Accenture ACN revealed the acquisition of Impendi, signifying a monumental leap forward in the conglomerate’s strategic outlook. The terms of the acquisition remain undisclosed, but the impact of this transaction is undeniable. By assimilating Impendi, Accenture reinforces its prowess in servicing the private equity domain, bolstering its spectrum of offerings in this domain.

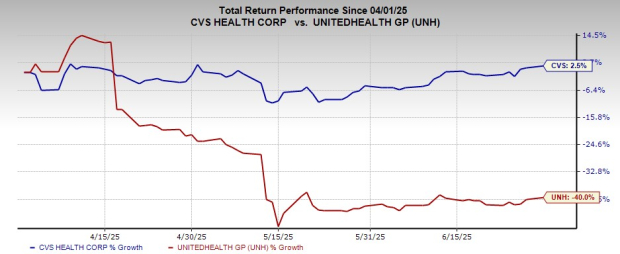

This move comes at a time when Accenture has showcased remarkable vigour, with a stellar 10.9% upswing in the last six months outpacing its industry’s 10.5% growth as well as the S&P 500 composite’s 4.5% rise in the same timeframe.

Impendi’s forte lies in sourcing and procurement services, with a particular emphasis on private equity. The firm prides itself on offering groundbreaking solutions, deep-rooted analytic proficiency, and a team of 130 professionals. These capabilities translate to improved profitability, expedited due diligence processes, and a substantial contribution to hastening the realization of investments.

Accenture’s Market Performance

Accenture PLC price | Accenture PLC Quote

Impact of the Acquisition on Accenture

Accenture’s acquisition of Impendi fortifies its private equity capabilities, delivering tailor-made sourcing and procurement services. Additionally, the integration of Impendi’s procurement analytics expertise augments Accenture’s capacity to advise private equity clients by unveiling crucial insights into spending and potential savings.

Access to Impendi’s innovative solutions deepens Accenture’s leadership in the private equity arena, ultimately contributing to quicker realization of value through meticulous due diligence and investment research. The acquisition significantly broadens Accenture’s global footprint, particularly benefitting clients in the United States and India, while diversifying its portfolio across multifarious industries.

In line with Accenture’s modus operandi of perpetual reinvention, this acquisition intensifies its dedication to adding value through advisory, technology, and managed services. Moreover, the infusion of Impendi’s talent enriches Accenture’s collective knowledge, cementing its standing in the private equity and related sectors.

ACN presently carries a Zacks Rank #3 (Hold).

Other Stocks of Interest

From a broader perspective, the following stocks in the Business Services sector are worthy of consideration:

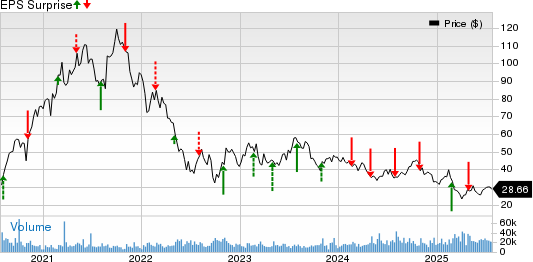

Broadridge Financial Solutions BR: The Zacks Consensus Estimate for Broadridge’s 2023 revenues suggests a 7.7% growth from the year-ago figure, with expected earnings growth of 10.1%. The company surpassed the consensus estimate thrice in the last four quarters, with the average surprise standing at 5.4%.

BR holds a Zacks Rank #2 (Buy). Explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

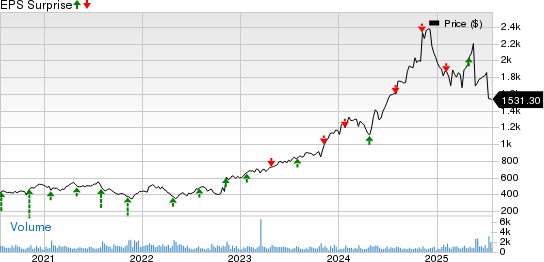

Booz Allen BAH: The Zacks Consensus Estimate for BAH’s 2023 revenues forecasts a 13% surge from the year-ago figure, with expected earnings growth of 10.3%. The company outpaced the consensus estimate thrice out of the four quarters, with the average surprise at 7.7%.

BAH currently holds a Zacks Rank of 2.

ABM IndustriesABM: The Zacks Consensus Estimate for ABM’s 2023 revenues indicates a 1% uptick from the year-ago figure, while earnings are anticipated to witness a decline of 5.1%. The company surpassed the consensus estimate thrice in the last four quarters, with a modest average surprise standing at 1.4%.

ABM is currently placed at a Zacks Rank of 2.

Zacks Discloses ChatGPT “Sleeper” Stock

One relatively unknown company lies at the epicenter of an extraordinarily dynamic Artificial Intelligence sector. By 2030, the AI industry is poised to exert an economic influence akin to the advent of the internet and the iPhone, amounting to a staggering $15.7 trillion.

As a gesture of goodwill for readers, Zacks has curated a supplementary report that elucidates this meteoric growth stock, alongside four other indispensable “must-buys.” And more.

Download Free ChatGPT Stock Report Right Now >>

Accenture PLC (ACN) : Free Stock Analysis Report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.