Back in July 2023, we predicted the potential redemption of Energy Transfer (ET) and its preferred shares. The cost of these preferred shares seemed exorbitant in comparison to other options available. Although not officially confirmed, our bet on the redemption was based on the company’s strong free cash flow. We highlighted the actions of other MLPs like NuStar Energy L.P. (NS), which were redeeming their most expensive preferred shares.

Today, Energy Transfer LP has announced its intention to offer senior notes due 2034 and 2054, along with fixed-to-fixed reset rate junior subordinated notes due 2054. The net proceeds from these offerings are slated to refinance existing debts and redeem all outstanding Series C, Series D, and Series E preferred units, with the latter being redeemable on May 15, 2024. This move emphasizes the company’s commitment to deleveraging and strengthening its financial position.

We now turn to assess the impact on existing shares and provide insights into investment strategies moving forward.

The Impact on Preferred Shares

The news has caused a marginal uptick in ET.PR.E, while the other two have seen minimal movement. As anticipated, the market had already priced in the potential redemption, leaving little room for significant changes. Currently, all three are trading near par value after factoring in their next January 31, 2024, distributions. Based on this, we advise holding onto ET.PR.D and ET.PR.C until redemption, while ET.PR.E presents a different scenario, given its pending reset to float and the call date.

Post May 15, 2024, distributions on the Series E Preferred Units will accrue at a percentage of the $25.00 liquidation preference, equal to an annual floating rate of the three-month LIBOR plus a spread of 5.161% per annum.

Despite the impending redemption, there is a short-term opportunity for investors with ET.PR.E trading slightly below par at $25.32. This presents a chance to earn a 7.6% yield on a cash-like vehicle until redemption. However, the decision to capitalize on this opportunity may be hindered by the complex tax implications associated with K-1 reporting.

Energy Transfer LP 9.250% FXD PFD I (NYSE:ET.PR.I)

With the main preferred shares of ET set for redemption, the focus has now shifted to the preferred shares inherited from Crestwood Equity Partners LP. These shares cannot be called and were previously deemed undervalued, with our research suggesting they should trade at $11.11.

Considering the BB-level yields, it is evident that ET.PR.I is undervalued and carries no call risk. Additionally, it holds a deep embedded option on yields, especially in the event of a deflationary shock. The pricing of the junior notes by ET serves as a benchmark, with the 30-year junior notes priced at a yield equivalent to the preferred shares and rated at BB by Fitch.

The strategic pricing of the concurrent offerings further supports our stance on the undervaluation of ET.PR.I. These fixed-to-fixed notes are priced to yield at 8%, providing additional context for the valuation of the inherited preferred shares.

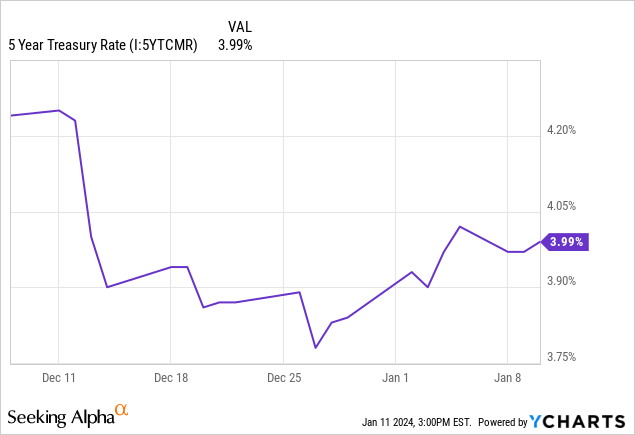

While the spread to the 5-year Treasuries remains unspecified, the offering of the notes and their respective interest rates have set a relevant precedent for evaluating the value of ET.PR.I.

Analysis of ET.PR.I’s Fixed High-Yield and Potential Appreciation

Investors holding ET.PR.I, Enron Corp.’s Series I Preferred Stock, are keenly eyeing the yield which reached 8% on the most recent Reset Interest Determination Date. This phenomenon is no small beans, with the spread likely hovering around an impressive 4%. The notes, not susceptible to floating, are creating a buzz within the investment community, offering a fixed high-yield that has the potential to yield substantial appreciation should yields plummet.

In light of this development, the question on everyone’s mind is the potential price point that ET.PR.I might hit. Barring any calls, analysts are doubling down on their prediction of $11.11, anticipating a surge to this price when large preferred share ETFs like iShares Preferred and Income Securities ETF (PFF) rebalance and push other ET preferreds off the list.

Rationale

The rationale behind holding ET.PR.I stands firm. For those unfazed by the complexities of a K-1, ET.PR.I serves as a solid contender for parking cash. Meanwhile, the undervalued nature of ET.PR.I, though the chasm has certainly lessened, keeps it in the game. Divesting at a price point of $11.25 is under consideration, with analysts leaning away from the “yields going lower” perspective. Simultaneously, the outlook for common equities is dim, prompting a push for additional weightage on preferreds. But that’s not all – the market boasts other securities with hidden value. Just last week, an 8% yielding K-1 preferred security outshone ET.PR.I despite being susceptible to calls. A potential call looms in the background, promising more than 50% appreciation, an aspect that appears to be of little concern.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.