Dividends – the sweet siren song of the investment world. Like the soothing lullaby of a summer breeze, dividends offer investors not only a passive income stream but a cushion against the capricious vagaries of the market. Embracing dividends can be akin to finding shelter during a financial storm, enabling investors to reap the bounty through reinvestment.

Diving deeper into the lair of corporate finance, the ability of a company to consistently elevate its dividend payouts is a concrete testament to its financial fortitude, a sign of a stable and robust footing. Furthermore, such dividend hikes serve as a reassuring beacon of a company’s long-term vitality, instilling unwavering confidence that it has the mettle to weather any near-term tempests.

Enterprise Product Partners

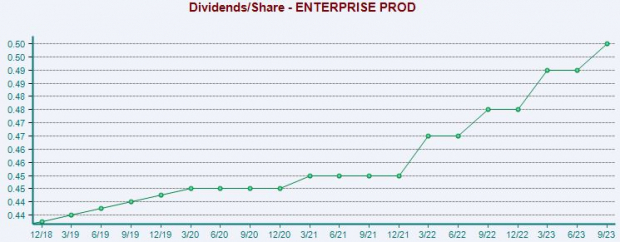

Enterprise Products Partners, a fortress of commodities services, including natural gas, natural gas liquids, and refined petrochemical products, has been basking in the spotlight. In a heartening display of solidarity, A.J. Teague, co-CEO, recently bolstered shareholder confidence by fortifying his position with the purchase of around 2400 EPD shares worth over $65,000. This muscular move has invigorated shareholders who have seen a 3% surge in the company’s quarterly payout, now standing at $2.06 per annum. By consistently boosting rewards for their stakeholders, EPD has etched a resplendent legacy peppered with unwavering consistency, as depicted in the enthralling chart below. To add a dash of intrigue, EPD shares have exhibited a modicum of resilient strength in the past month, outshining the S&P 500 with a 2.6% stride compared to the latter’s modest 1.7% gain. While the gap in performance isn’t cavernous, it certainly warrants a discerning eye.

Broadcom

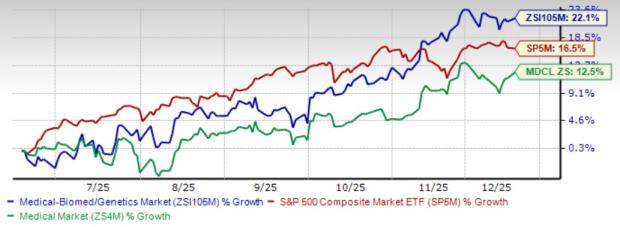

Broadcom, the grand maestro of semiconductor devices, has been tuning an impressive melody of financial growth. Its current fiscal year has been harmonious, with a robust 11% uptick in the Zacks Consensus EPS Estimate, now shining at $47.88. Delighting their shareholders, Broadcom has been exemplifying a steadfast commitment to increasing dividends, marked by a robust 13.7% five-year annualized growth rate. With AVGO shares yielding a rock-solid 2% annually, well above the Zacks Computer and Technology sector average of 0.7%, Broadcom’s virtuoso performance has captured the imagination of investors far and wide. Articulating their prowess, the company’s cash-generating prowess, with a remarkable free cash flow of $16.3 billion throughout its FY22 and a trailing twelve-month figure eclipsing $17.6 billion, has further buttressed its shareholder-friendly narrative, as exhibited below.

Abbott Laboratories

The narrative embraces Abbott Laboratories, an intrepid explorer in the realm of healthcare products. This heralded entity is part of the esteemed Dividend Aristocrats group, an exclusive sanctuary for those with an enviable track record of elevating payouts for over 25 consecutive years. In sublime anticipation of its upcoming release expected in late January, the Zacks Consensus EPS Estimate of $1.19 whispers of a tantalizing 15% growth from the year-ago period. Spanning through its last ten releases, Abbott Laboratories has been a pinnacle of consistent earnings performance, handily surmounting our consensus EPS and revenue expectations with audacious aplomb.

Bottom Line

Behold the quintessence of corporate nobility – companies that dance to the tune of boosting dividends, a resounding declaration of their success and their unwavering devotion to their shareholders. For those seeking a gilded flock of dividend growers, the triumvirate comprising Enterprise Product Partners EPD, Abbott Laboratories ABT, and Broadcom AVGO stands resolute, poised to realize the dreams of income investors far and wide.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Abbott Laboratories (ABT) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.