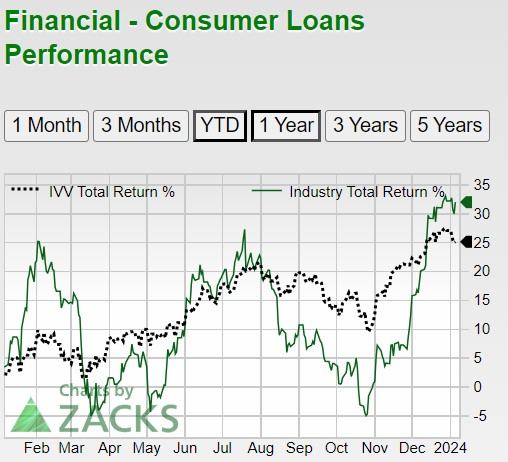

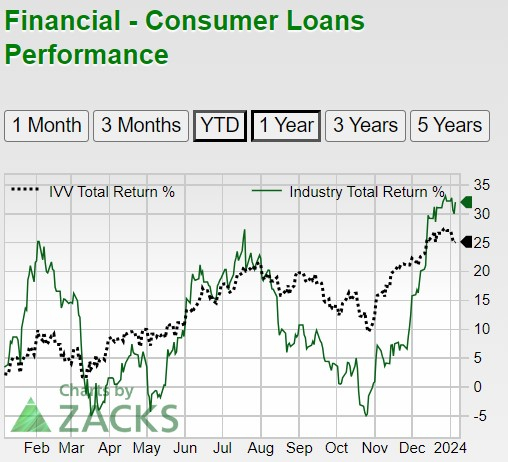

Inflationary pressures have stressed the market, making many consumer loan stocks more enticing. The Zacks Financial-Consumer Loans Industry has yielded a whopping total return of +32% over the last year, dividends included.

Two noteworthy contenders in this space are Capital One Financial COF and Discover Financial Services DFS, which leads to the pertinent question of whether now is the opportune time for investors to consider purchasing stock in these consumer loan giants for potential growth.

Image Source: Zacks Investment Research

Overview & Compelling Valuations

Capital One and Discover shares had been substantially undervalued for the better part of 2023 subsequent to the collapse of certain financial institutions. Nonetheless, they retain a dominant foothold in consumer lending, particularly in personal and credit loans. Discover also offers home loans, with Capital One focusing on auto loans following the cessation of its mortgage services in 2017.

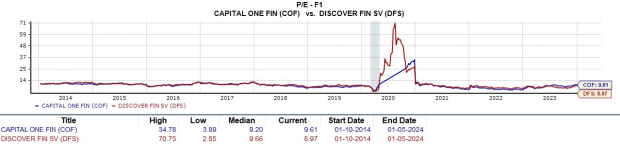

While both Capital One and Discover shares have experienced a rebound, they are still trading at just 9.6X and 8.9X forward earnings, respectively. This is well below the S&P 500’s 19.6X and closer to the Zacks Financial-Consumer Loans Industry average of 7.5X.

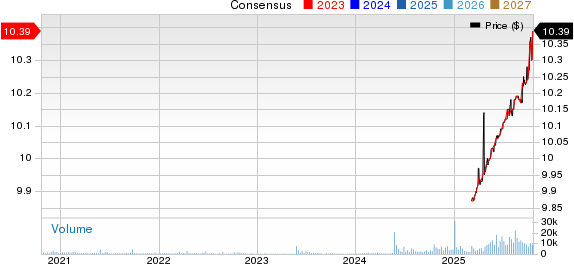

Image Source: Zacks Investment Research

In terms of price to sales, Capital One’s P/S ratio of 1.3X and Discover’s 1.6X are below the optimum level of less than 2X, and the S&P 500’s 4.2X, with their industry average at 0.9X.

Image Source: Zacks Investment Research

Comparative Outlook

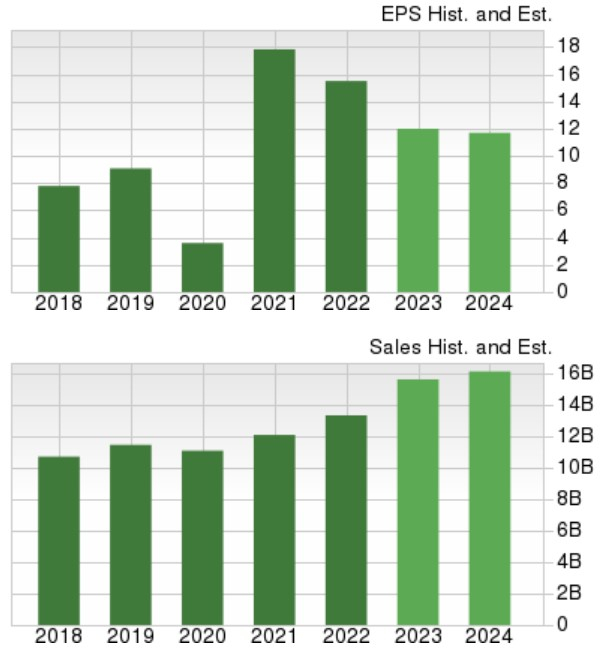

Capital One and Discover have maintained appealing sales growth, despite the dampening effect of high inflation on their bottom lines in the post-pandemic era.

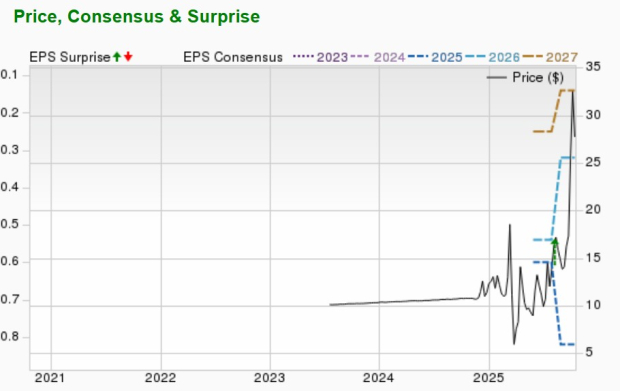

Looking at Capital One’s forecast, earnings for fiscal 2023 stand at $12.79 per share, compared to $17.71 per share in 2022. However, there is a projected rebound in FY24 EPS, expected to rise by 8% to $13.78 per share. Furthermore, total sales are estimated to have increased by 7% in FY23 and are anticipated to rise by an additional 4% this year, reaching $38.36 billion.

Image Source: Zacks Investment Research

Turning to Discover, annual earnings for FY23 are expected to be $12.27 per share, in comparison to $15.50 per share in 2022. For fiscal 2024, there is an anticipated stabilization and an over 1% increase in earnings, reaching $12.47 per share. Discover’s total sales are forecasted to have surged by 18% in FY23 and are expected to rise by an additional 6% in FY24, reaching $16.66 billion.

Image Source: Zacks Investment Research

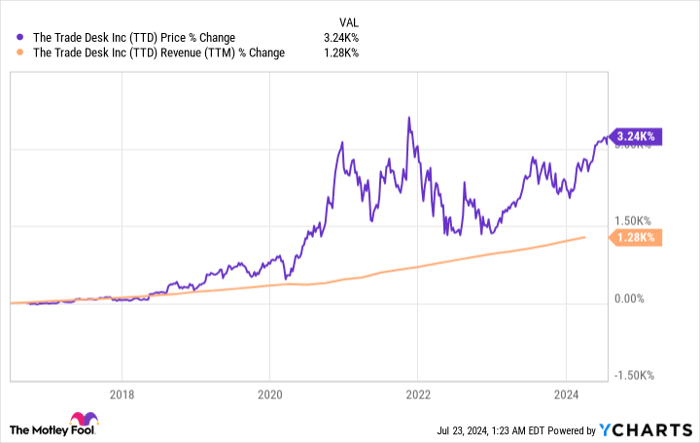

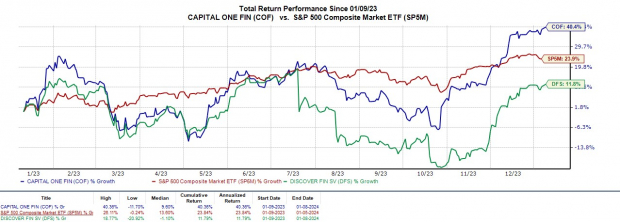

Recent Total Return Performance

Leveraging the robust performance and resurgence of the Zacks Financial-Consumer Loans Industry over the past year, Capital One’s +40% total return has outperformed its Zacks Subindustry’s +32% and the benchmark’s +24%, while Discover’s +12% has slightly lagged behind.

Image Source: Zacks Investment Research

Despite Discover’s price performance trailing the broader market, its 2.5% annual dividend yield surpasses the S&P 500’s 1.4% and even exceeds its industry average of 2.2%, with Capital One boasting a respectable yield of 1.81%.

Image Source: Zacks Investment Research

Takeaway

Presently, Capital One Financial and Discover Financial Services’ stocks both hold a Zacks Rank #3 (Hold). Their appealing valuations certainly point to potential growth, but this may hinge on the capacity to deliver favorable fourth-quarter results later in the month, with Discover set to report on January 17 and Capital One on January 25.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Discover Financial Services (DFS) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.