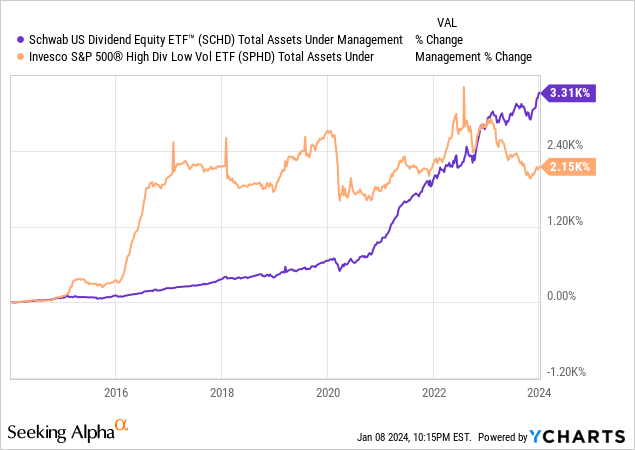

Both the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and the Invesco S&P 500 High Dividend Low Volatility ETF (NYSEARCA:SPHD) are popular dividend ETFs that boast attractive long-term total return performance track records, good current dividend yields, and strong dividend growth histories. As a result, it’s not surprising that both have enjoyed robust assets under management growth over time:

In this article, we will discuss what makes a dividend ETF a good passive income snowball vehicle and then share why we only think that SCHD measures up to these qualifications.

What Constitutes a Passive Income Snowball?

Warren Buffett once pointed out that prevailing over financial hurdles for the long haul revolves around crafting a passive income snowball. This method involves gradually amassing a steady stream of income from investments that require minimal active involvement, such as dividends from stocks, interest from bonds, or rental income from real estate.

This approach is critical for long-term financial independence as it fosters a growing flow of funds independent of active work that generally grows exponentially over the long term. This happens when passive earnings from investments are reinvested, akin to a snowball increasing in size as it rolls downhill. Eventually, this income reaches a point where it covers living expenses, liberating the investor from the need to rely on active income sources.

Key Attributes of an ETF as a Good Passive Income Snowball

While developing a passive income snowball sounds – and is – simple, the two keys to success are:

(1) Ensuring that your passive income snowball consists of quality underlying holdings.

(2) Having the discipline to consistently invest and reinvest in your passive income snowball until it starts to generate enough passive income to comfortably cover your living expenses.

We’re constructing our passive income snowball out of individual stocks because we believe that doing so can:

- Maximize our risk-adjusted yield

- Maximize our risk-adjusted return

However, for investors lacking the time and/or expertise to sufficiently research and build a diversified portfolio to accomplish this purpose, investing in ETFs is a viable alternative. When assessing a dividend ETF’s viability as a passive income snowball, three key factors are paramount:

- Sufficient diversification

- A low expense ratio

- A balance of yield plus growth potential.

Sufficient diversification is crucial in reducing risks of being concentrated in any single sector. For example, investors who were fully invested in technology stocks in the late 1990s suffered substantial losses that took a long time to fully recover; those heavily invested in bank stocks just before the Great Financial Crisis lost nearly everything; and those heavily invested in retail and hospitality stocks during the COVID-19 outbreak also suffered considerable underperformance relative to the broader market. As a result, a well-diversified dividend ETF should encompass a range of sectors and geographies, minimizing risk associated with specific market segments.

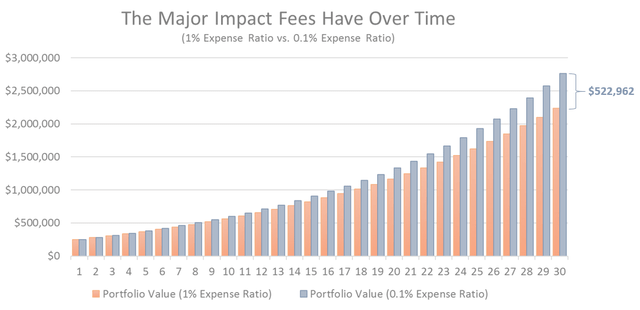

Additionally, an ETF’s expense ratio is crucial as lower expenses translate to higher net returns for investors. As dividend ETFs typically use simple or passive investing strategies, they should inherently have lower management costs, making them relatively efficient wealth creators over the long term. On the other hand, a higher expense ratio can significantly erode the ETF’s long-term returns:

Lastly, the balance of current yield and growth potential is vital when determining if an ETF is suited as a good passive income snowball. While a high current dividend yield is useful, it’s also important to balance this with the long-term growth prospects of the underlying stocks in the ETF. A high yield with no growth potential might indicate companies struggling to expand or maintain their dividends. Conversely, a moderate yield with strong growth prospects suggests a sustainable and potentially increasing dividend over time, enabling the fund to generate phenomenal long-term total returns while also generating inflation-beating dividend growth. This balance is key to ensuring both immediate income and future appreciation.

Why SCHD Offers More Bang for Your Buck

Based on these three criteria, SCHD clearly outshines SPHD:

1. Diversification: SCHD’s diversification dwarfs SPHD’s in terms of the number of holdings, although SPHD has less concentration within its top holdings.

SCHD has 104 individual holdings, more than double those of SPHD, which only has 51 individual holdings in its portfolio. Meanwhile, the top 10 holdings represent 40.86% of SCHD’s portfolio:

- AbbVie Inc. (ABBV) – 4.37%

- Merck & Co., Inc. (MRK) – 4.33%

- Amgen Inc. (AMGN) – 4.25%

- Broadcom Inc. (AVGO) – 4.17%

- The Home Depot, Inc. (HD) – 4.12%

- Texas Instruments Incorporated (TXN) – 4.03%

- Verizon Communications Inc. (VZ) – 3.98%

- Chevron Corporation (CVX) – 3.90%

The Battle of Dividend ETFs: SCHD versus SPHD

When it comes to dividend-focused ETFs, the showdown between Schwab US Dividend Equity ETF (SCHD) and Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) is akin to a clash of investment titans. Both ETFs have their merits, but for the savvy investor seeking robust passive income, one emerges as the superior choice.

Diverse Holdings

SCHD’s portfolio boasts over 100 individual positions, giving it a breadth of holdings that resembles a well-stocked pantry catering to a variety of tastes. On the other hand, SPHD holds companies identified from the S&P 500, with a focus on the 75 stocks with the highest dividend yields.

While SPHD offers a broader approach, SCHD’s methodology shines through with a more extensive diversification. This diversity provides a sturdy foundation akin to a well-constructed building, crafted with varying materials and sturdy framework.

Emphasis on Quality

SCHD’s selection process places an emphasis on dividend sustainability and business quality, ensuring that only the strongest businesses with sustainable dividends are included in the portfolio. Meanwhile, SPHD aims to minimize exposure to price fluctuations, focusing primarily on balancing higher yields with lower volatility.

The distinction in approach underscores SCHD’s dedication to cherry-picking top-notch prospects, akin to an art collector meticulously curating masterpieces, while SPHD leans more toward priming a resilient shield against market jolts, embracing the role of a cautious guardian.

Expense Ratio: The Cost Factor

In the realm of expense ratios, SCHD emerges victorious with a mere 0.06% expense ratio, significantly trumping SPHD’s five times higher 0.30% expense ratio. This fee discrepancy underscores the enduring and costly burden that SPHD imposes on investors who opt for this ETF.

Yield Plus Growth

While SPHD touts a higher TTM dividend yield, SCHD’s dividend growth over the past decade stands at an impressive 11.39% CAGR, dwarfing SPHD’s slower growth rate of 6.37%. This juxtaposition favors SCHD, crafting a compelling story where robust growth meets steadfast stability.

In essence, the data paints a portrait of SCHD as the diligent gardener, nurturing a bountiful patch of steadily maturing crops, while SPHD assumes the role of an inclining mountain, mighty but unmoving.

Investor Takeaway

In the grand scheme of building a passive income snowball, SCHD emerges as the more compelling option, underpinned by its superior diversification, lower expense ratio, and a better balance of yield and growth potential. SCHD’s approach resonates more with the long-term financial independence goals of dividend-focused investors compared to SPHD’s focus on instant stability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.