Before diving into the reliability of brokerage recommendations and how to strategically use them, let’s first consider the current sentiment among Wall Street analysts regarding Lululemon (LULU). Investors often rely on these insights to inform their trading decisions, but how much weight should we truly attribute to them?

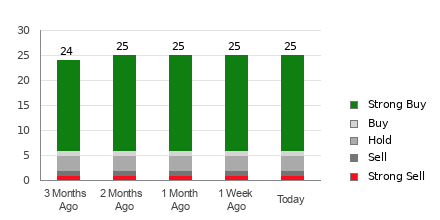

As of now, Lululemon boasts an average brokerage recommendation (ABR) of 1.50, falling between Strong Buy and Buy on the 1 to 5 scale. This rating is a culmination of insights provided by 27 brokerage firms, with 70.4% leaning towards Strong Buy and 11.1% towards Buy out of the 27 recommendations.

Understanding the Brokerage Recommendations

While the ABR suggests a favorable stance on Lululemon, caution must be exercised in not solely relying on this metric. Numerous studies have demonstrated the limited success of brokerage recommendations in accurately predicting stocks with substantial price growth potential.

Why is this so? The analysts at these brokerage firms often exhibit a strong bias towards positively rating stocks that their employers have vested interest in. It’s been observed that for every “Strong Sell” recommendation, they assign five “Strong Buy” recommendations, reflecting a potential misalignment of interests between these firms and retail investors.

It’s prudent to use brokerage recommendations as a complement to one’s own analysis or in tandem with a proven tool for predicting stock price movements. One such tool is the Zacks Rank, renowned for its audited track record in categorizing stocks from #1 (Strong Buy) to #5 (Strong Sell) based on their price performance outlook.

Distinguishing ABR from Zacks Rank

Although both ABR and Zacks Rank use a 1 to 5 scale, they operate on entirely different methodologies. ABR hinges solely on brokerage recommendations and is usually displayed as a decimal figure, while Zacks Rank leverages a quantitative model based on earnings estimate revisions, displayed as whole numbers.

Brokerage analysts, due to their employers’ vested interests, tend to liberally offer positive ratings, potentially misleading investors. In contrast, Zacks Rank hinges on actual earnings estimate revisions, a factor closely correlated with short-term stock price movements. Additionally, Zacks Rank grades are allocated proportionately across all stocks, maintaining an equilibrium among the five ranks.

Another critical distinction lies in the timeliness of these metrics. ABR may not always reflect the latest analyst sentiment, whereas Zacks Rank promptly incorporates analysts’ earnings estimate revisions, ensuring timeliness in predicting future price movements.

Is LULU a Worthy Investment?

Examining the earnings estimate revisions for Lululemon, the Zacks Consensus Estimate for the current year has risen by 0.5% over the past month to $12.46. Analysts’ collective optimism regarding the company’s earnings potential, signified by substantial consensus in revising EPS estimates upward, may be a strong indicator of impending stock upswing.

Given the recent consensus estimate changes and other associated factors, Lululemon has garnered a Zacks Rank #2 (Buy). This affirmative rating implies that the Buy-equivalent ABR for Lululemon could indeed offer valuable guidance to potential investors.

Feeling curious about a potential game-changer in the AI sector? Zacks is sharing an exclusive report on an under-the-radar company poised amidst the AI revolution, alongside 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Want detailed stock analysis on lululemon athletica inc. (LULU)? Find it here

Read the full article on Zacks.com here

Visit Zacks Investment Research

Please note that the opinions expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.