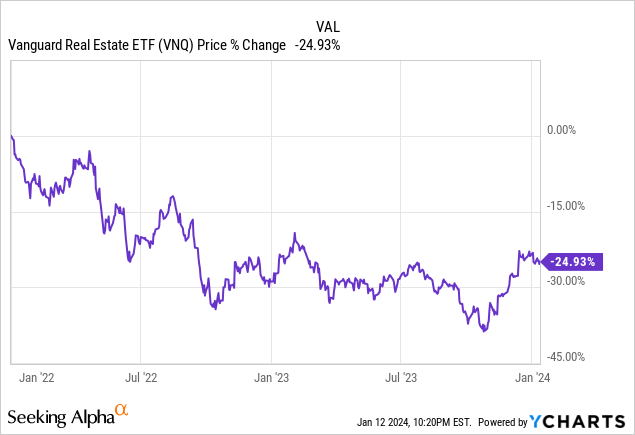

Investors take note – REITs (VNQ) are currently boasting historically high dividend yields.

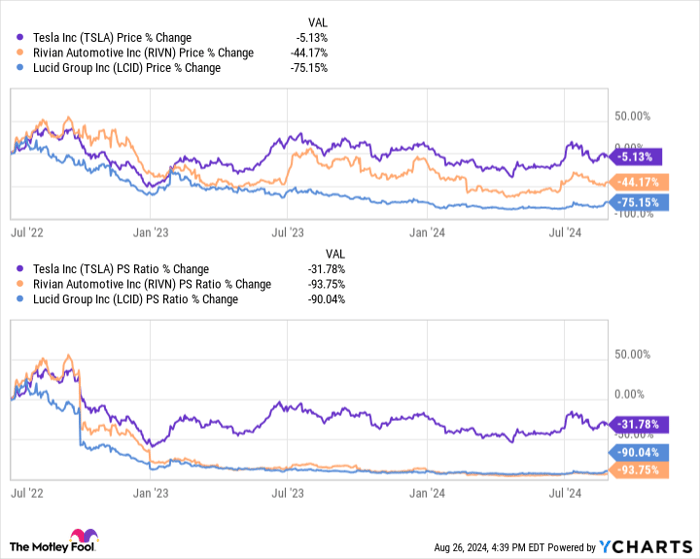

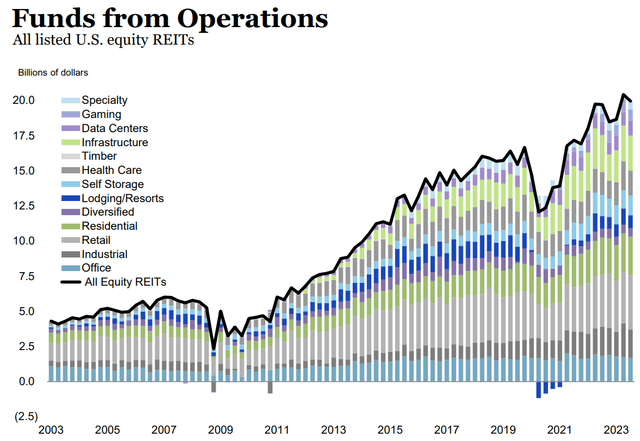

This notable trend has been facilitated by a substantial drop in share prices over the past two years, despite continued growth in dividend payments:

These higher dividend payments, together with lower share prices, have culminated in surging dividend yields, some even reaching up to 10%.

In this analysis, we will explore two enticing high-yielding prospects being added to our Portfolio. However, it’s vital to recognize the relatively higher risk associated with both these REITs. Hence, we advocate for only modest exposure within a diversified portfolio.

NewLake Capital Partners

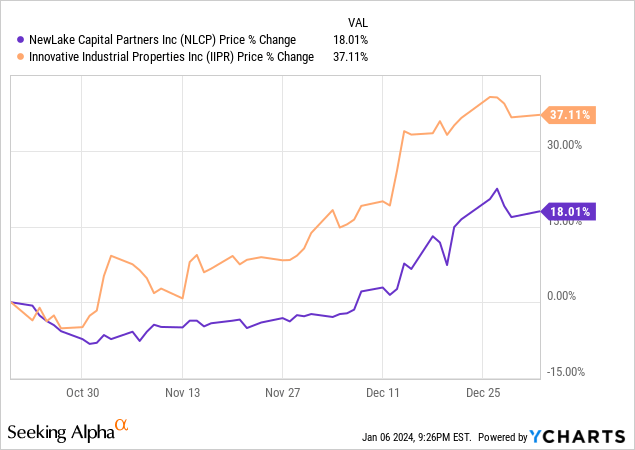

One standout among REITs focusing on cannabis cultivation facilities is NewLake Capital Partners (OTCQX:NLCP):

Despite recent appreciation, it still significantly lags behind its larger counterpart, Innovative Industrial Properties (IIPR). This can be attributed to its absence from a major exchange, resulting in slower capital flows:

- No debt: NLCP stands out as one of the select few REITs operating without any debt. With a substantial net cash position (~10% of its market cap), it is well-positioned to seize opportunities and fortify its defenses against potential risk factors.

- Limited license: NLCP strategically invests solely in cannabis cultivation facilities located in limited license jurisdictions. This serves as a critical risk mitigant, countering inevitable tenant issues in this sector. Furthermore, with the supply of these properties restricted by licenses amid growing cannabis demand, we anticipate sustained and appreciating property values over time.

- Size advantage: At approximately 8 times smaller than IIPR, NLCP is primed for long-term benefits. While it currently lacks access to external equity markets for growth, future opportunities could allow for markedly swifter expansion compared to IIPR, given the substantial impact of each new acquisition. Moreover, by leveraging some debt, NLCP could further enhance the accretive nature of new investments on its FFO per share.

- Lower valuation: Despite owning superior properties, maintaining a debt-free status, and enjoying superior long-term growth prospects, NLCP presently trades at a substantial discount, with an 8x FFO, a 10% dividend yield, and an estimated 20% NAV discount. In contrast, IIPR is priced at 12x FFO, offering a 7.5% dividend yield and presenting an estimated 20% NAV premium. This valuation delta is unrelated to the fundamental prowess of the company and is primarily due to IIPR’s listing on a major exchange, affording its shares broader buyer appeal.

- Buybacks: Having completed a $10 million buyback authorization, NLCP has sanctioned additional repurchases to capitalize on discounted share prices. This judicious capital employment is poised to create substantial value, particularly given its shares’ implied cap rate of about 15%. The management’s alignment with shareholders is evident, with the Chairman, former CEO of GPT, having demonstrated excellence in steering another REIT to success in the past.

- Catalyst: Distinct stock exchange listings favor IIPR over NLCP, a discrepancy we expect to normalize as regulatory shifts could pave the way for NLCP’s listing on a comparable exchange. This transition is anticipated to elevate demand for its shares and garner a commensurate or superior valuation to that of IIPR. In the interim, we are seizing the opportunity to acquire NLCP at a favorable discount through the OTC market.

Furthermore, we assess the downside risk to be relatively contained even in a worst-case scenario. Speculative REITs that rely on debt, such as MPW, CORR, or Branicks, face the stark threat of bankruptcy and complete equity erosion. Conversely, with NLCP wielding no debt, a formidable cash position, and a considerably discounted valuation, the downside appears considerably curtailed.

Even if NLCP were to implement a comprehensive 30% rent reduction across the board, it would still trade at a high implied cap rate, a relatively low FFO multiple, and sustain a respectable dividend yield.

Such an extreme scenario appears highly implausible, considering the management’s laudable track record, substantial stake in the enterprise, forward-looking focus on limited license states, and the unlikelihood of a glaring underwriting misstep. Notably, the ongoing aggressive share buybacks are emblematic of management’s conviction that the prevailing stock pricing factors in the downside to a significant extent.

Moreover, despite contending with tenant challenges in 2023, the REIT managed to augment its FFO, propelled by robust 2.7% escalations in its leases and highly enriching share buybacks.

The recent hike in its dividend, now yielding 9.6%, underpins the sustainability of the payout. Furthermore, the current payout ratio nestles at the lower end of the targeted range of 80-90% of AFFO.

Therefore, we opine that the risk-reward balance tilts decidedly in favor of embracing NLCP for investors seeking substantial yield whilst cautiously navigating the REIT landscape.

Underestimated Uniti Group Holds Promise for Discerning Investors

Uniti Group is an infrastructure real estate investment trust (REIT) that boasts a portfolio of fiber networks and currently offers an enticing 10% dividend yield despite recent market underperformance relative to IIPR and the broader REIT market.

The Backstory

A few years ago, cannabis REITs were the darlings of the market, commanding large premiums to their net asset values (NAV). Investors viewed them as a way to tap into the rapid growth of the cannabis sector with reduced risk through ownership of critical infrastructure. However, sentiment has since turned, casting a shadow over the sector’s prospects.

Significant Challenges

Uniti Group faced a steep decline in its share price in recent years, owing to two primary reasons:

- Debt Burden: The company carries more leverage than the typical REIT, with a debt-to-EBITDA ratio of 6x, leading to concerns amid a surge in interest rates.

- Tenant Concentration: UNIT relies heavily on one tenant, Windstream, for a significant portion of its cash flow. Windstream contends that its rent is excessive and should be lowered upon lease expiration, posing a threat to the REIT’s income stream.

These are undeniably significant risks, and there’s no glossing over them.

Potential Upside

Uniti’s solace lies in its long lease with Windstream, which isn’t set to expire until 2030. Moreover, at a recent REIT conference, UNIT’s CEO expressed confidence in the fairness of the current market rent, suggesting that the allegations by Windstream may be a mere negotiation tactic. This stance is bolstered by the essential nature of Uniti’s fiber networks, their increasing demand, and the upward trajectory of their replacement cost amid recent inflation.

The company also has the advantage of no major debt maturities until 2027, allowing ample time to diversify its revenue sources, fortify its balance sheet, and negotiate with Windstream from a position of strength.

Despite its market cap being a mere fraction of its future revenue potential, trading at 4x FFO with a dividend yield over 10%, Uniti Group is currently undervalued. The market’s pessimism is chiefly reflected in the 19% implied yield attributed to the Windstream master lease, which, if recalculated at a more reasonable yield, suggests a 100-200% potential upside from the current share price.

In an intriguing development, the CEO displayed confidence in the company by purchasing over $1 million worth of shares last year, indicative of a divergence from the market’s valuation.

Promising Possibilities

The 10.5% dividend yield is well covered, and a potential decision to cut it could serve to weaken the bear thesis. Furthermore, with ongoing rumors of a partial or complete business sale and a strategic review underway, coupled with the CEO’s share purchases, Uniti Group presents possible avenues for future growth and value realization.

The private markets, rich in infrastructure funds awaiting deployment, could potentially offer a significantly higher valuation for these assets, given the essential nature of Uniti’s fiber networks.

Final Thoughts

While several REITs currently offer high dividend yields, their continued availability in the face of potential interest rate cuts remains uncertain. As valuations remain discounted, a prospective rush of investors back into REITs may be on the horizon, driving share prices higher and reducing dividend yields. The present moment offers a timely opportunity to secure these high yields before they potentially diminish.

Please note that this article discusses securities that do not trade on a major U.S. exchange, and investors should exercise caution due to the associated risks.