Stock Analysis

In this comprehensive breakdown, we assess the strengths and weaknesses of three cybersecurity stocks: CrowdStrike (CRWD), Palo Alto Networks (NASDAQ:PANW), and SentinelOne (NYSE:S).

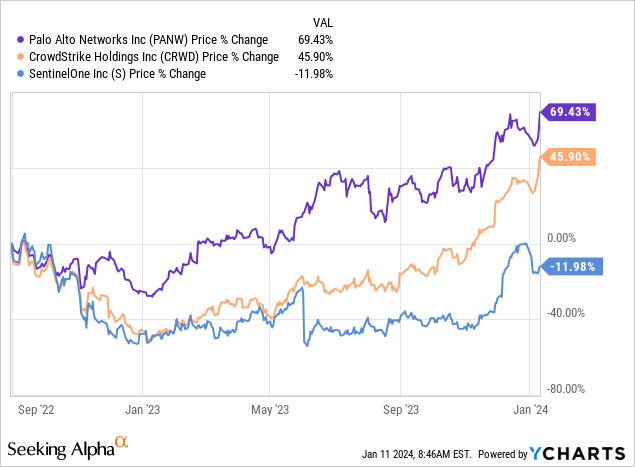

The two stocks that stand out as compelling options for a more fervent investment are Palo Alto Networks and SentinelOne. Why not CrowdStrike? Well, I run a very concentrated portfolio, and two cybersecurity stocks provide ample exposure to this sector.

However, across this analysis, it is essential to highlight that the cybersecurity sector, as a whole, is a promising prospect for investors. Ultimately, it comes down to individual preferences.

Palo Alto is a stalwart, CrowdStrike is delivering outstanding performance, and SentinelOne, while still unproven in its underlying profitability, is attractively priced, given the assumptions. Moreover, relative to its market capitalization, SentinelOne’s debt-free balance sheet is the most appealing among its peers.

We have much ground to cover, so let’s delve right in.

Recapping the Journey

Back in August, my bullish coverage of CrowdStrike acknowledged some lingering uncertainty about whether it could truly shine against towering expectations. However, the company has since proven itself by achieving highly profitable status. Consequently, I upgraded my call on the stock from neutral to bullish in early 2023, and the performance has lived up to expectations.

Why CrowdStrike? Why Now?

CrowdStrike’s flagship product, the Falcon platform, leverages advanced technologies like artificial intelligence to detect and halt cyber threats in real time.

The company aids organizations in securing their computer systems, networks, and data with a comprehensive suite of cybersecurity solutions, safeguarding against various attacks, including malware and ransomware. Essentially, CrowdStrike’s mission is to prevent breaches from cyber threats.

In the near term, CrowdStrike demonstrates robust prospects, fueled by its impressive fiscal Q3 2024 performance. Achieving the $3 billion ARR milestone, marking a 35% year-over-year growth, sets CrowdStrike apart as the only pure-play cybersecurity software vendor to reach this milestone.

With an accelerating net new ARR of $223 million and a focus on innovation, including the introduction of the Falcon Platform Raptor release and strategic acquisitions like Bionic, CrowdStrike is well-positioned for continued growth. Awards and accolades, coupled with successful expansions in cloud security, identity threat protection, and next-gen SIEM offerings, underscore CrowdStrike’s dominance in the cybersecurity space. The company’s commitment to a single-built-by-design platform instills confidence in its ability to reach the outlined goal of $10 billion in ARR over the next 5 to 7 years.

However, one key challenge facing CrowdStrike centers around balancing aggressive investments in innovation driving top-line growth while maximizing free cash flow. The aim to reach approximately 36% free cash flow margins over the next 3 to 5 years is a noteworthy aspiration, given its growth trajectory.

Revenue Growth Projections

Fiscal year end for CRWD is January 2024, so when referring to fiscal 2025, it essentially means this calendar year, adjusted by a month.

CrowdStrike is expected to conclude fiscal Q4 2024 with approximately 33% year-over-year growth rates, if not slightly higher. The takeaway is that there is a high likelihood that in fiscal 2025, CrowdStrike will deliver another year of over 30% compound annual growth rate (CAGR).

From a street perspective, the expectations hover around 30% CAGR as well. Notably, these figures generally start conservatively, leaving room for upward revisions as the company progresses. Overall, CrowdStrike is expected to generate close to $4 billion in revenues next year, a substantial figure for a company growing at a 30% CAGR.

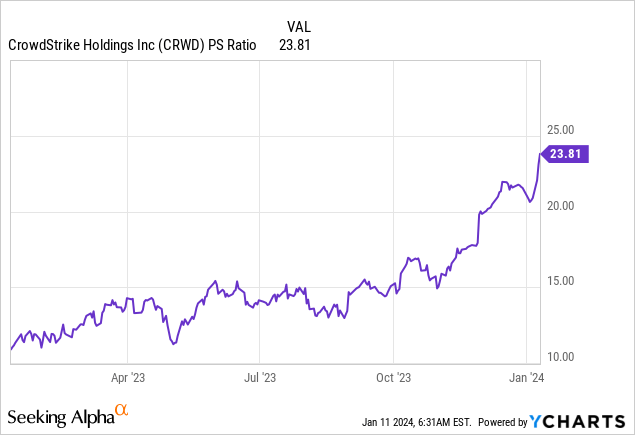

Valuation Analysis

Boosted-Profit Tech Tycoons: CRWD & SentinelOne

The climb of CRWD’s multiple over the past 12 months resembles a rocket launch. Despite what the forward-looking multiple depicts, CRWD is effectively priced at 17x forward sales. The company continues to grow at a remarkable 30% CAGR and is progressively enhancing its underlying profitability, a feat epitomized by a prospective $1.5 billion non-GAAP operating income on the horizon.

SentinelOne: A Turnaround Tale

I’ve navigated from bearish to bullish on SentinelOne, making an uplifting recommendation subsequent to its latest financial performance.

SentinelOne boasted a formidable 42% year-over-year revenue growth and a substantial 43% increase in Annual Recurring Revenue in fiscal Q3 2024. The company’s success in modernizing endpoint security, with a notable 15% year-over-year growth in ARR per customer, establishes its strength in large enterprises and platform adoption.

Revenue Surge and Eying Profit

SentinelOne’s revenue growth is on a stellar trajectory, likely to hit close to a 40% Compound Annual Growth Rate (CAGR) into fiscal 2025. Despite trailing behind CRWD in terms of scale, SentinelOne’s growth momentum mirrors CRWD’s trajectory 3-4 years prior. Moreover, SentinelOne’s strides in streamlining its cost structure have put profitability within tantalizing reach.

SentinelOne Surges, Rapidly Breaching Projected Margins

SentinelOne, compared to the same period a year ago, displayed a stunning improvement of 3,200 basis points year-over-year on the EBIT line and the non-GAAP operating line, signaling significant progress. The fiscal Q4 2024 outlook, with a negative 14% non-GAAP operating margin, sets the stage for surpassing predicted margins.

In the preceding quarter, fiscal Q2 2024, the company initially anticipated negative 22% operating margins but revealed a more favorable negative 11%. Additionally, the fiscal year’s projected negative 25% margin has been revised to an expected negative 20%. Cumulatively, this could indicate that fiscal Q4 2024 might conclude with approximately negative 10% operating margins or even as low as negative 8%, potentially edging closer to breakeven. However, concerns over the sustainability of rapid cost-cutting measures and their potential impact on innovation and customer satisfaction linger.

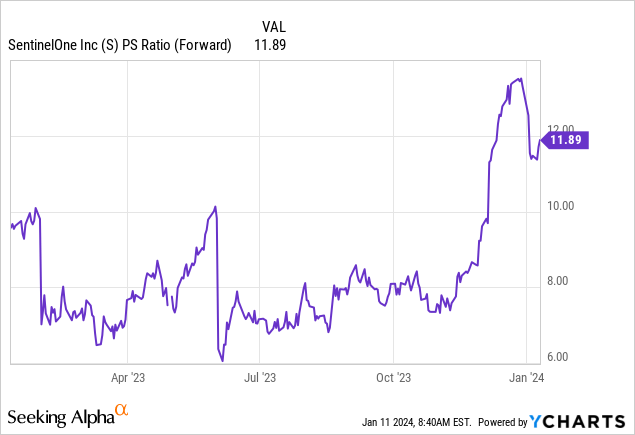

Forward Sales Evaluation and Market Cap Projection

Estimates suggest that SentinelOne could generate approximately $860 million in revenues next year, portraying the stock at about 8x forward sales. This estimation diverges from the graphic due to the impending fiscal year adjustment. Depending on its growth trajectory and proximity to profitability, the stock could garner a 12x to 14x multiple. With a forward price to sales ratio of about 8x, expectations of the stock reaching an $11 billion market cap in the next 18 months arise.

The Allure of Palo Alto Networks

Since August 30, 2022, I’ve staunchly endorsed PANW, advocating for its fair pricing at 43x forward EPS, considering its robust long-term growth and 25% CAGR in EPS.

Palo Alto Networks is a top cybersecurity choice due to its unfulfilled potential, despite being a consistent strong performer. Its allure is furthered by the escalating demand for cybersecurity solutions in 2024.

Unraveling the Cybersecurity Sector: A Closer Look at Palo Alto Networks

In the realm of the resilient tech spending sector, Palo Alto Networks emerges as a prospect poised for substantial gains. As the demand for cybersecurity solutions holds steadfast, with budgets remaining intact, the company stands to benefit from a sustained and robust demand for its offerings.

This trajectory is underscored by the broader context of the cybersecurity sector, where Palo Alto consistently highlights the ongoing trend of market consolidation. Such industry acknowledgment permeates discussions in earnings calls of various cybersecurity companies, reflecting the increasing demand for cybersecurity solutions across categories such as firewalls, endpoint protection, and systems-on-chip management. This demand is characterized by both volume and complexity, laying a fertile ground for Palo Alto’s growth.

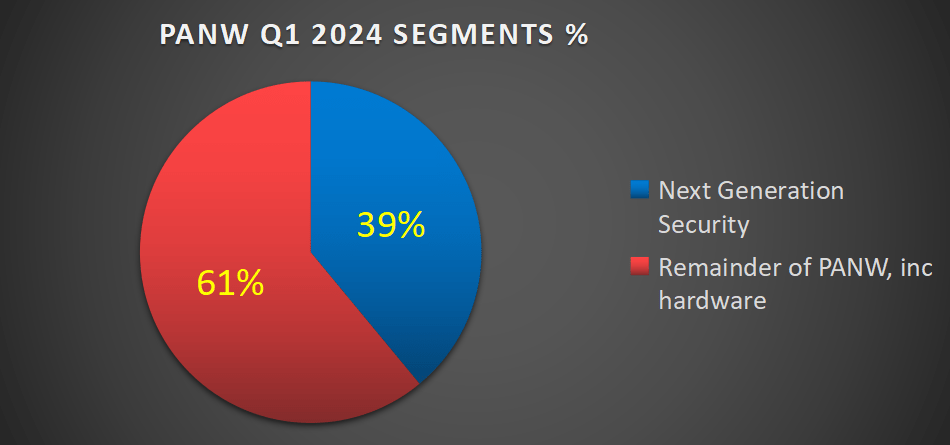

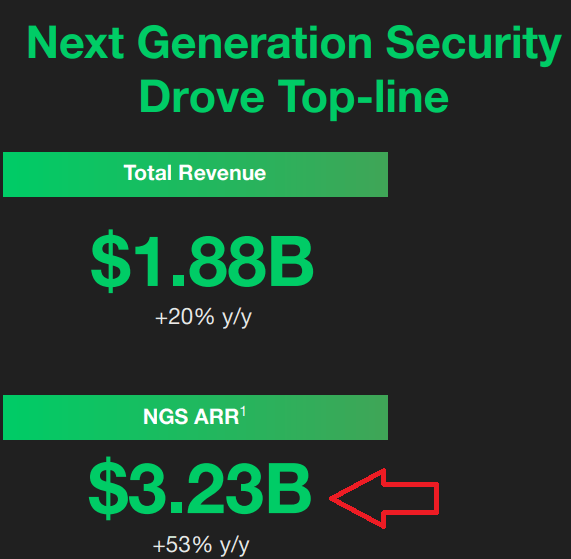

Gravitating toward a straightforward investment thesis for Palo Alto, the company’s revenue illustrates the compelling traction garnered by its Next Generation Security portfolio. Approximately 39% of its revenue stems from this segment, driving rapid growth and cementing its position in the market.

Despite experiencing a degree of customer cannibalization, as “hardware customers” transition to Palo Alto’s next-generation security, the pivotal aspect lies in the full adoption of Palo Alto’s platform by these customers. This adoption solidifies the company’s position in the market, securing a loyal customer base unlikely to churn out.

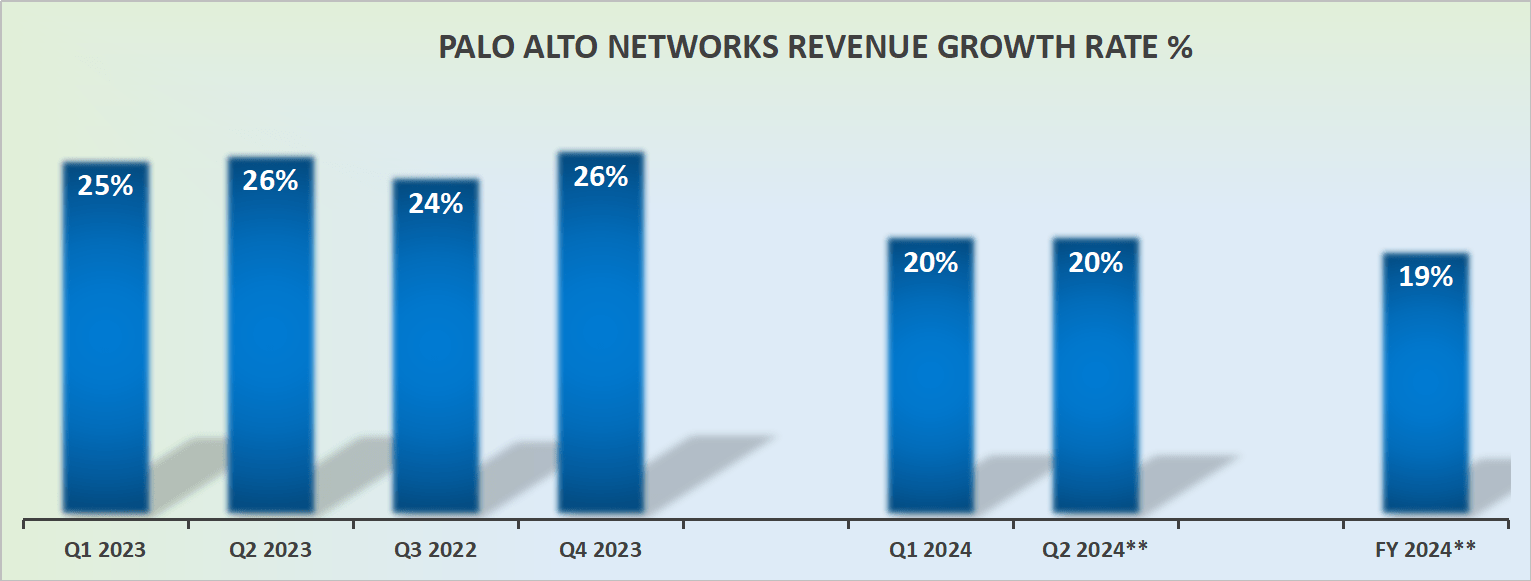

Evaluating Revenue Growth Rates

Palo Alto Networks, encompassing a more mature business model, exhibits growth rates that do not parallel those of some of its counterparts such as CrowdStrike or SentinelOne. Notably, its legacy hardware business plays a defining role in the company’s growth trajectory, presenting as highly free cash flow generative.

For transparency’s sake, a favorable investment proposition is upheld as long as Palo Alto consistently achieves a CAGR above 15%. This threshold is rooted in the observation that tech businesses falling below 15% in growth rates tend to lose significant market share to competitors, making it challenging for them to reclaim growth in intrinsic value.

While businesses may potentially reaccelerate, such occurrences are admittedly rare. Microsoft (MSFT) serves as a compelling business study in this context, yet successful reacceleration instances remain scarce, despite optimistic proclamations.

PANW Stock Valuation: Forward EPS Insight

Delving into Palo Alto’s fiscal 2024, characterizing its EPS growth trajectory to around $5.60 with an estimated 20% y/y growth for fiscal 2025, sheds light on its pricing at 46x forward EPS. This assessment places Palo Alto within an intriguing valuation context, reflective of its position in the cybersecurity market.

While the comparatives with CrowdStrike and SentinelOne denote a variance in focus, attributed to Palo Alto’s comparatively slower growth, the underlying profitability takes precedence as SentinelOne focuses on scale and profitability maximization.

The Verdict

As we culminate this comprehensive analysis of cybersecurity stocks, the investment lens converges on Palo Alto Networks and SentinelOne as the more compelling choices amidst industry stalwarts. Palo Alto Networks stands as a resilient player with measured growth and a 46x forward EPS multiple in fiscal 2025, positioning it as a steadfast contender in the market.

Conversely, SentinelOne, though currently operating on a smaller scale, propels itself into the spotlight with an alluring growth trajectory, marked by a potential 40% CAGR. Additionally, its 8x forward sales multiple solidifies its pivotal role in the evolving cybersecurity landscape, underscoring the significance of imminent profitability.

Guided by these nuances, the prognosis leans toward SentinelOne attaining a market cap of $11 billion in the upcoming 18 months, highlighting the significance of impending profitability in shaping this cybersecurity stock’s trajectory.