In the Q4 Earnings Season Outlook, Zacks Director of Research Sheraz Mian points out a number of compelling insights for the upcoming earnings season.

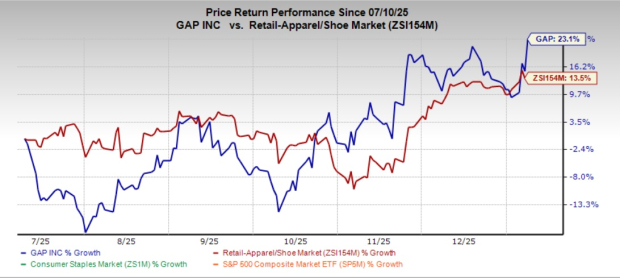

For the fourth quarter, earnings estimates have seen a downward trend since October of 2023, but have since stabilized. The S&P 500’s earnings are predicted to decrease by (-0.4%) compared to the previous year, while revenues are expected to grow by 2.2% year over year.

Among the sectors, transportation, construction, basic materials, conglomerates, aerospace, consumer discretionary, and tech have experienced a decline in Q4 earnings estimates, whereas the estimates have risen for utilities, autos, industrials, energy, and finance within the Zacks sectors.

With these key factors in mind, the forthcoming earnings season will bring a spotlight onto several significant companies, including Microsoft, Visa, and Exxon Mobil.

Image Source: Zacks Investment Research

Microsoft: A Leading Technological Barometer

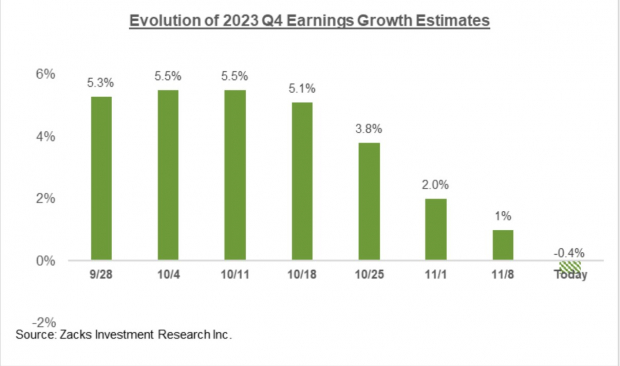

Recent market events have seen Microsoft MSFT overtake Apple as the world’s most valuable publicly traded company, closing in on the $3 trillion milestone. While Apple has witnessed some selling since mid-December, Microsoft has attracted new buyers, achieving record highs in the past week.

Earnings from Microsoft hold significance as they reflect broad spending across various technological sectors, from its cloud computing products to the Office 365 software suite and burgeoning AI business, providing a deep insight into the economy.

Microsoft is scheduled to report earnings on Tuesday, January 23.

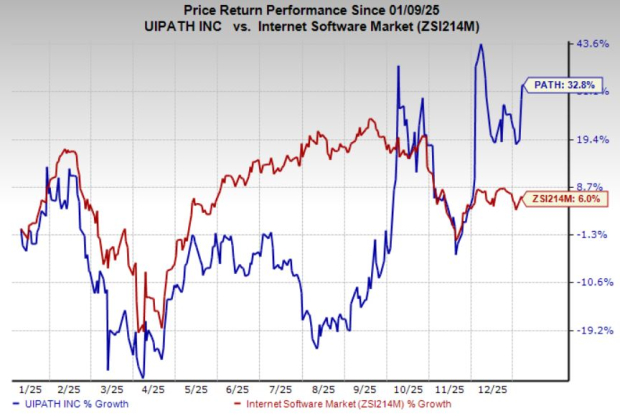

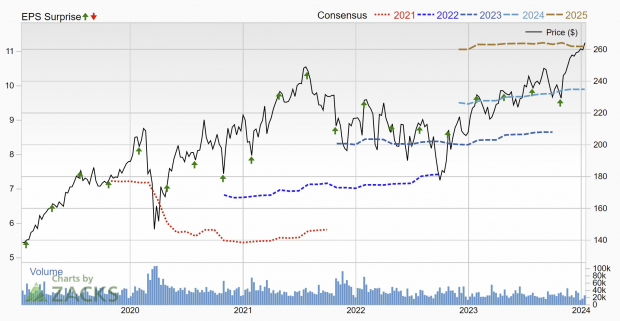

With a current Zacks Rank #3 (Hold) rating, Microsoft’s earnings estimates have remained relatively stable over the last two months. Notably, the Zacks Earnings ESP predicts a (-1.47%) shortfall in the upcoming report.

Image Source: Zacks Investment Research

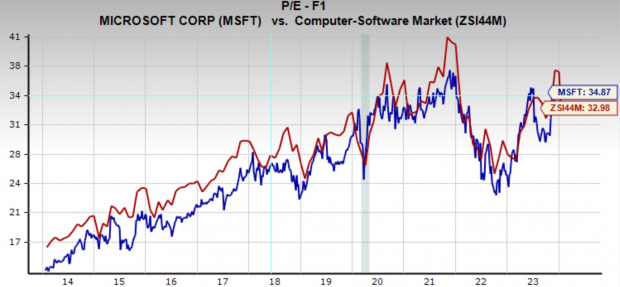

Trading at a forward earnings multiple of 34.9x, well above its 10-year median of 25.5x, Microsoft also offers a dividend yield of 0.8%. Following a robust performance last year and with a premium valuation, the possibility of a sell-off after the earnings announcement cannot be discounted.

Image Source: Zacks Investment Research

Visa: Unraveling Consumer Behaviors

Visa V, renowned for its stellar business fundamentals, also provides invaluable insights into consumer behaviors during the earnings season, offering detailed transaction volumes that illuminate consumer trends.

Visa is set to announce earnings on Thursday, January 25 after the market closes.

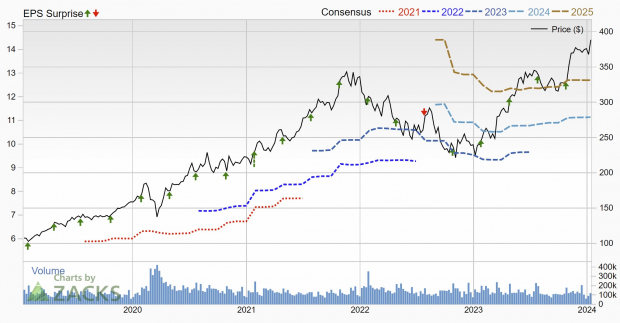

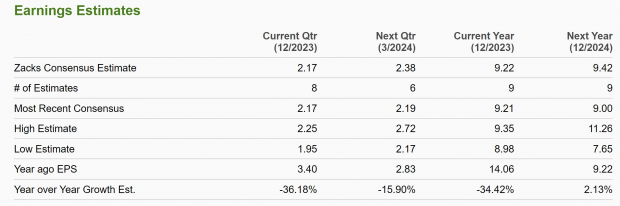

Maintaining a Zacks Rank #3 (Hold) rating, Visa’s earnings trend has shown a steady, slight increase over recent years. Projections indicate that Visa is likely to surpass earnings estimates by 0.32%, as predicted by the Zacks Earnings ESP.

Image Source: Zacks Investment Research

Despite mixed earnings revisions, current levels present a compelling opportunity for investment. Over the past year, Visa’s management has repurchased $5 billion in shares and raised the dividend payment by 16%.

Image Source: Zacks Investment Research

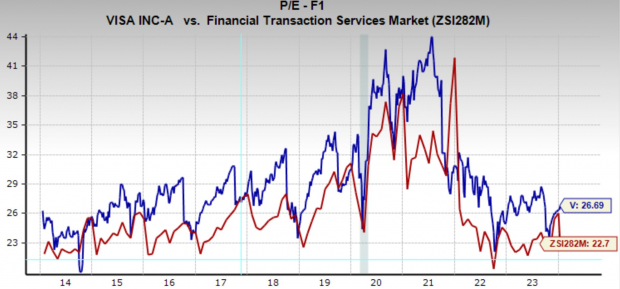

Moreover, with a one-year forward earnings multiple of 26.7x, marginally below its 10-year median of 27.8x, Visa, being a company of its caliber, rarely presents itself at a profound discount.

Exxon Mobil: Gauging Global Economic Climate

Keeping a vigilant eye on the energy sector this year, Exxon Mobil XOM serves as a prime indicator of the prevailing condition within the oil and gas industry on a broader scale. For numerous reasons, it is imperative for investors to carefully analyze Exxon Mobil’s earnings.

Primarily, the crude oil market mirrors global economic growth, and consequently, Exxon Mobil’s profits follow suit. Secondly, the oil market is currently witnessing the early to intermediate phases of a sustained undersupply, indicating potential insufficiency in oil production vis-a-vis economic requirements.

Exxon Mobil Earnings Report

Evaluating Exxon Mobil’s Financial Performance

XOM reports earnings on Friday, February 2 before the market opens. The company currently holds a Zacks Rank #3 (Hold), indicating mixed earnings revisions. Due to lower oil prices, it is expected to register steep year-over-year declines in earnings. Despite this, Zacks Earning ESP forecasts an earnings beat of 1.93%.

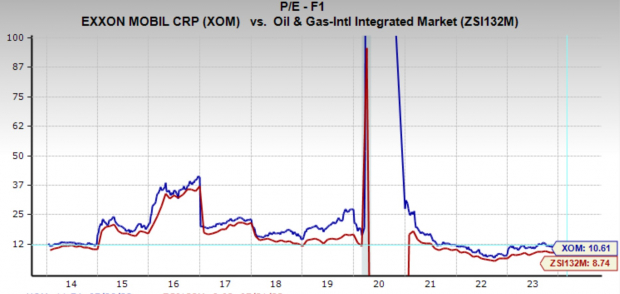

Exxon Mobil’s one year forward earnings multiple stands at 10.6x, and it offers a generous dividend yield of 3.8%.

Exploring Investment Opportunities

Zacks names #1 Semiconductor Stock, highlighting its potential for exponential growth. With promising earnings performance and an expanding customer base, this stock is poised to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor market is projected to witness substantial growth from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research