STAG Industrial, Inc. (NYSE:STAG), established in 2010 and headquartered in Boston, MA, is a REIT focused on acquiring and leasing industrial properties across the United States.

No doubt, STAG has a well-diversified portfolio, plenty of liquidity, low debt, and its performance has been phenomenal. However, the current dividend yield can be considered low these days and I see an increase as unlikely. Also, the shares are trading at a small discount to NAV but don’t provide enough protection as I would prefer. That is personal, though, and I urge you to keep reading as you may be in a position to appreciate the stock more.

Diversified Portfolio

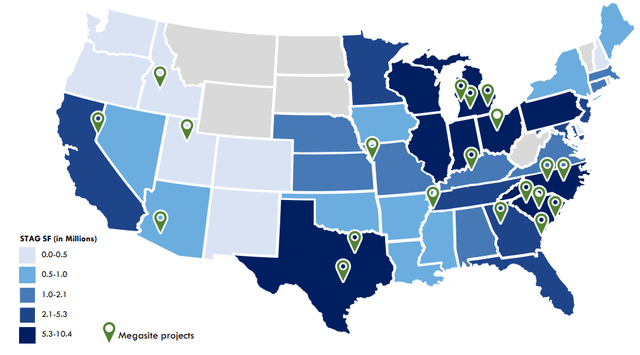

As of the end of the third quarter of 2023, the REIT owned 568 industrial buildings, aggregating 112 million rentable sqft, spread across 41 states.

More notably, approximately one third of its assets are located within a 60-mile radius of Megasite projects; locations related to the “Investing in America” agenda which has injected more than $464 billion in private investment across various industries.

The portfolio diversification and its relevance to national initiatives indicate a robust business strategy vis-a-vis location and tenant base.

Strong Performance and Modest Market Appreciation

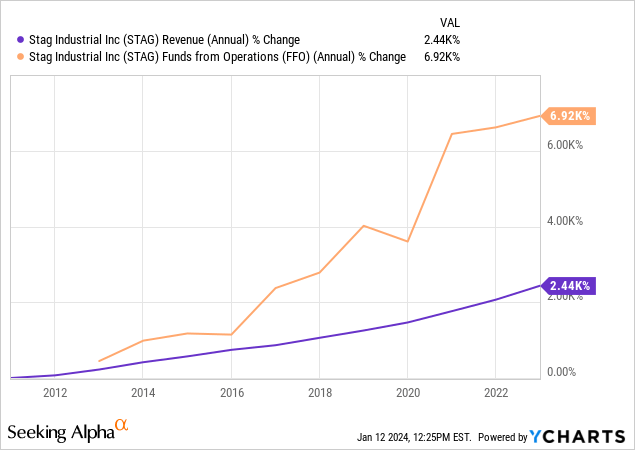

STAG’s historical operating performance showcases exponential growth in revenue and FFO.

In addition, the occupancy rate was 98% for the same-store portfolio as of the end of the third quarter in 2023, depicting great efficiency in asset management and leaving some room for more growth solely coming from a net increase in leases signed.

Interestingly, STAG’s price performance has been very modest for an extended period, not aligning with the company’s strong financials.

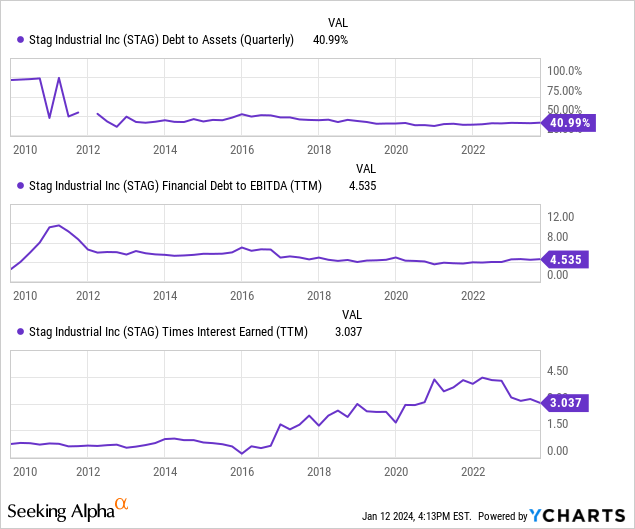

Sensible Leverage and Favorable Debt Profile

STAG employs debt to finance only 40.99% of its assets and maintains a Debt/EBITDA ratio of 4.5x, reflecting both low leverage use and strong liquidity.

Furthermore, its credit facilities, term loans, notes, and mortgages have a weighted average interest rate of 3.72%, a favorable cost in the current environment.

With such an average rate, the risk of a significant increase in interest expense in the near term is low, providing stability to the company’s financials.

STAG Industrial: A Close Analysis

STAG Industrial, Inc. (STAG) is a real estate investment trust (REIT) focused on the acquisition and operation of single-tenant industrial properties throughout the United States. While the company’s investment strategy has garnered attention, a deeper examination is warranted. Let’s take a closer look at the company’s financials, dividend, valuation, risks, and possible verdict for investors.

Financial Analysis

STAG has been diligent in managing its debt obligations, with upcoming maturities in 2026 exhibiting little deviation in interest rates from the prevailing ones. This prudent financial management highlights the company’s position in navigating interest expense, instilling confidence in investors regarding its fiscal soundness.

Dividend & Valuation

Although STAG offers a monthly dividend and a decent forward yield, the lack of substantial growth in the dividend payments over the past decade may raise concern for potential investors. Also, with the current share price representing a narrow margin of safety, cautiousness is advised, warranting a closer examination of the company’s dividend profile and valuation.

Risks

Investors should be mindful of the narrow margin of safety and the opportunity cost associated with STAG Industrial. The potential impact of rapidly changing market conditions on the company’s net asset value (NAV) calculation cannot be underestimated, emphasizing the significance of a thorough risk assessment.

Verdict

While STAG Industrial presents promising aspects, the dividend profile and share prices may prompt a prudent hold, with a potential reconsideration around the $30 per share mark. This suggests that STAG deserves a spot on investors’ watchlists, awaiting opportune conditions for entry.

In conclusion, STAG Industrial’s proposition merits careful consideration, and investors are encouraged to weigh the pros and cons to make informed decisions. Your thoughts on STAG Industrial – are you currently invested or considering it? Share your insights in the comments section below.