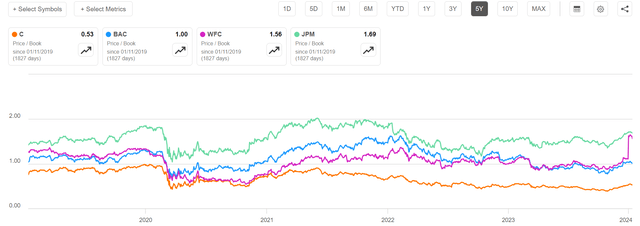

Citigroup (NYSE:C) released its earnings for the December quarter on 12th January, delivering both good and bad news for investors. The U.S. bank reported a $1.8 billion loss, falling below expectations. However, the loss was largely driven by restructuring charges and other non-operating costs. Strikingly, Citi management unveiled plans for an aggressive restructuring effort, including a projected 20,000 job cuts. This surprise announcement saw shares in Citigroup surge by about 1%, in marked contrast to the closing drops of -1%, 1%, and -3% for JPM, BAC, and WFC, respectively. This upward movement in stock price might be indicative of investors’ initial expectations that the accelerated restructuring endeavors could help the bank bridge the valuation gap with its key U.S. bank counterparts. Notably, Citi shares are presently trading at roughly 0.5x P/B, significantly trailing behind the valuation of JPMorgan (JPM), Bank of America (BAC), and Wells Fargo (WFC), a relative undervaluation that has persisted for several years now.

Looking ahead to 2024 and beyond, I remain bullish on Citigroup stock, buoyed by my conviction that shares are undervalued relative to the bank’s fundamentals and cyclically adjusted earnings power. Furthermore, my optimism about the macro backdrop is rooted in the Fed’s dovish rates shift, which may not only prop up stabilizing net interest income amidst falling deposit cost pressures but also stimulate investment banking volume.

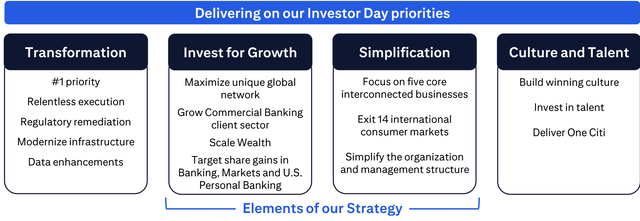

Citigroup’s Aggressive Restructuring Push

Citigroup is gearing up for a pivotal year as it endeavors to reverse its underperformance compared to rivals JPMorgan Chase & Co. and Wells Fargo & Co. in 2023. CEO Fraser and CFO Mark Mason face mounting pressure to deliver results. To this end, Citi’s management team is actively focused on downsizing the bank, streamlining operations, and optimizing resource allocation for growth.

Leading up to Q4 reporting, Citi had already announced its departure from competitive and risky businesses such as municipal-bond and distressed-debt trading. This came on the heels of divesting a significant portion of its international retail business, including operations in Taiwan, Russia, and Argentina.

Alongside its Q4 results, Citigroup revealed plans to slash approximately 20,000 jobs, affecting about 8% of the bank’s workforce (240,000). The anticipated cuts may incur expenses of up to $1.8 billion, with potential annual savings reaching $2.5 billion by 2026 upon completion. Applying an 8x P/E multiple to the $2.5 billion cost savings and discounting at an 8% annual cost of capital, the equity upside to the job cuts may amount to $17 billion, inferring a 15-20% upside to the bank’s current equity valuation. Given this substantial potential, the mere 1% boost in trading following the announcement appears somewhat timid, considering the implied execution risk buffer.

In addition to the job cuts resulting from the restructuring process, the bank foresees an additional reduction of 40,000 workers through planned exits from its consumer banking business in Mexico and other regions. If this pans out as projected, Citi’s overall workforce could shrink to as low as 180,000 by 2025 or 2026, reflecting a decrease of 60,000 compared to the Q4 count.

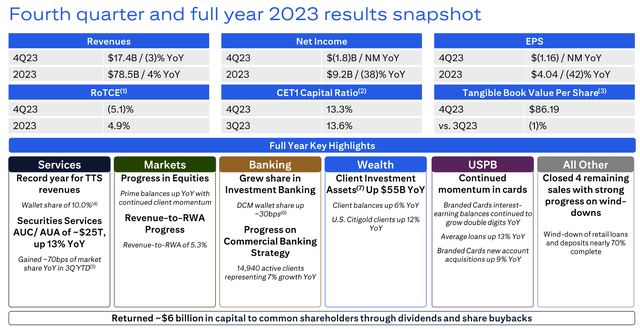

Disappointing Q4 Results Mask Structural Earnings Potential

For the final quarter of 2023, Citigroup’s performance was overshadowed by a $1.8 billion loss, predominantly driven by $4 billion in charges and expenses. This includes $800 million linked to the restructuring efforts and significant impacts from its exposure to Russia, as well as the devaluation of Argentina’s peso. Within this barrage of charges and expenses, there is also a notable outlay of $1.7 billion as part of a “special assessment” from the Federal Deposit Insurance Corporation, aimed at recouping losses tied to regional bank failures in the prior year.

Even after excluding the one-off charges and expenses, the bank’s revenues slipped by 3% to $17.4 billion while the operating income declined by more than 20% compared to the fourth quarter of 2022. Citigroup’s full-year earnings dropped by 38% from the previous year to $9.2 billion.

Corporate lending at Citi experienced a 26% drop due to reduced borrowing demand stemming from higher interest rates, contributing to the challenges in the bank’s Q4 performance. Moreover, a decline in market volatility toward the end of the year adversely impacted the bank’s traders, with revenue from the sales and trading in FICC down by 25%. Despite these challenges, increased spending on the bank’s credit cards led to a 12% rise in revenue in its consumer banking division, while corporate spending boosted revenue in Citi’s treasury services division by 6%. Furthermore, the investment banking division performed well, up more than 20% year over year, marking its best result in over two years.

Notably, for FY 2023, Citi’s payout ratio on earnings stood at approximately 73%. Over the year, the bank returned close to $6 billion to investors in the form of dividends and buybacks, implying a significant 6-7% equity yield.

Promising Structural Earnings Power

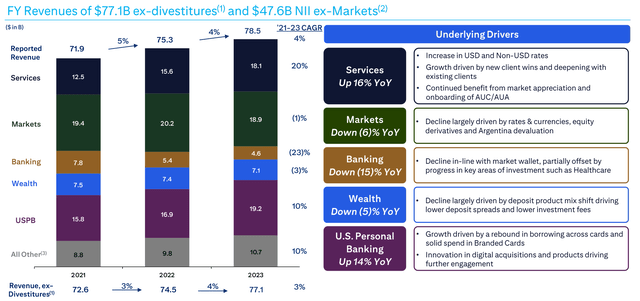

Given all the restructuring activity at Citi, investors are advised to look past quarterly numbers and anchor their assessment of Citi stock investment on the bank’s structural earnings power. Citigroup’s CFO, Mark Mason, recently outlined projections

Citigroup: A Strong Buy Opportunity

The outlook for Citigroup’s revenue growth appears promising, positioning the company for a 4-5% CAGR through 2026 with a targeted annual topline of $87-92 billion. Across its segments, the company anticipates robust growth, with Treasury and Trade Solutions leading the surge, Investment Banking poised for a rebound, and Wealth Management targeting significant market share expansion. The CFO suggests that the remaining revenue delta for the 4-5% CAGR target is achievable through the Markets/Trading and/or the Card division.

The projections align with historical trends and reflect the company’s positive performance in recent years.

Additionally, as part of the restructuring, operating expenses are expected to decrease to $51-53 billion per year, significantly below the 2023 level of $54.3 billion. This reduction, if realized, could lead to an 11-12% Return on Tangible Equity (ROTE).

Looking ahead, the projection of an 11-12% ROTE for 2025/2026 suggests that investors buying shares at the current 0.5 P/B ratio may potentially receive a generous 15-17% distribution yield by 2026, factoring in dividends and buybacks.

Valuation Should Offer Attractive Upside

At present, Citigroup stock appears significantly undervalued, trading at an approximate 0.5x Price-to-Book Value (P/BV) and a 9x projected multiple on 2024 earnings. When considering the adjustments for restructuring and growth, the bank’s projected 2025/2026 earnings multiple could be as low as 5-6x, based on an 11-12% projected ROTE.

As the restructuring initiatives come to fruition and Citigroup’s ROTE improves, a reversion to a P/BV ratio of 0.8-0.9x seems likely, indicating the potential for a 60-80% undervaluation in Citigroup stock.

In the interim, investor sentiment should benefit from growing confidence in a dovish rates shift, contributing to optimism about an improved credit environment, supportive loan growth, manageable write-downs, and an enhanced macro environment for investment banking activities.

Given these factors, I would recommend a Buy rating for Citigroup shares, backed by their strong growth prospects and significant upside potential.