, such as Puma Biotechnology, Inc., ADMA Biologics, and Acadia Pharmaceuticals, each carrying a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy).

Conclusion

Despite the challenges faced by Alnylam, the company has demonstrated resilience and an unwavering commitment to overcoming obstacles and unlocking new opportunities.

Investors may want to consider the company’s long-term growth prospects, keeping in mind the unpredictable nature of the stock market and the potential for a bright future for Alnylam.

Alnylam’s dynamism and agility are a testament to its commitment to driving innovation and delivering value to patients and shareholders alike.

ACADIA Pharmaceuticals Inc. Rallies 79.9%

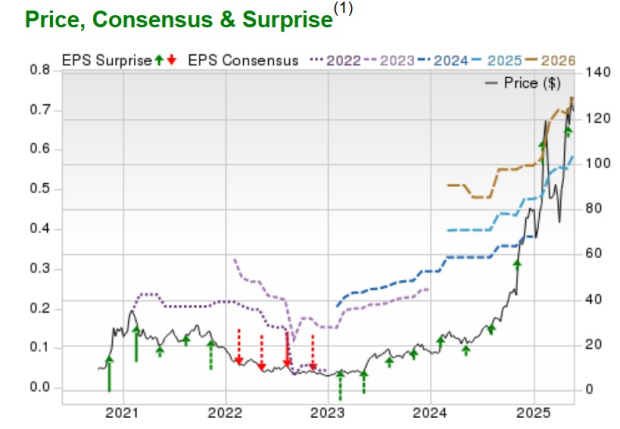

The consensus estimate for Acadia’s 2024 EPS is pegged at $1.04. Over the past year, shares of ACAD have rallied 79.9%.

Performance Review

ACAD beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

Exponential Growth Potential

The recent surge in the stock price of ACADIA Pharmaceuticals Inc. has sparked avid interest among investors, with the company’s consensus estimate for 2024 EPS exceeding expectations at $1.04. The remarkable 79.9% rally in ACAD shares over the past year has positioned the company as a formidable contender in the pharmaceutical sector.

Inconsistent Performances

Though ACADIA Pharmaceuticals Inc. has exhibited a pattern of beating estimates in two of the trailing four quarters, the company has missed the mark on the remaining two occasions, resulting in an average earnings surprise of 20.69%. Despite these inconsistencies, investors remain captivated by the company’s long-term growth potential.

Zacks Top 10 Stocks for 2024

For potential investors seeking to capitalize on the bullish momentum, Zacks Investment Research recommends taking a closer look at ACADIA Pharmaceuticals Inc. Positioned among the top 10 stocks for 2024, ACAD has the potential to deliver enormous returns, as evidenced by its impressive 79.9% rally in the past year.

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.